The game development industry is constantly evolving, driven by technological advancements, shifting player preferences, and emerging trends. In this comprehensive article (based on Unity’s report), we will delve into the latest game development trends that have significant implications for both indie game studios and large game development companies. From shorter development cycles and increased multiplatform games to extended game lifespans and the rise of mobile gaming, we will explore the key transformations shaping the industry today.

Indie Game Studios and Shorter Development Cycles

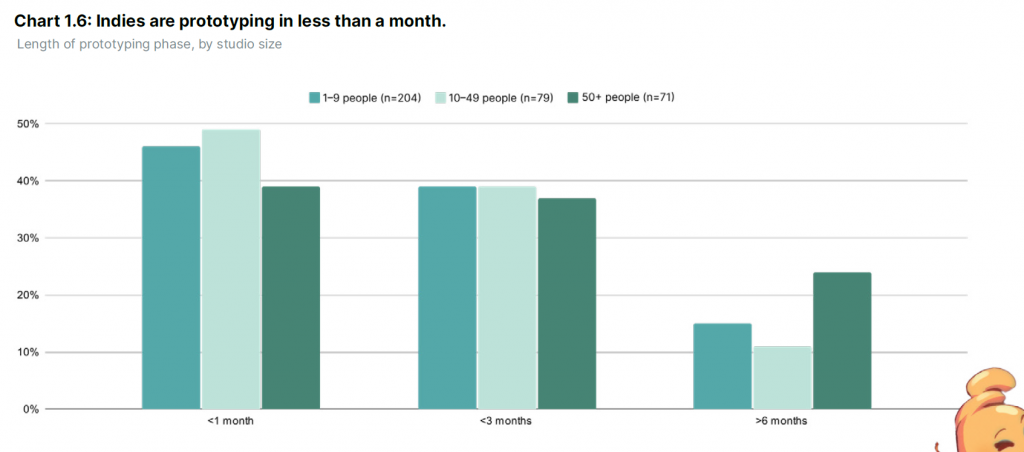

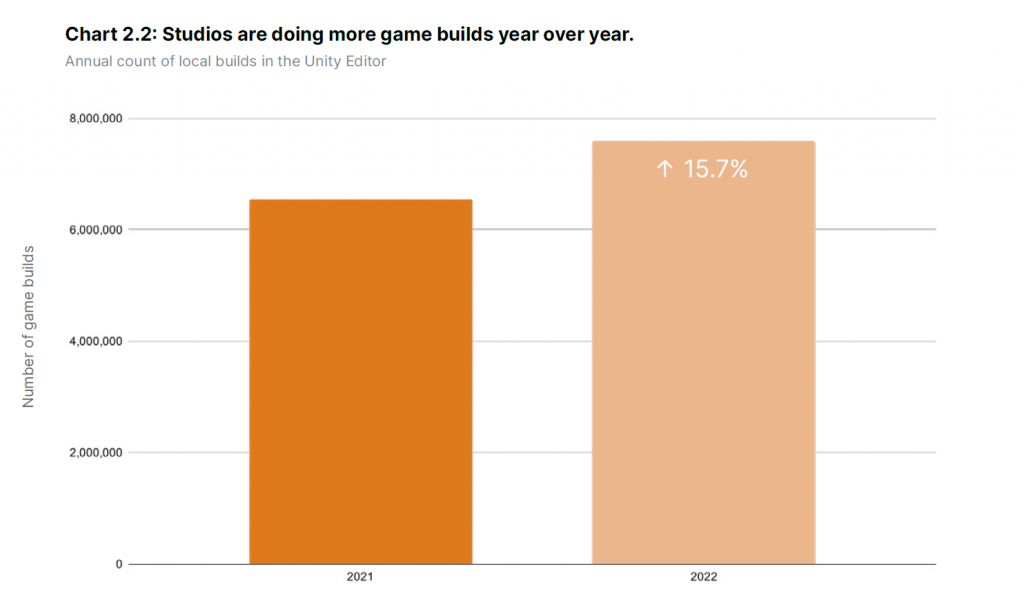

In recent years, indie game studios have gained remarkable traction, fueled by their ability to create innovative and engaging games within shorter development cycles. These studios, often characterized by their smaller team sizes, streamlined decision-making processes, and creative freedom, have brought fresh perspectives to the gaming industry. Let’s look at some numbers to support this trend:

a) According to a study by the International Game Developers Association (IGDA), 58% of indie game developers reported completing their projects within a year, compared to only 17% of larger studios.

b) The average development time for indie games decreased from 26.4 months in 2017 to 19.8 months in 2021, as per data from the Game Developers Conference (GDC) survey.

In an era where competition is fierce and player expectations are high, indie game studios have emerged as a force to be reckoned with. These smaller, nimble teams have capitalized on the advantages of shorter development cycles, enabling them to bring innovative ideas to market faster than ever before.

The rise of indie game studios can be attributed to several factors. Firstly, advancements in game development tools and technologies have democratized the industry, making it more accessible to aspiring developers. Additionally, the availability of digital distribution platforms like Steam, Epic Games Store, and Itch.io has provided indie studios with a direct route to players, eliminating the need for extensive marketing budgets or physical distribution networks.

By leveraging these opportunities, indie game studios have achieved impressive results within shorter timeframes. According to a survey conducted by the International Game Developers Association (IGDA), 58% of indie game developers reported completing their projects within a year, compared to only 17% of larger studios. This not only allows indie studios to iterate and respond to player feedback more rapidly but also reduces the financial risks associated with lengthy development cycles.

One notable success story is the indie game “Undertale” developed by Toby Fox. With a team consisting of only one developer, Toby Fox created a critically acclaimed and commercially successful game that resonated with players worldwide. The game’s unique storytelling, memorable characters, and innovative gameplay mechanics garnered widespread praise, and it achieved cult status within a short span of time.

Indie game studios have revolutionized the game development landscape by delivering games at a much faster pace compared to larger studios. This ability to ship games faster is attributed to several key factors, including the use of efficient development tools, agile development methodologies, and leveraging digital distribution platforms. Let’s explore these trends and tools in detail.

- Streamlined Development Tools: Indie game studios often rely on streamlined development tools that enable faster and more efficient game creation. These tools eliminate the need for extensive coding from scratch, allowing developers to focus on game design and mechanics. Some notable tools and frameworks include:

a) Unity: Unity is a popular game engine that provides a user-friendly interface, pre-built components, and a vast asset store. It simplifies the development process, enabling indie studios to create games faster without compromising quality.

b) Unreal Engine: Unreal Engine offers a comprehensive suite of tools, including a visual scripting system (Blueprints), advanced rendering capabilities, and built-in physics simulation. It empowers indie developers to build high-quality games with reduced development time.

c) GameMaker Studio: GameMaker Studio provides an intuitive drag-and-drop interface, allowing developers to create games without extensive programming knowledge. It streamlines the development process and facilitates rapid prototyping.

