10 Best Stripe Alternatives for SaaS Businesses in 2024: looking for alternatives to Stripe? Our 2024 guide reviews the top 10 payment processors, comparing key features and pricing to help you choose.

Are you frustrated with high fees, limited support, and the complexities of managing multiple payment tools with Stripe? You’re not alone. Many SaaS businesses are looking for alternatives that offer better features, lower costs, and more comprehensive support.

Stripe is a popular payment processing platform, but it isn’t fit for every business. Therefore, Finding the right payment solution is critical for managing transactions.

In this article, we will look at the 10 best Stripe alternatives for SaaS businesses in 2024. These alternatives provide different features and benefits that can better meet the unique needs of your business.

What is Stripe?

Stripe is a giant in the world of online payments. It’s a payment processing platform that helps businesses accept credit cards and other payment methods. Imagine it like a virtual credit card machine for your website or app.

Stripe Pros & Cons

Pros:

- Lots of Features: Stripe offers multiple features that can be helpful for businesses of all sizes.

- Secure: Security is a top priority, and Stripe takes it seriously.

Cons:

- Fees: Stripe charges a large fee for every transaction, which adds up over time.

- Limited Support: Mostly online support resources. Getting help on the phone is tough.

- Not All-in-One: May not be the best fit for complex businesses with needs like automatic tax calculations.

Stripe Pricing

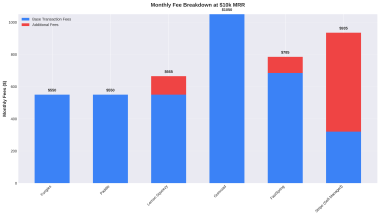

Stripe billing fees depend on the type of transaction and your billing volume. Here’s a breakdown of the main charges:

- Transaction fees: Stripe charges 2.9% + 30¢ for each successful card charge. There are additional fees for specific scenarios:

- 0.5% for manually entered cards

- 1.5% for international cards

- 1% if currency conversion is necessary

- ACH direct debit: 0.8% with a cap of $5.00 per transaction

- Invoicing fees:

- Invoicing Starter: 0.4% per paid invoice (designed for simpler invoicing needs)

- Invoicing Plus: 0.5% per paid invoice (includes advanced features like automatic reconciliation)

Why You Should Consider Alternatives to Stripe?

While Stripe offers a lot of features, it isn’t the perfect solution for every business. Here are some reasons why you should explore Stripe alternatives:

Building a Piecemeal Stack Is Complicated

Imagine buying a bunch of mismatched furniture for your room. It might look okay, but it wouldn’t be very comfortable or functional, right? The same thing can happen with your payment processing.

Stripe is a good payment gateway, but it doesn’t handle everything you need. For example, it doesn’t deal with automatic tax calculations or recurring billing for subscriptions. This means you need to use other separate services for those tasks. Having a bunch of different tools is confusing and time-consuming to manage.

Additional Maintenance Work

Stripe is known for being easy to use, but it still requires some maintenance. For example, you need to update your account information or deal with occasional technical issues. This takes time away from focusing on other important parts of your business.

Tax Liability Is Complicated

Taxes are a real headache for businesses, and Stripe doesn’t handle everything automatically. You’ll still be responsible for figuring out sales tax rates, collecting taxes from customers, and filing tax returns. This is especially tricky if you’re selling to customers in different states or countries.

Therefore, using a Stripe alternative that offers built-in tax features can save you a lot of time and hassle.

Top 10 Alternatives to Stripe in 2024

To help you decide, we put together a comparison chart of Stripe and 9 of its top competitors. This table compares features, pricing, and other important factors to consider.

| Provider | Overview | Key Features | Pros | Cons | Pricing |

| Stripe | Clean and developer-friendly | Super customizable, tons of integrations. | Easy to use, great for startups. | Can be expensive for high-volume sales. | Starts at 2.9% + $0.30 per transaction. |

| Fungies | Merchant of Record with multiple PSP’s underneath | Responsible for chargebacks and taxes. Advanced checkout and store customization. | Handles all taxes. Clean and easy UI to building checkout overlays, online store and pricing tables. | Still working on API documentation. | 5%+$0.5 per transaction. |

| Paypal | The OG online payment system | Widely recognized, easy for customers to use. | Fast setup, built-in buyer protection. | Higher fees than some competitors, limited customization | Starts at 2.9% + $0.30 per transaction. |

| Authorize.Net | A trusted veteran | Secure and reliable, good for established businesses. | Strong customer support, good fraud protection. | Can be complex to set up, not the most user-friendly. | Pricing depends on transaction volume, contact for a quote |

