The Gaming Market Size Overview

The year 2023 was a landmark period in the video game industry, characterized by an overwhelming number of new game launches, deals, innovative ventures, and shifts in strategy according to Newzoo.

The gaming market is multifaceted, and identifying the right trends is crucial for developing effective strategies.

To anticipate the future, it’s vital to understand the historical and current market dynamics. Let’s revisit the most significant numbers and developments in the gaming market of 2023.

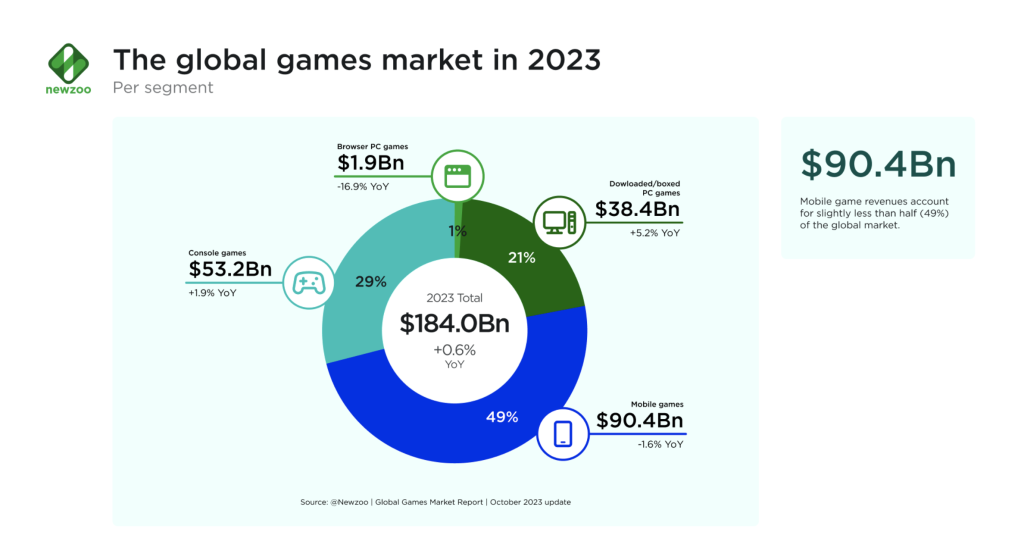

In 2023, the global games market was projected to reach $184.0 billion. Rewinding to a year earlier, the market size was estimated at $182.9 billion in 2022, marking the first forecasted decline in year-on-year revenue since we began monitoring the global games market. This decline was seen as a period of market correction.

However, this downward trend was short-lived. Our projections for 2023 show an increase in the global games market to $184.0 billion, a growth of 0.6% year-on-year. By 2026, we expect the market to expand to $205.7 billion, with a compound annual growth rate (CAGR) of 1.3% from 2021 to 2026.

Breaking down the 2023 figures by segment, console gaming is forecasted to reach $53.2 billion, showing a growth of 1.9% year-on-year. This growth was influenced not only by exchange rates but also by other market factors.

A notable highlight of 2023 was the PC gaming segment, which is expected to grow by 3.9%, reaching $40.4 billion. While live-service games continue to be the main source of revenue in this segment, 2023 has shown that premium game releases also significantly contribute to growth in PC gaming.

Our analysis in the October 2023 games market update revealed that while new releases met expectations, their success did not add to the revenues from live-service games or back catalog sales. Instead, premium titles appeared to take away revenue from popular live-service games, suggesting a competitive revenue scenario in this segment.