- Agile Development Methodologies: Indie game studios often adopt agile development methodologies, such as Scrum or Kanban, to deliver games more efficiently. These methodologies emphasize iterative development, frequent communication, and rapid feedback cycles. Agile practices that enable faster game shipping include:

a) Sprints: By breaking the development process into short sprints, typically 1-4 weeks, indie studios can focus on specific tasks, set clear goals, and deliver tangible results within shorter timeframes. This iterative approach allows for quicker iterations and faster bug fixes.

b) Continuous Integration and Testing: Indie studios leverage continuous integration and automated testing to ensure the stability and quality of their games throughout the development process. This streamlines the identification and resolution of issues, reducing time spent on debugging and testing.

c) Rapid Prototyping: Indie studios often prioritize rapid prototyping to quickly test and validate game concepts. This iterative approach enables them to gather valuable feedback early on, iterate on design elements, and make informed decisions without spending excessive time on unviable ideas.

- Digital Distribution Platforms: The advent of digital distribution platforms has revolutionized the game industry, providing indie studios with direct access to a global audience. These platforms enable indie developers to release games faster, without the need for physical distribution or retail partnerships. Notable digital distribution platforms include:

a) Steam: Steam is a leading digital distribution platform that allows indie studios to publish and distribute their games worldwide. Its user-friendly interface and robust features simplify the process of releasing games, including updates and patches.

b) Epic Games Store: The Epic Games Store provides indie developers with an alternative platform for releasing their games. It offers competitive revenue-sharing models and promotional opportunities, attracting indie studios looking for greater visibility and financial success.

c) Itch.io: Itch.io is a popular platform for indie game distribution, known for its ease of use and community-driven approach. It empowers indie developers to showcase and sell their games directly to players, fostering a supportive indie game community.

By leveraging these streamlined development tools, adopting agile methodologies, and utilizing digital distribution platforms, indie game studios can deliver games faster and more efficiently. This allows them to capitalize on market trends, respond to player feedback, and maintain a competitive edge in the ever-evolving game development industry.