| WePay | Perfect for crowdfunding and marketplace | Perfect for crowdfunding and marketplaces. | Great for businesses with multiple sellers or donors. | Limited features for traditional online stores. | Pricing depends on features needed, contact for a quote |

| Stax | Built for high-volume businesses | Customizable pricing, offers volume discounts. | Scalable for large companies, good reporting tools | Can be complex to set up, may not be ideal for small businesses | The monthly subscription for stax starts from $100 a month. It can go upto $199+ depending on your desired plan. |

| 2Checkout (Verifone) | Global payment gateway | Accepts payments from many countries, good for international sales | Multilingual support, fraud prevention tools. | Can be more expensive for smaller businesses. | Pricing depends on features needed, contact for a quote. |

| Adyen | All-in-one payment powerhouse | Extensive features, handles in-store and online payments. | Great for complex businesses, excellent security. | More expensive than some options, complex setup. | Contact for a quote. |

| Braintree | Owned by PayPal, focuses on mobile payments | Easy integration with mobile apps, good for in-app purchases. | Fast and secure for mobile transactions | May not be the best for traditional online stores. | Pricing depends on features needed, contact for a quote. |

| Square | King of the brick-and-mortar stores | Free point-of-sale system, easy for in-person payments. | Great for physical stores, user-friendly interface. | Limited features for online-only businesses. | Starts at 2.6% + $0.10 per transaction. |

Note: This is not an exhaustive list, and pricing may change. Be sure to visit each provider’s website for the latest information.

Fungies

Looking for a Stripe alternative built specifically for SaaS businesses? Check out Fungies! It offers a payment infrastructure that can handle billing and taxes without any hassle. You can also embed a checkout page directly into your software. This is a big time-saver, especially for solo developers or small SaaS businesses that need to get up and running quickly.

Key Features:

Fungies offers features below:

- Subscription management

- Automatic tax calculations (depending on location)

- Secure payment processing

- Developer-friendly tools for easy integration

- Front-end online store

- Overlay checkout

Pros:

- All-in-one solution for SaaS or Digital Businesses

- Customizable online store

- Overlay checkout

- Zero Setup fee

- Easy to set up

- May offer tax compliance features

- Simple pricing 5% + $0.50 per transaction

Cons:

- Fungies is a relatively new company. Because of this, there might be fewer resources or reviews available compared to established players.

- API Documentation still needs some works

Pricing:

With Fungies, you pay a simple transaction fee of 5% plus 50¢ per transaction. This clear and upfront pricing means you know exactly what to expect, without any hidden costs. The best part is that you can start building your game’s web store today at no initial cost. Fungies allows you to create and publish your store for free, with no credit card required.

Paypal

PayPal is a giant in the online payment world. You’ve probably used it to shop online before! While it’s not the only option, it can be a good alternative to Stripe for some businesses.

Key Features:

- Credit card and ACH processing: Accept payments from major credit cards and bank accounts.

- Invoicing: Send invoices to your customers electronically.

- Buyer and seller protection: PayPal offers some protection for both buyers and sellers in case of disputes.

Pros:

- Widely recognized brand: Many customers already trust and use PayPal.

- Easy to use: Setting up a PayPal account is pretty straightforward.

- Security: PayPal has a lot of experience with online payments and security.

Cons:

- Higher fees for some transactions: PayPal’s fees can be a bit higher than Stripe’s for some transactions.

- Limited customization: You don’t have as much control over the look and feel of your checkout pages with PayPal.

Pricing:

PayPal’s fees depend on the type of transaction. For credit card transactions, they typically charge 2.9% + a fixed fee per transaction. You can find more details and pricing options on the PayPal website.

Square

You might know Square for their point-of-sale systems used in brick-and-mortar stores. But Square also offers online payment processing! This can be a good option if you have a physical store and also sell online.

Key Features:

- Credit card processing: Accept payments from major credit cards.

- Point-of-sale hardware: Square offers hardware like card readers to accept payments in person.

- Inventory management: Keep track of your stock with Square’s inventory tools.

- Loyalty programs: Reward your repeat customers with loyalty programs.

Pros:

- Great for brick-and-mortar stores: Square integrates seamlessly with their point-of-sale systems.

- Easy to use: Setting up Square is user-friendly.

Cons:

- Higher fees for online transactions: Square’s online processing fees can be a bit steeper than Stripe’s.

- Limited features: Square might not be the best option for businesses that rely heavily on subscriptions.

Pricing: Square’s fees for online transactions are typically 2.6% + $0.10 per transaction or 3.5% + a fixed fee. They also have fees for using their point-of-sale hardware. You can find more details on their website.

Braintree

Braintree, owned by PayPal, is a payment processor that focuses on mobile payments. This can be a good option if your business relies heavily on mobile apps.

Key Features:

- Credit card processing: Accept payments from major credit cards.