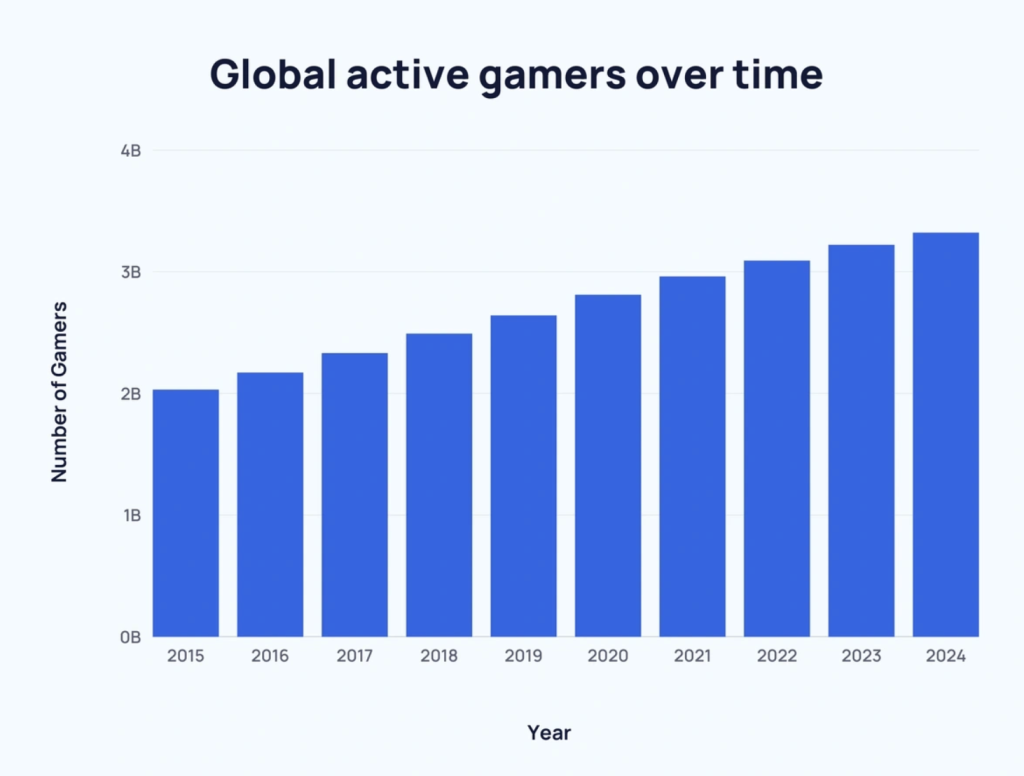

The global player count is also on the rise, with an expected reach of 3.38 billion in 2023, an increase of 6.3% from the previous year. Growth in emerging markets is a key driver of this increase in player numbers. Furthermore, the number of paying players is anticipated to grow by 7.3% to 1.47 billion, with the accessibility of local payment methods playing a significant role in unlocking growth in the gaming market.

These figures represent just a snapshot of the industry’s growth. For a more comprehensive analysis of key markets, regions, and trends that are crucial for future forecasting, access to our Games Market Reports and Forecasts data sets, market sizing and forecasting tools, and our industry-leading quarterly reports is available.