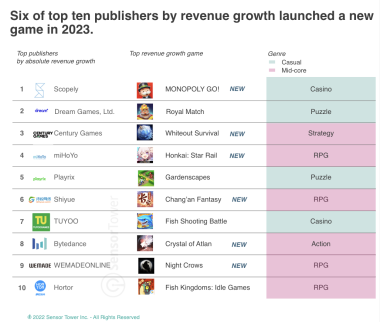

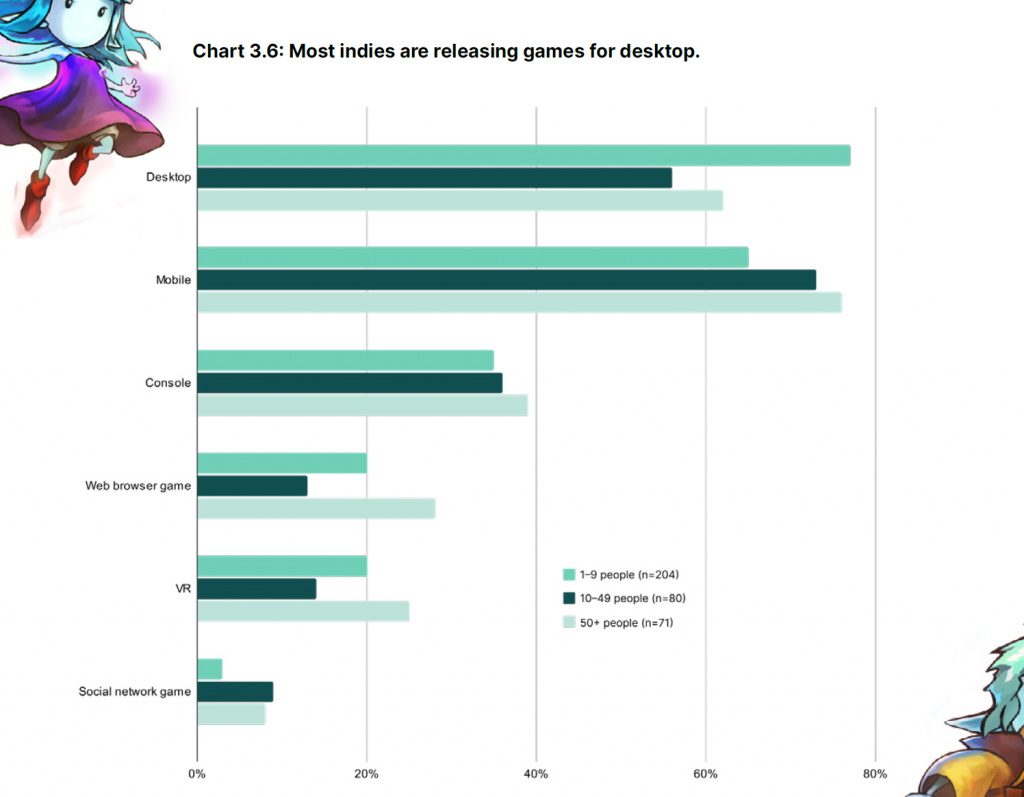

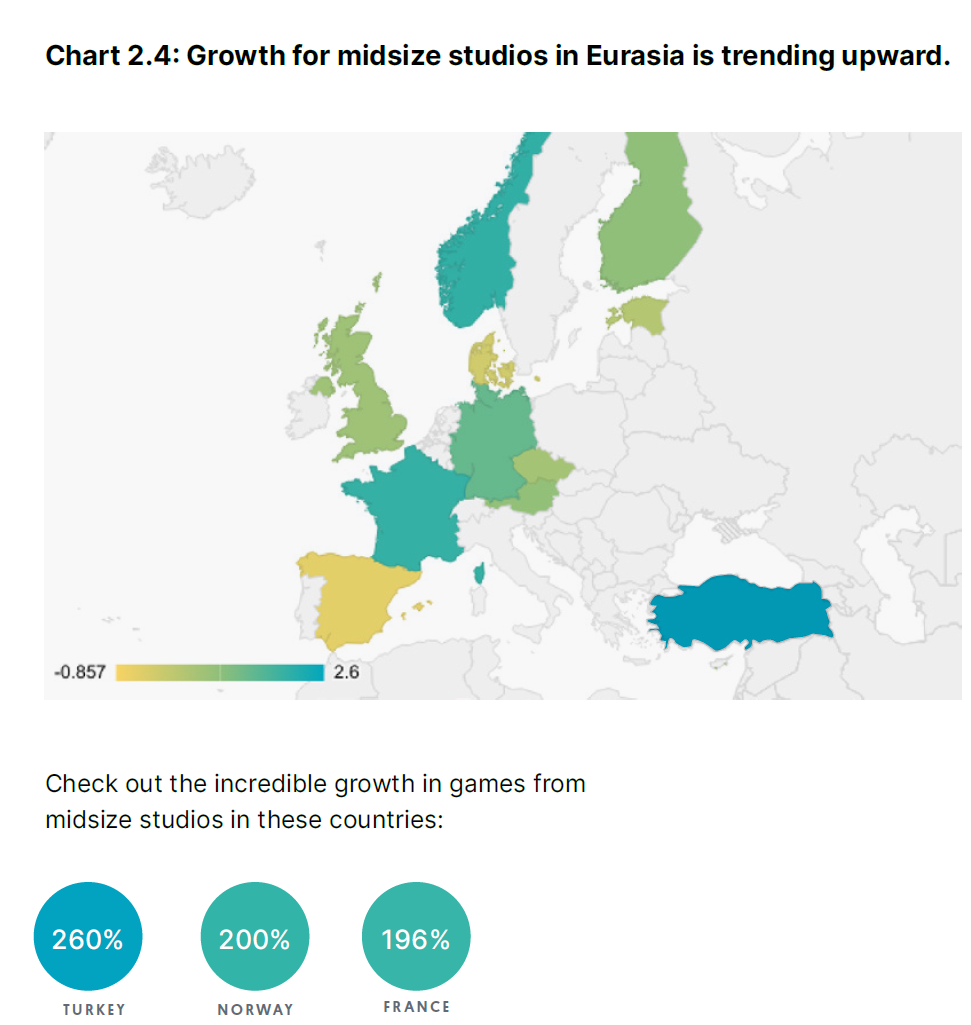

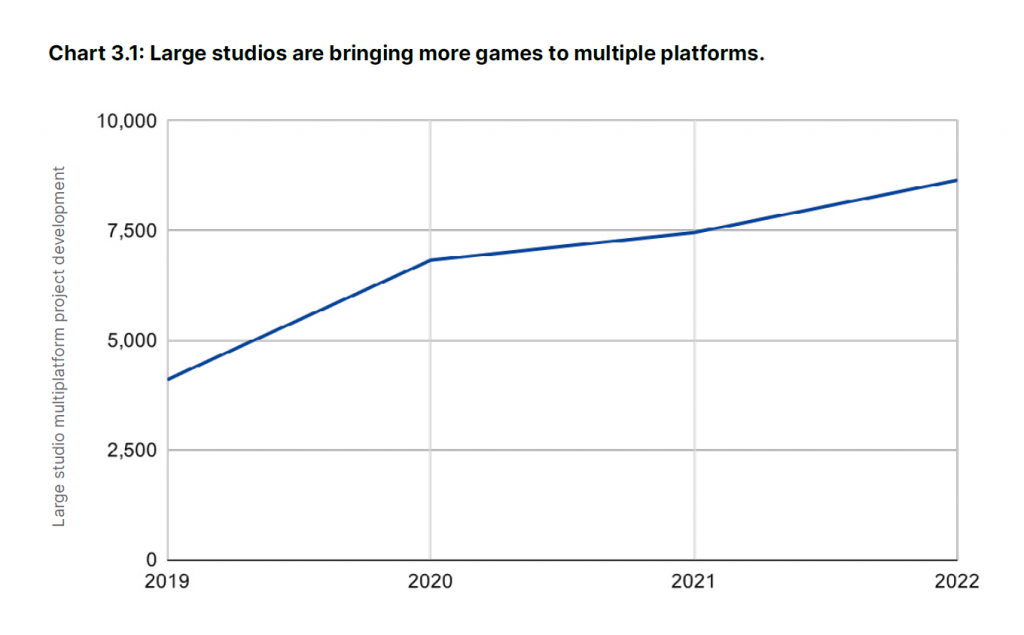

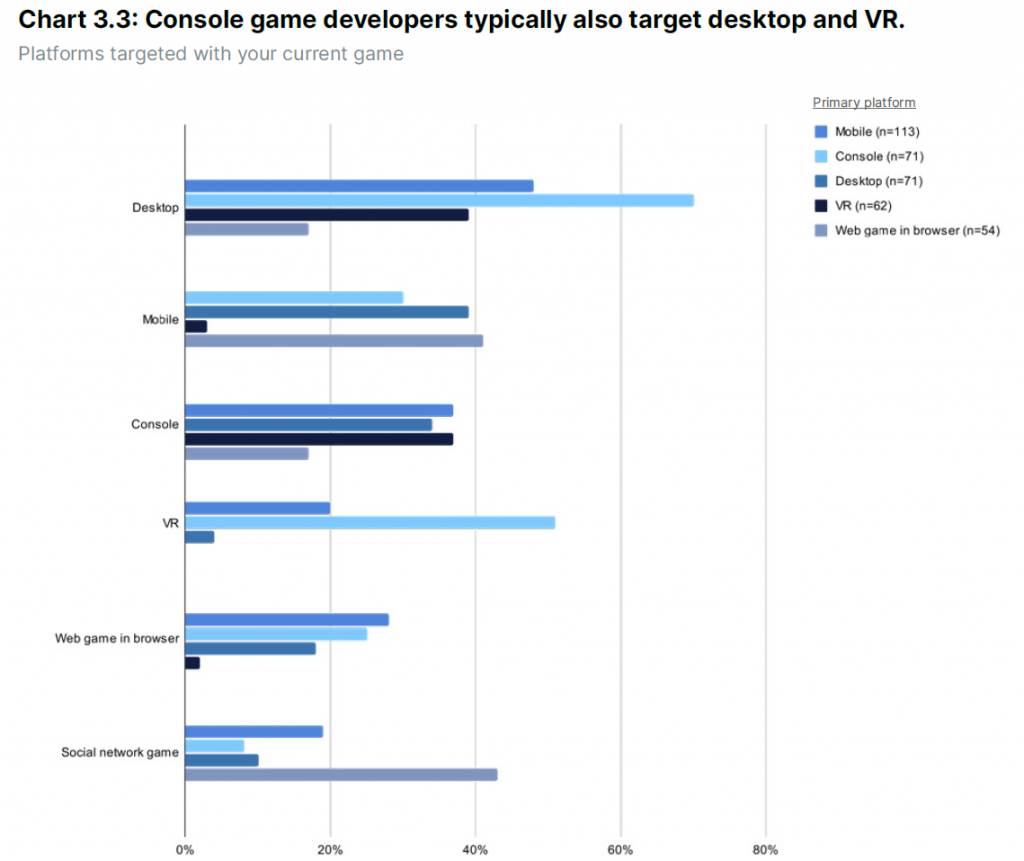

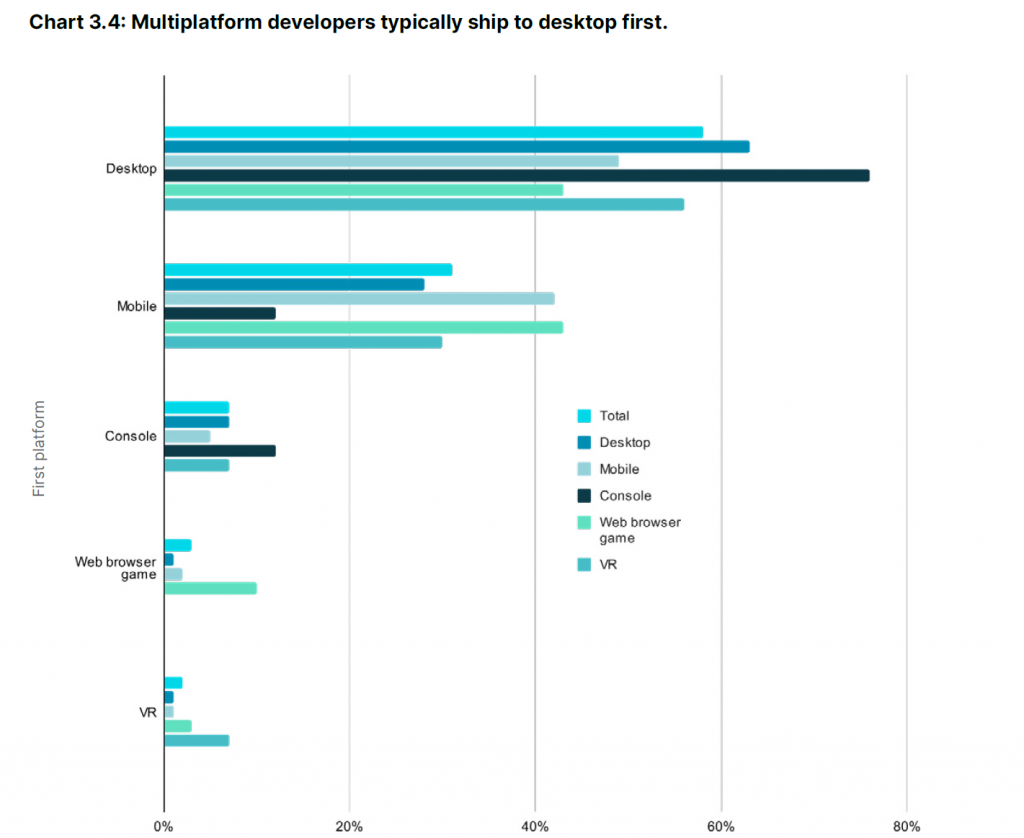

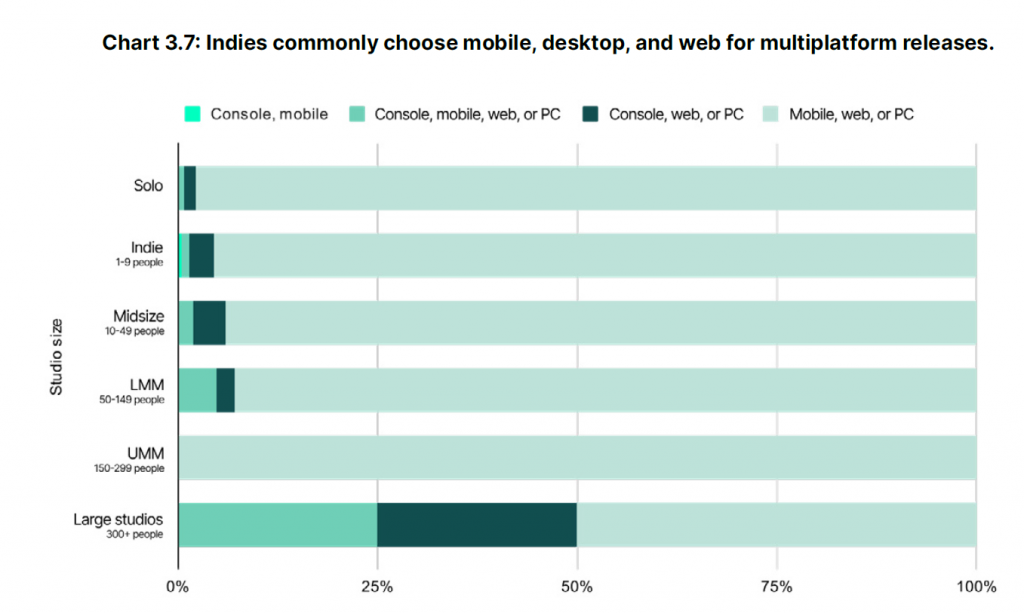

While indie studios thrive on shorter development cycles, large game development companies are embracing the concept of multiplatform games to maximize their reach and revenue potential. With the advent of various gaming platforms such as consoles, PCs, and mobile devices, the demand for games across different platforms has grown exponentially.

Large Studios and the Rise of Multiplatform Games

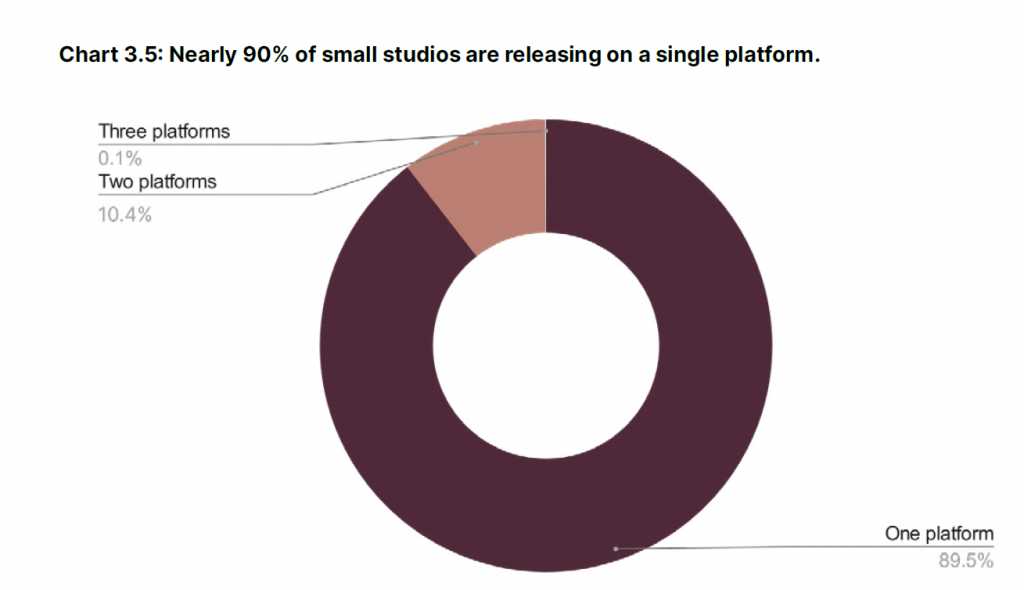

While indie game studios thrive in producing games with shorter development cycles, larger game development companies have been increasing their focus on creating multiplatform games. The widespread availability of gaming platforms, including consoles, PCs, and mobile devices, has encouraged studios to target a broader player base. Here are some noteworthy statistics:

a) According to a report by Newzoo, the number of multiplatform games released by large game development studios increased by 32.6% from 2018 to 2022.

Recognizing this trend, major game development studios are increasingly investing in multiplatform releases. According to a report by Newzoo, the number of multiplatform games released by large studios increased by 32.6% from 2018 to 2022. By developing games that can be played on a variety of platforms, these studios can tap into diverse player preferences and expand their potential player base.

b) The trend of multiplatform game releases is evident across industry giants like Electronic Arts (EA), Ubisoft, and Activision Blizzard, as they continue to invest in cross-platform development to cater to diverse player preferences.