- Mobile wallets: Integrate with mobile wallets like Apple Pay and Google Pay for a smooth checkout experience.

- Fraud prevention: Braintree offers tools to help prevent fraud.

Pros:

- Easy to integrate with mobile apps: Perfect for businesses that get a lot of sales through their app.

- Secure: Backed by the security of PayPal.

Cons:

- Owned by PayPal: Fees might be similar to PayPal’s.

- May not be ideal for traditional websites: Braintree is geared more towards mobile payments.

Pricing:

Braintree’s fees vary depending on the type of transaction. They typically charge 2.9% + a fixed fee per transaction, similar to PayPal. You can find more details on their website.

Adyen

Adyen is a heavyweight in the payment processing world. They offer a wide range of features and can handle complex international transactions. This might be a good option for larger businesses that sell globally.

Key Features:

- Credit card processing: Accept payments from all major credit cards.

- Global payments: Adyen can handle payments from customers around the world.

- Fraud prevention: Advanced fraud prevention tools to keep your business safe.

- Data analytics: Get insights into your sales data to make better business decisions.

Pros:

- Robust features: A powerful option for businesses with complex needs.

- Global reach: Great for businesses that sell internationally.

Cons:

- More complex setup: Setting up Adyen might require more technical knowledge compared to some other options.

- Higher fees: Adyen’s fees can be higher than some other processors, especially for smaller businesses.

Pricing:

Adyen’s pricing is custom-quoted based on your business needs. Be sure to contact them for a quote.

Authorize.Net

Authorize.Net is a well-established payment processor that’s been around for a long time. They offer a variety of features for businesses of all sizes.

Key Features:

- Credit card processing: Accept payments from major credit cards.

- Recurring billing: Set up automatic payments for subscriptions.

- Fraud prevention tools: Help protect your business from fraud.

Pros:

- Reliable and established: A trusted option with a long history.

- Good for high-risk businesses: Authorize.Net may be willing to work with businesses that others might consider risky.

Cons:

- Complex setup process: Setting up an Authorize.Net account can be a bit tricky.

- Higher fees for some transactions: Their fees can be higher for certain types of transactions.

Pricing:

Authorize.Net’s fees vary depending on the type of transaction. They typically charge 2.9% – 3.9% + a fixed fee per transaction. You can find more details on their website.

2Checkout (Verifone)

If you’re a business that deals with high-risk industries, 2Checkout might be a good option for you. They specialize in working for businesses that Stripe or other processors might consider risky.

Key Features:

- Credit card processing: Accept payments from major credit cards, even in high-risk industries.

- Global payments: Sell to customers around the world, in different currencies.

- Fraud prevention: Advanced fraud prevention tools to protect your business.

- Multilingual support: Reach a wider audience with support in multiple languages.

Pros:

- Accepts payments from high-risk businesses: A good option if Stripe or others have rejected you.

- Global reach: Sell internationally with ease.

Cons:

- Higher fees: 2Checkout’s fees can be steeper than some other processors.

- Complex setup process: Getting started with 2Checkout might take more time and effort.

Pricing: 2Checkout’s fees vary depending on the industry and transaction type. They typically range from 3.4% to 8.8% + a fixed fee per transaction. Be sure to contact them for a quote.

GoCardless

GoCardless focuses on a specific payment method: ACH transfers. This is where money is pulled directly from a customer’s bank account, instead of using a credit card. This can be a good option for businesses that offer subscriptions or recurring payments. As ACH transfers often have lower fees than credit card transactions.

Key Features:

- Direct bank transfers (ACH): Accept payments directly from your customer’s bank accounts.

- Recurring billing: Set up automatic payments for subscriptions.

- International payments: Accept ACH payments from customers in some countries.

Pros:

- Lower fees than credit cards: ACH transfers typically have lower processing fees than credit cards.

- Great for recurring payments: A good option for subscription-based businesses.

Cons:

- Limited to ACH payments: You can’t accept credit cards or other payment methods.

- Not ideal for international sales: ACH payments are currently limited to certain countries.

Pricing:

GoCardless charges a transaction fee of 1% – 2%, depending on the payment volume. You can find more details on their website.

WePay

WePay focuses on processing payments for online marketplaces and crowdfunding platforms. So, if you run a website where people buy and sell things from each other, WePay might be a good fit.

Key Features:

- Credit card processing: Accept payments from buyers on your marketplace.

- Payouts to sellers: Easily send payouts to the sellers on your platform.

- Dispute resolution tools: WePay can help mediate disputes between buyers and sellers.

Pros:

- Built for marketplaces: WePay has features specifically designed for online marketplaces.

- Dispute resolution: Helps you handle disagreements between buyers and sellers.