Top PC and Console Titles 2023

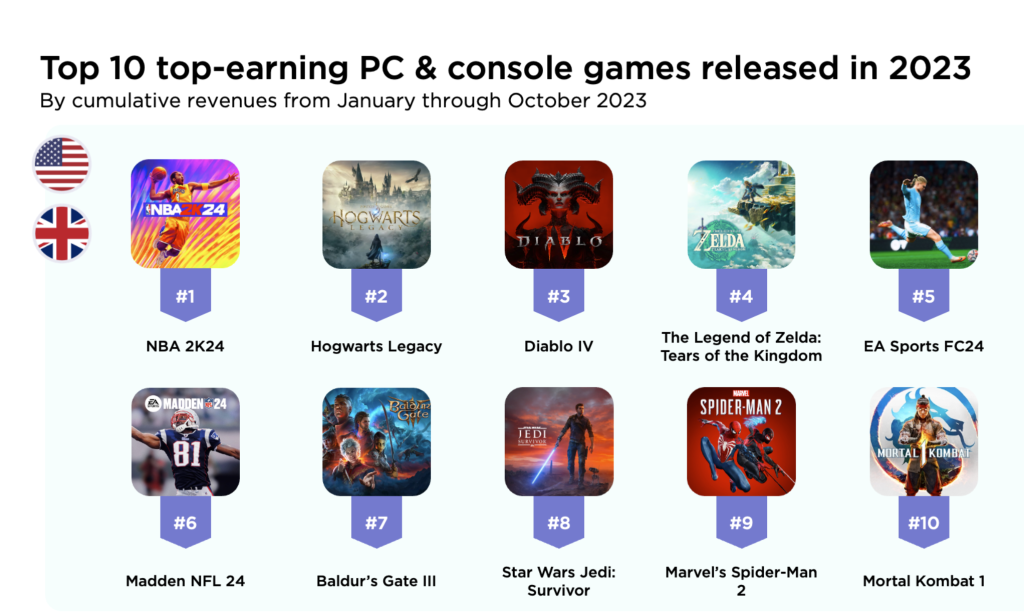

Analyzing the top-grossing PC and console games of 2023 from January to October, the report utilized the Game Performance Monitor’s Revenue Add-On to dissect the highest-earning game releases in both the US and the UK.

In a year marked by numerous high-profile releases, it’s fascinating to see which titles achieved the highest sales. NBA 2K24 led the pack, benefitting from its substantial fanbase in the US and an effective mix of both premium and ongoing revenue streams.

Noteworthy among single platform releases were “The Legend of Zelda: Tears of the Kingdom” and “Marvel’s Spider-Man 2“. Additionally, “Baldur’s Gate III” stands out for not only winning Game of the Year but also for being the sole top-10 game from an independent studio.

It’s important to note that this ranking focuses on the highest earners of the year, favoring games released earlier in 2023, like “Hogwarts Legacy“. This ranking doesn’t account for revenue generated during the critical holiday season. For example, “Call of Duty: Modern Warfare III” would likely have made a significant impact on this list if data from November and December were included.

This top 10 list of the most lucrative PC and console games of 2023, based on cumulative revenues from January through October, is specifically for the US and UK markets.

Top Games by MAU in 2023

During the period from January to October 2023, the gaming landscape saw certain PC and console games rising to prominence based on their monthly active users (MAU). The Game Performance Monitor provided a detailed view into which games maintained the highest levels of player engagement throughout most of the year.

Live service games, known for their regular free updates and focus on sustained player involvement, unsurprisingly made up the majority of the top 10 most-played games by MAU. Interestingly, none of these top 10 games were new launches in 2023, though it can be argued that titles like Counter-Strike 2 and Call of Duty: Modern Warfare III went beyond being just updates.

Analyzing average MAUs across 37 markets from January through October, Fortnite emerged as the frontrunner in terms of engagement on PC and console platforms. While there was a slight dip in Fortnite’s MAU growth in 2023, the game regained momentum with the reintroduction of Fortnite OG in November 2023, maintaining its lead over others in terms of average MAU and player share.

Among the Nintendo Switch titles, Fortnite, Minecraft, and Rocket League were notable for being in the top 10 in terms of average MAU. Our data tracking for engagement metrics on the Switch was limited to the US and UK markets, hence the exclusion of the main Nintendo console from the overall yearly ranking.

Additionally, it’s worth mentioning that “The Legend of Zelda: Tears of the Kingdom” achieved the highest average MAU on the Nintendo Switch. The game’s popularity, fueled by players sharing their creative exploits in the game’s expansive world, was a key factor in its high ranking.