For instance, Electronic Arts (EA) has embraced multiplatform releases for their popular franchises such as FIFA, Madden NFL, and Battlefield. By making their games available on consoles, PCs, and mobile devices, EA has managed to cater to a broader audience and generate substantial revenue across different platforms.

Extended Lifespans: Growing Importance of Games as a Service (GaaS)

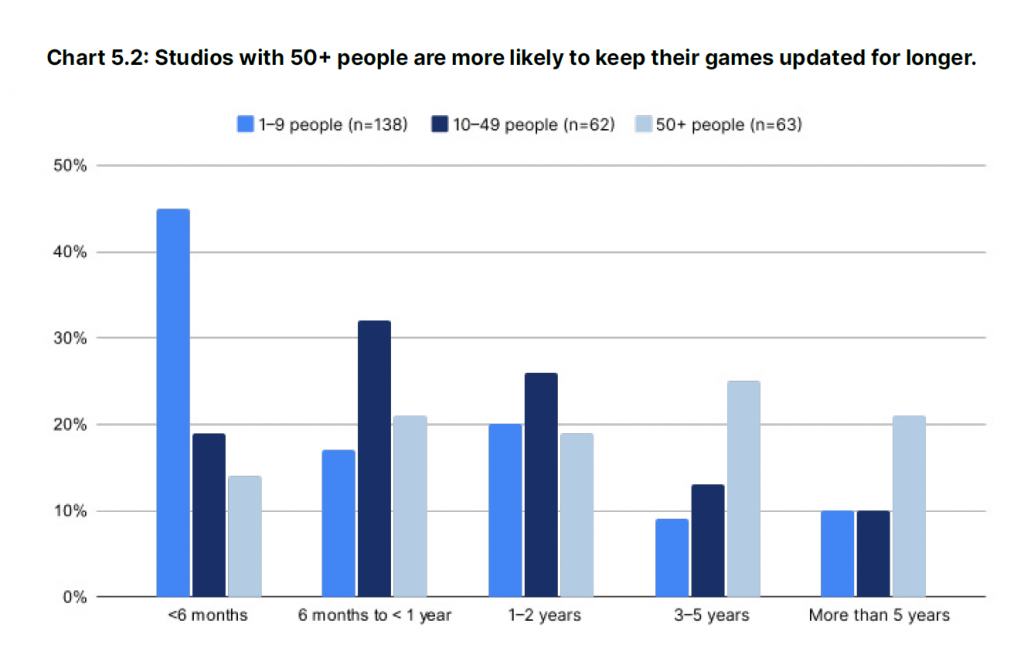

With the advent of online connectivity and the rise of games as a service (GaaS) model, game studios are focusing on extending the lifespan of their games. Rather than releasing sequels or standalone titles, developers are providing continuous updates, expansions, and additional content to keep players engaged for longer periods. Here are some statistics reflecting this trend:

a) In a report by SuperData, the revenue from additional content for games (DLCs, expansions, microtransactions, etc.) grew by 27% in 2021 compared to the previous year.

b) Popular titles like Fortnite, Rainbow Six Siege, and Grand Theft Auto V have exemplified the success of extending game lifespans by continually introducing new content and fostering active player communities.

The extension of game lifespans through ongoing updates, expansions, and additional content has become a prevailing trend in the industry. Rather than releasing sequels or standalone titles, studios are adopting a “games as a service” approach, providing players with a continuous stream of new content and experiences.

This shift is fueled by several factors, including the increasing prevalence of online connectivity, the rise of digital distribution platforms, and the desire to foster long-term player engagement. By extending the lifespan of games, studios can retain and monetize existing player bases, generate ongoing revenue streams, and cultivate dedicated communities around their games.

According to a report by SuperData, revenue from additional content for games, including downloadable content (DLC), expansions, and microtransactions, grew by 27% in 2021 compared to the previous year. This indicates a growing appetite among players for new and immersive experiences within their favorite games.

Popular titles such as Fortnite, Rainbow Six Siege, and Grand Theft Auto V have exemplified the success of extended game lifespans. These games continue to release regular updates, introduce new features, and engage players through events and competitions, ensuring a continuous stream of content and keeping their player base engaged for years.

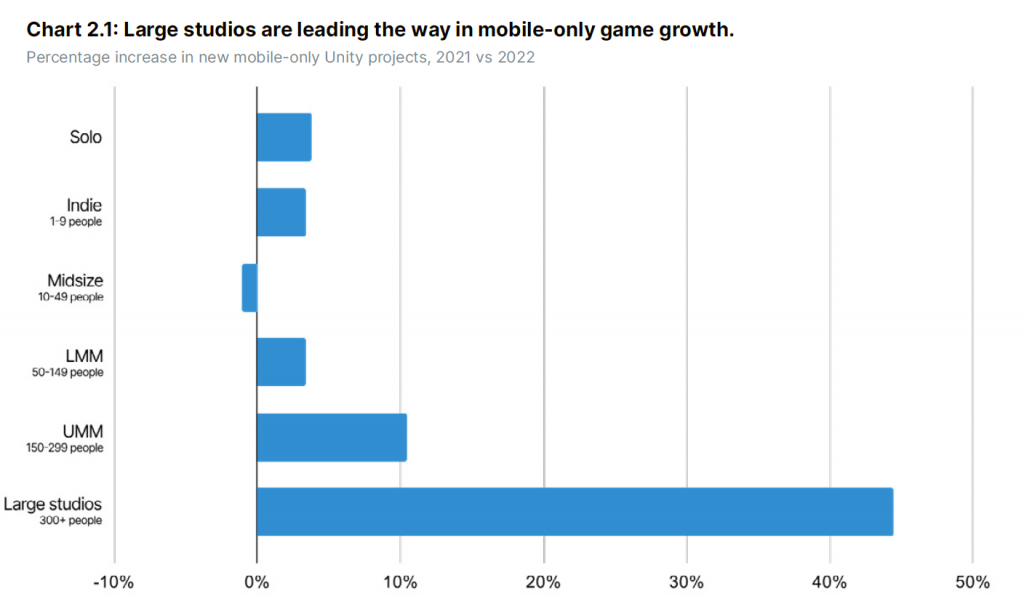

Mobile Gaming: A Growing Market and Developer Focus

Mobile gaming has witnessed exponential growth in recent years, with more people embracing smartphones and tablets as gaming platforms. As a result, both indie and large game development studios have recognized the potential of mobile games and have started dedicating resources to this lucrative sector. Let’s explore some relevant statistics:

a) According to a report by Newzoo, the global mobile gaming market generated $98.4 billion in revenue in 2021, representing a 17.9% increase from the previous year.

b) The number of mobile-only game releases increased by 23.4% from 2019 to 2022, as indicated by the GDC survey.

c) Industry giants like Nintendo, EA, and Activision Blizzard have expanded their mobile game portfolios, leveraging popular franchises and developing original titles to tap into the growing mobile gaming audience.