Cons:

- Limited to marketplaces: WePay might not be the best option for traditional online stores.

- Less popular than some other processors.

Pricing:

WePay’s fees depend on the transaction type. You can find more details on their website.

Stax

Stax is a relatively new player in the payment processing game. However, they’re making waves with their focus on helping businesses streamline their finances.

Key Features:

- Credit card processing: Accept payments from customers.

- Automated accounting: Stax can categorize your transactions and connect to popular accounting software.

- Bill pay: Pay your business bills directly through Stax.

Pros:

- All-in-one solution: Stax combines payments with accounting tools.

- New and innovative: Stax offers features that some older processors don’t.

Cons:

- New company: Stax is still growing, so there might be fewer resources or reviews available compared to established players.

- We need more information to confirm all features and pricing.

Pricing:

The monthly subscription for stax starts from $100 a month. It can go upto $199+ depending on your desired plan.

How We Selected These Alternatives For Stripe?

To help you navigate, we looked at a bunch of sources to find the top contenders to Stripe. Here’s what we did:

- Picked Trusted Sources: We searched websites from experts in business and technology. We looked at sites like Forbes, Paddle, and GoCardless. We also checked the forums to conclude our choice.

- Compared Features: We made a checklist of features that might be important to businesses. These include processing credit cards, managing subscriptions, and handling international payments. Then we checked which features each payment processor offered.

- Considered Reviews: We looked at reviews from real business owners to see what they think about different processors.

- Weeded Out the Unknowns: There are tons of payment processors out there. But we focused on the ones with a good reputation and established track record.

Not all payment processors are created equal! We wanted to find options for different business types. Here’s what we considered:

- Easy to Use: Is it beginner-friendly or super complex?

- Features: Does it have the features your business needs, like subscriptions or global payments?

- Fees: How much will it cost you to process payments?

- Business Type: Is it a good fit for your specific industry (SaaS, marketplace, etc.)?

By looking at all these factors, we came up with a list of Stripe payment alternatives that cater to different business needs.

Remember, this is just a starting point! Do your research and see which payment processor is the right fit for you.

How to Choose The Best Credit Card Processor?

So, you’re ready to accept credit card payments online? Awesome! But with so many processors out there, how do you pick the right one? Don’t worry, we’ve got you covered. Here are some key things to consider:

1. Think About Your Business Needs:

- If you’re a new business, you might want a processor that’s easy to use and has a good reputation.

- If you offer subscriptions, you’ll need a processor that can handle recurring payments.

- If you want to sell to customers worldwide, you’ll need a processor that supports international payments.

2. Compare Features:

- This is a must-have! But some processors offer additional features like invoicing or mobile payments.

- Make sure the processor has strong security measures to protect your customer’s information.

- What happens if you run into problems? Make sure the processor offers good customer support.

3. Don’t Forget the Fees!

- Processors charge a fee for every transaction you process. These fees can vary, so be sure to compare rates.

- Some processors charge a monthly fee, on top of transaction fees.

- Watch out for any hidden fees, like setup fees or chargeback fees.

4. Read Reviews:

- See what other businesses are saying about different processors. This can give you valuable insights into the pros and cons.

5. Do a Free Trial (If Available):

- Some processors offer free trials, so you can try out their service before you commit.

Final thoughts

In conclusion, finding the best Stripe alternatives for SaaS businesses in 2024 is important. Each of the options we discussed offers unique features and benefits.

In my recommendation, Fungies is an outstanding alternative to Stripe. Fungies is specifically designed to cater to the unique needs of SaaS companies, offering features such as subscription management, automatic tax calculations, and secure payment processing. Its developer-friendly tools make integration seamless, and with a transparent pricing model of 5% plus 50¢ per transaction, you can avoid hidden costs.

FAQs

Why does my SaaS business need credit card processing?

Your SaaS business needs credit card processing to easily accept payments from customers. Most people prefer using credit cards for online transactions because it is quick and convenient. Credit card processing allows you to set up recurring billing. This is important for subscription-based services.

Who are the biggest Stripe payment alternatives?

Several payment processors serve as major Stripe alternatives. PayPal is one of the most popular due to its wide acceptance and ease of use. Square offers robust tools for both online and offline sales. Adyen is favored by large enterprises for its global reach. Fungies is another noteworthy option. Especially for SaaS businesses, providing payment infrastructure, tax compliance, and embedded checkout.

What’s the best Stripe alternative for SaaS businesses?

For SaaS businesses, Fungies stands out as an excellent Stripe alternative. It provides essential tools like payment processing, tax compliance, and embedded checkout. This makes it easy for SaaS and solo developers to implement payments. While there are other alternatives like PayPal and Braintree. Fungies is specifically tailored to meet the needs of SaaS companies.