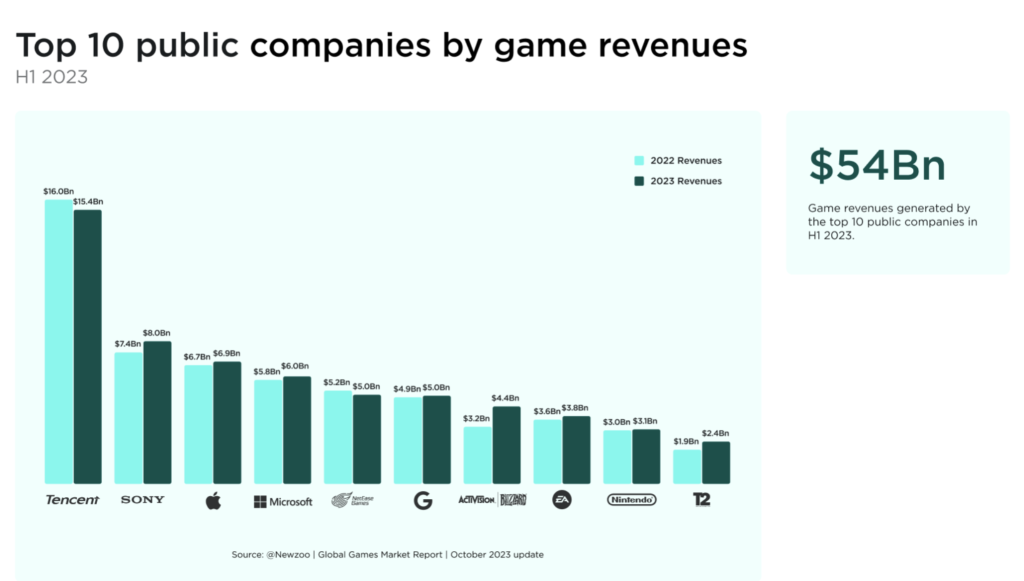

Dominance in the Gaming Industry: Top 10 Public Companies’ Revenue Soars in H1 2023

A Financial Overview of Gaming Giants

In the first half of 2023, the gaming industry witnessed a significant financial feat. The top 10 public game companies amassed an impressive $54 billion in revenue, capturing nearly 30% of the global market’s total annual revenues. This remarkable achievement underscores the financial dominance of leading companies in the gaming sector.

Analyzing the Revenue Dynamics

These top-tier companies generated an astonishing $54.4 billion in the first half of 2023 alone. This concentration of revenue among a select few companies highlights a trend of market consolidation that has become increasingly evident in the gaming industry. The revenue distribution in the gaming market has historically been skewed toward the largest and most influential players, and this year’s figures further cement that trend.

Microsoft and Activision Blizzard: A Powerhouse Duo

A notable highlight of the financial landscape was the combined revenue of Microsoft and Activision Blizzard, which totalled $10.4 billion in the first half of 2023. This formidable alliance has positioned Microsoft as the second-highest revenue-generating games company, surpassing Sony for the first time since the inception of tracking public company revenues in this sector.

The Future Outlook

The alliance between Microsoft and Activision Blizzard is poised to have a significant impact on the global gaming market in 2024 and beyond. The industry is witnessing a phase of aggressive consolidation, marked by large mergers and acquisitions. These developments are reshaping the competitive landscape, signaling a new era of corporate dynamics in the gaming world. As the industry evolves, these monumental mergers and the resulting shifts in market power will be critical trends to observe.

Revisiting the Predicted Trends of 2023

As the report steps back and analyze the gaming market of 2023, it’s intriguing to compare the year’s happenings with the predictions made at its start. Let’s delve into the accuracy of these forecasts and the actual trends that emerged in the gaming world.

1. The Shift to Service-Based Models in AAA and AA Games

One of our initial predictions was that more AAA and AA publishers would pivot their main franchises to a service-based model. However, this shift has not materialized as expected, at least not yet.

2. The Microsoft-Activision Acquisition

A significant development was the completion of Microsoft’s acquisition of Activision-Blizzard in October. This major deal, anticipated to have regulatory implications, also included agreements to enable third-party cloud gaming services to stream games from both Microsoft and Activision Blizzard.

3. Hybrid Monetization Strategies

We foresaw the PC and console markets adopting hybrid monetization strategies, including advertising. This prediction was partly accurate. While these markets have explored various monetization methods, advertising hasn’t yet made a significant impact.

4. Mergers and Acquisitions

Contrary to our expectation of a slowdown, the appetite for mergers and acquisitions (M&A) in the gaming industry remained robust, evidenced by the closure of some notable deals.