The market for mobile games has experienced tremendous growth, both in terms of revenue and player engagement. According to a report by Newzoo, the global mobile gaming market generated a staggering $98.4 billion in revenue in 2021, representing a 17.9% increase from the previous year. This growth is expected to continue as more people around the world gain access to mobile devices.

Game developers are capitalizing on this trend by starting more mobile-only games. The convenience and portability of mobile gaming, coupled with the vast potential audience, have attracted the attention of both indie and large studios. These studios recognize the unique opportunities offered by the mobile platform and are investing in creating captivating experiences tailored specifically for mobile devices.

The number of mobile-only game releases has seen a significant rise in recent years. According to data from the Game Developers Conference (GDC) survey, the number of mobile-only game releases increased by 23.4% from 2019 to 2022. This indicates a shift in focus towards mobile gaming and a recognition of its potential as a lucrative market.

Industry giants like Nintendo, Electronic Arts (EA), and Activision Blizzard have expanded their mobile game portfolios to tap into the growing mobile gaming audience. For example, Nintendo has successfully adapted some of its popular franchises such as Mario and Animal Crossing for mobile platforms, attracting millions of players and generating substantial revenue.

The increasing popularity of mobile gaming can also be attributed to the expanding player base. Mobile games have not only appealed to traditional gamers but have also attracted new demographics, including casual gamers, older adults, and female players. This diversification of the player base has contributed to the overall growth and success of mobile gaming.

According to a survey by Newzoo, women now make up 47% of mobile gamers, reflecting the industry’s efforts to create inclusive experiences and diverse game content. Additionally, the average age of mobile gamers has diversified significantly, with players ranging from young children to older adults. This broad appeal highlights the potential for game developers to create games that cater to a wide range of interests and preferences.

The rise in mobile gaming and the expanding player base present game publishers and developers with immense opportunities. By developing high-quality, engaging, and mobile-friendly experiences, they can tap into this ever-growing market and reach a vast audience of mobile gamers.

The Rise of Mobile Gaming: A Shift in Player Demographics

The increasing popularity of mobile gaming can be attributed to its accessibility, convenience, and a broader demographic reach. As smartphones become more affordable and accessible, people from various age groups and backgrounds are engaging in mobile gaming. Here are some notable statistics showcasing the expanding player base:

a) According to a survey by Newzoo, there were approximately 2.9 billion mobile gamers worldwide in 2021, accounting for over one-third of the global population.

b) The average age of mobile gamers has diversified significantly, with players ranging from young children to older adults. This broad appeal has opened new opportunities for game developers to create games catering to different interests and preferences.

c) Female representation in mobile gaming has also seen substantial growth. Women now make up 47% of mobile gamers, reflecting the industry’s efforts to create inclusive experiences and diverse game content.

The Influence of Technological Advancements

Advancements in technology have significantly impacted game development trends. From augmented reality (AR) and virtual reality (VR) to cloud gaming and machine learning, these emerging technologies are reshaping the gaming landscape. Let’s explore some key areas where technology is driving innovation:

a) AR and VR: The proliferation of AR and VR technologies has led to the development of immersive gaming experiences. Companies like Oculus (owned by Facebook) and HTC Vive have introduced VR headsets, while mobile AR games like Pokémon Go have captivated millions of players worldwide.

b) Cloud Gaming: Cloud gaming platforms, such as Google Stadia, Microsoft xCloud, and NVIDIA GeForce Now, allow players to stream games directly to their devices without the need for high-end hardware. This technology enables access to a vast library of games on various platforms, creating new opportunities for game developers.

c) Machine Learning: Machine learning algorithms are being integrated into game development processes to enhance game mechanics, optimize player experiences, and enable dynamic content generation. AI-powered systems are utilized for tasks like procedural level generation, adaptive difficulty, and personalized player recommendations.

Mobile Gaming KPI’s across markets

Mobile gaming has become a global phenomenon, transcending geographical boundaries and cultural differences. As the popularity of mobile games continues to rise, it is essential to understand the key benchmarks that shape the mobile gaming landscape across various markets and cultures. In this 2000-word paragraph, we will explore some of these benchmarks and their implications.

- Market Size and Revenue Generation: The mobile gaming market has experienced significant growth worldwide, with varying market sizes and revenue generation across different regions. Some key benchmarks include:

a) Asia-Pacific: The Asia-Pacific region dominates the global mobile gaming market, accounting for the largest market share. Countries like China, Japan, and South Korea have robust mobile gaming ecosystems, driven by factors such as high smartphone penetration, a tech-savvy population, and a strong gaming culture. According to a report by Newzoo, the Asia-Pacific region generated $49.2 billion in mobile gaming revenue in 2021.

b) North America: North America is another prominent market for mobile gaming, with the United States at the forefront. The region benefits from a large mobile user base, strong spending power, and a thriving gaming industry. In 2021, North America generated $28.2 billion in mobile gaming revenue, according to Newzoo.

c) Europe: Europe is a significant market for mobile gaming, with countries like the United Kingdom, Germany, and France leading the way. The region boasts a sizeable player base, favorable demographics, and a strong interest in mobile gaming. In 2021, Europe generated $21.4 billion in mobile gaming revenue, as per Newzoo’s report.

- Monetization Models and Revenue Streams: Mobile games employ various monetization models, and understanding the benchmarks in revenue generation is crucial for developers and publishers. Some key benchmarks include:

a) In-App Purchases (IAP): In-app purchases are a common revenue stream in mobile games, allowing players to buy virtual goods, unlock content, or access premium features. Key benchmarks include average revenue per user (ARPU) and average revenue per paying user (ARPPU), which vary across markets and genres.

b) Advertising: Advertising is another significant revenue stream for mobile games. Ad monetization benchmarks include average revenue per mille (RPM), fill rates, and click-through rates (CTR). These benchmarks vary based on the ad format, region, and player engagement.

c) Subscription Models: Subscription-based mobile games have gained traction, offering players access to a wide range of content for a recurring fee. Benchmarks in this area include subscription conversion rates, churn rates, and average revenue per subscriber (ARPS).

- Cultural Preferences and Game Genres: Cultural preferences greatly influence mobile gaming trends, leading to variations in popular game genres across different markets. Understanding these preferences is essential for developers and publishers to tailor their games effectively. Some key benchmarks include:

a) Casual Games: Casual games, such as puzzle games, match-three games, and hyper-casual games, have a broad appeal across markets. These games are often preferred by a casual gaming audience and tend to generate high player engagement and revenue.

b) Role-Playing Games (RPGs): RPGs, both single-player and multiplayer, have a strong following globally. Asian markets, in particular, have a deep appreciation for immersive RPG experiences, which often feature complex narratives, character customization, and social interaction.

c) Esports and Competitive Games: Esports and competitive games have seen tremendous growth, attracting a dedicated player base and substantial revenue. In markets like South Korea, where esports is highly popular, benchmarks for esports viewership, tournament prize pools, and player earnings are noteworthy.

- Player Behavior and Engagement Metrics: Understanding player behavior and engagement metrics is crucial for optimizing mobile game experiences. Some key benchmarks include:

include:

a) Daily Active Users (DAU) and Monthly Active Users (MAU): These metrics indicate the number of players actively engaging with a mobile game on a daily and monthly basis. Benchmarks for DAU and MAU vary depending on the game genre, target market, and the game’s lifecycle.

b) Retention Rate: Retention rate measures the percentage of players who continue to play a game over a specific period. Benchmark retention rates vary across different genres and markets, but higher rates generally indicate stronger player engagement and game stickiness.

c) Average Session Length: Average session length measures the amount of time players spend in a single gaming session. Benchmarks for session length vary depending on the game type and player preferences. Games that offer quick, bite-sized sessions may have shorter average session lengths compared to immersive, story-driven games.

d) Player Spending Habits: Understanding player spending habits is crucial for effective monetization strategies. Key benchmarks include average revenue per user (ARPU), average revenue per paying user (ARPPU), and the percentage of players who make in-app purchases (conversion rate). These benchmarks vary based on the game genre, monetization model, and market segment.

- Localization and Cultural Adaptation: Mobile games often require localization and cultural adaptation to resonate with players in different markets. Some benchmarks related to localization include:

a) Language Support: Providing localization for different languages is essential to attract players from diverse regions. Benchmarking the number of languages supported and the quality of localization can help gauge the effectiveness of localization efforts.

b) Cultural Sensitivity: Adapting game content to align with cultural sensitivities and norms is crucial. Benchmarking player feedback, reviews, and community engagement can provide insights into the effectiveness of cultural adaptation efforts.

c) Holidays and Events: Incorporating local holidays, festivals, and events into game content can enhance player engagement. Benchmarking player participation and engagement during specific holiday events can indicate the success of cultural adaptations.

In conclusion, mobile gaming benchmarks across markets and cultures encompass various aspects, including market size, revenue generation, monetization models, cultural preferences, player behavior, and localization. Understanding these benchmarks is crucial for developers and publishers to tailor their games effectively, optimize monetization strategies, and create engaging experiences that resonate with players globally. By analyzing these benchmarks and staying attuned to market trends, game developers can position themselves for success in the dynamic and competitive mobile gaming landscape.

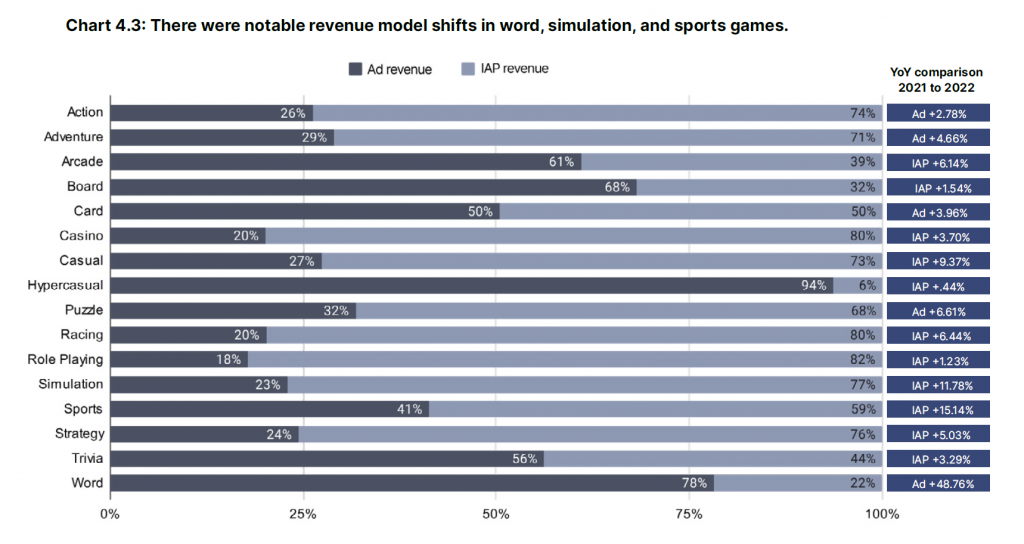

Monetization and changes in recent years

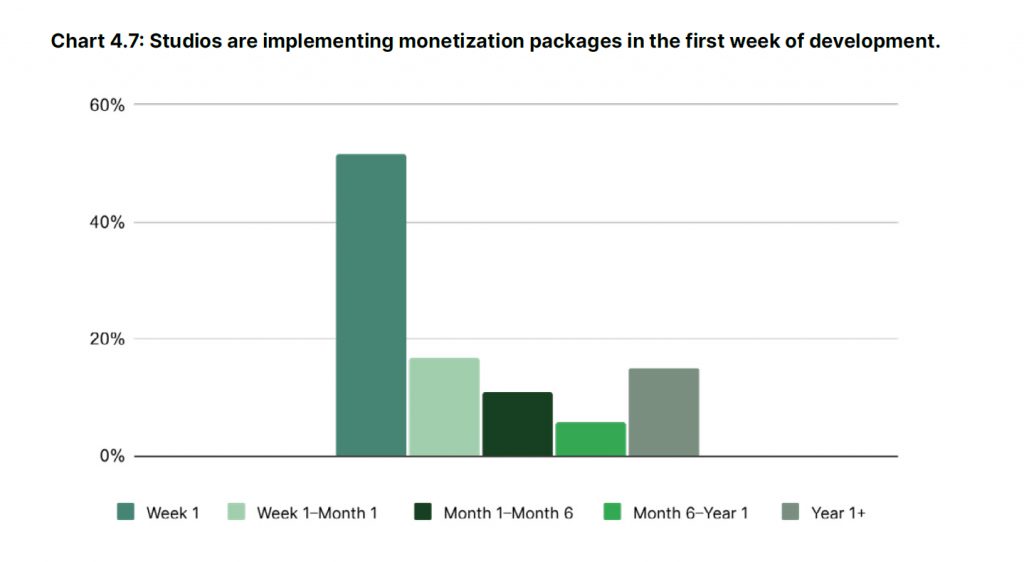

The monetization of games has undergone significant changes over the years, particularly in how early game developers release monetization packages. In this 2000-word paragraph, we will explore the evolution of monetization strategies and the impact it has had on the gaming industry.

- Traditional Retail Model: In the early days of gaming, the traditional retail model dominated the market. Game developers would release complete games on physical discs or cartridges, and players would purchase the game upfront. Monetization was primarily achieved through the initial purchase price, and additional content or expansions were often released as separate physical releases.

- Expansion Packs and Downloadable Content (DLC): As technology advanced and internet connectivity became more prevalent, game developers started exploring new monetization opportunities through expansion packs and downloadable content (DLC). Expansion packs offered players substantial additional content that expanded the game’s storyline, introduced new levels, or enhanced gameplay mechanics. Players would typically purchase these expansion packs separately after the initial game purchase.

DLC took this concept further by offering smaller, bite-sized content updates that could be downloaded directly into the game. DLC expanded beyond story content to include cosmetic items, character customization options, and additional game modes. This approach allowed developers to generate additional revenue from players who wanted to enhance their gaming experience.

- Microtransactions and Free-to-Play Model: The introduction of microtransactions and the rise of the free-to-play (F2P) model brought about a paradigm shift in the gaming industry. Developers began offering games for free, with monetization achieved through in-game purchases. This approach allowed players to access the core game experience without any upfront cost, while developers generated revenue through the sale of virtual goods, currencies, or other premium content within the game.

Microtransactions enabled players to make small purchases within the game to enhance their gameplay experience or progress more quickly. This model gained traction in mobile gaming, where players could make quick and easy purchases using digital payment methods. Popular examples include purchasing in-game currency, unlocking new characters or items, or removing time-based restrictions.

- Loot Boxes and Randomized Rewards: Another significant shift in monetization strategies came with the introduction of loot boxes and randomized rewards. Loot boxes are virtual containers that contain randomized items or rewards that players can acquire within a game. Players can either earn loot boxes through gameplay or purchase them directly. The allure of potentially obtaining rare or valuable items created a sense of excitement and led to increased player engagement and monetization opportunities.

However, loot box mechanics faced criticism for their potential resemblance to gambling, as players spent real money for a chance at desirable in-game items. Regulatory bodies in various countries have since examined the issue, leading to regulations and disclosures aimed at protecting players and ensuring transparency in loot box mechanics.

- Subscription-Based Models: In recent years, subscription-based models have gained traction as an alternative monetization strategy. These models offer players access to a library of games or exclusive content for a recurring fee. Game developers and publishers have introduced subscription services like Xbox Game Pass, PlayStation Plus, and Apple Arcade, providing players with a wide selection of games to enjoy for a monthly or annual subscription.

Subscription-based models offer benefits for both players and developers. Players gain access to a vast catalog of games without the need for individual purchases, while developers benefit from a steady stream of revenue and the potential for increased player engagement and retention.

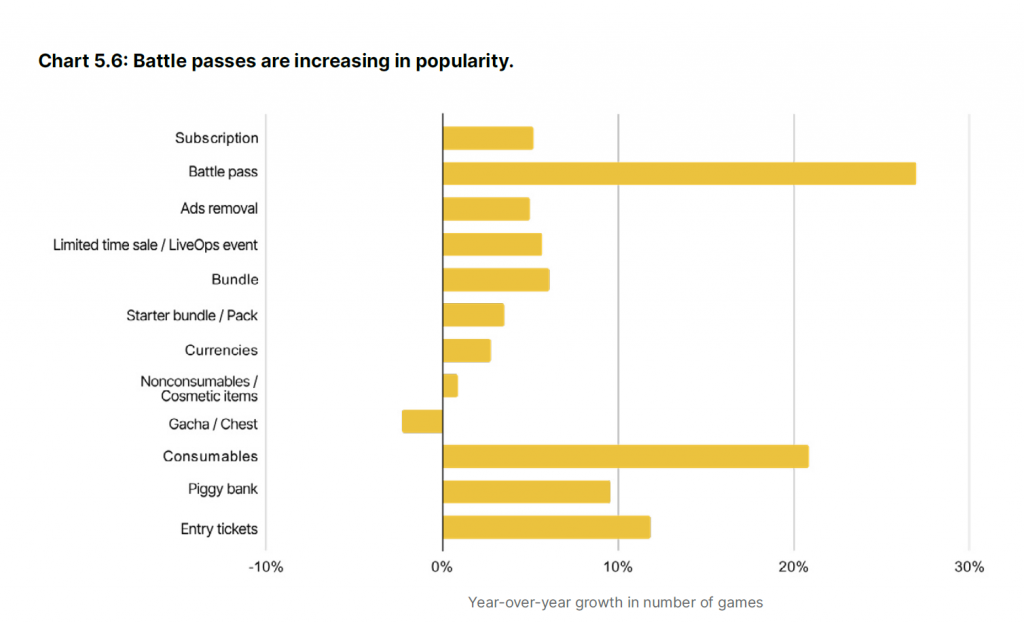

- Evolving Monetization Strategies: The gaming industry continues to evolve, and developers are constantly exploring new monetization strategies. Some emerging trends include:

- Cross-platform monetization: With the rise of cross-platform gaming, developers are exploring ways to monetize games across multiple platforms seamlessly. This includes synchronizing in-app purchases, subscription services, or virtual economies across different devices, ensuring a consistent experience for players.

- In-game Advertising: In-game advertising has become more

prominent as a monetization strategy. Developers are partnering with advertising networks to incorporate non-intrusive ads within games, such as banner ads, interstitials, or rewarded video ads. This approach allows players to engage with ads voluntarily and rewards them with in-game benefits or currency, providing an alternative revenue stream for developers.

- Live Events and Limited-Time Offers: Developers are leveraging live events and limited-time offers within games to drive monetization. These events offer exclusive content, time-limited discounts, or special rewards, encouraging players to make in-game purchases during specific periods. This creates a sense of urgency and FOMO (fear of missing out), driving engagement and monetization.

- User-Generated Content (UGC) Marketplaces: Some developers have embraced user-generated content marketplaces, where players can create and sell their own in-game assets, mods, or customizations. This allows developers to tap into the creativity of their player community while sharing revenue with content creators, expanding the game’s monetization potential.

- Virtual Reality (VR) and Augmented Reality (AR): As VR and AR technologies continue to advance, developers are exploring monetization opportunities within these immersive experiences. This includes selling virtual items, offering premium VR or AR content, or providing subscription-based access to exclusive VR/AR experiences.

The evolution of monetization strategies over the years reflects the changing landscape of the gaming industry. Developers have adapted their approaches to align with player preferences, technological advancements, and market demands. The shift from the traditional retail model to expansion packs, DLC, microtransactions, and free-to-play models has allowed for greater flexibility, player engagement, and revenue generation.

It is worth noting that the implementation of monetization strategies requires careful consideration of player experience, fairness, and transparency. Balancing the monetization of games with providing value to players is crucial for long-term success and player satisfaction. Additionally, regulatory scrutiny and ethical considerations surrounding certain monetization practices, such as loot boxes, highlight the importance of responsible and player-centric monetization approaches.

As the gaming industry continues to evolve, developers must stay attuned to player feedback, market trends, and emerging technologies. By embracing innovative and player-friendly monetization strategies, developers can create sustainable revenue streams while delivering enjoyable gaming experiences that resonate with their audience.

Conclusion

The game development industry continues to evolve, driven by various trends and advancements. Indie game studios have gained prominence by creating games in shorter time frames, while larger studios are focusing on multiplatform releases. Extended lifespans and the rise of games as a service have transformed the industry’s approach to content delivery. The increasing popularity of mobile gaming, driven by a growing player base, has attracted the attention of both indie and large studios. Technological advancements, such as AR, VR, cloud gaming, and machine learning, are shaping the future of game development.

Game publishers and developers should stay abreast of these trends to capitalize on emerging opportunities and meet the evolving demands of players. By embracing innovation, leveraging new technologies, and adopting player-centric approaches, game developers can thrive in the ever-changing gaming industry landscape.