5. Semiconductor Supply Chain Recovery

Our prediction of a rebound in the global semiconductor supply chain, boosting console availability, turned out to be accurate, marking a positive development for hardware accessibility.

6. User Acquisition Challenges in Mobile Gaming

We accurately predicted that acquiring users for mobile (hyper)casual games would become more challenging in the post-ATT era. This challenge has led many mobile developers to consider moving towards PC and console game development.

7. Cloud Gaming’s PaaS Expansion

Cloud gaming service providers indeed increased their investments in Platforms as a Service (PaaS), diversifying beyond consumer gaming to support various graphically intensive applications, including generative AI tools.

8. Generative AI in Game Development

As predicted, generative AI has facilitated certain aspects of game development, although we’re still years away from its full application in AAA game design. Its use remains limited but promising.

9. The State of VR Gaming

Our prediction about the growth of VR gaming being steady but niche was partially correct. The VR install base increased to 30.8 million by the end of 2023, a 15.6% year-on-year growth. However, maintaining active users and encouraging spending on new content remains a challenge.

10. Gaming in the Automotive Industry

The concept of gaming in cars is evolving, and while we haven’t reached the point of playing games like Fortnite in AI-powered autonomous vehicles, gaming is emerging as a potential niche in the automotive industry.

Cross-platform is the new norm

Cross-Platform Gaming: A Rising Trend

In 2023, the world of gaming continued to cement its place in the cultural zeitgeist, touching more lives than ever before. The Global Gamer Study of 2023, encompassing 74,000 respondents across 36 markets, revealed some compelling insights into the habits of gamers worldwide. One of the most striking findings is the diversity in gaming platforms used by players. Nearly half of all gamers are not confined to a single platform; instead, they spread their gaming experiences across multiple platforms. Remarkably, 15% of gamers are tri-platform players, engaging in games on PC, console, and mobile.

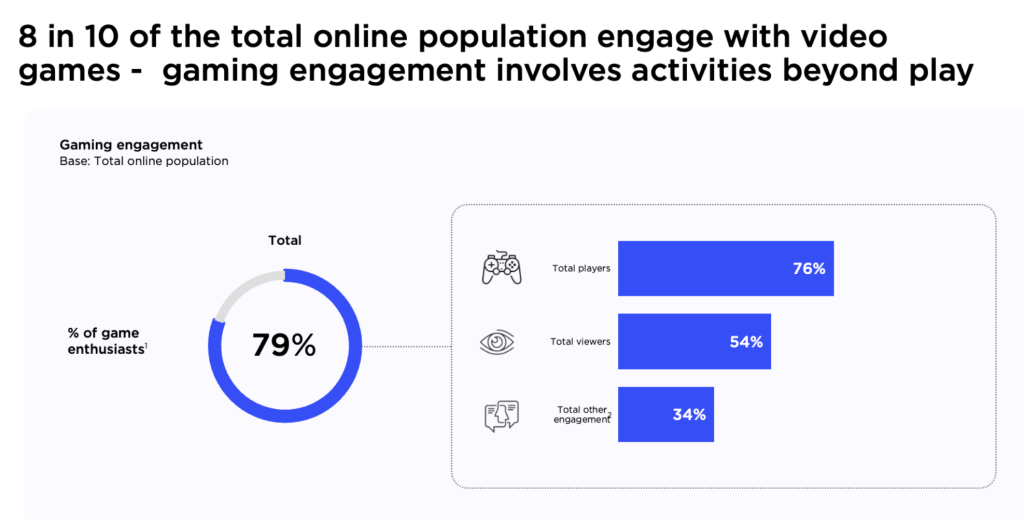

Broader Engagement in Gaming

The study found that 80% of the total online population engages with video games, indicating the vast reach of gaming in today’s digital world. More interestingly, the scope of gaming engagement extends far beyond just playing games. People are increasingly interacting with games through various forms and across different media, not limited to traditional devices like computers and consoles.

Gaming and Non-Gaming Brands: A Synergistic Relationship

Non-gaming brands are increasingly recognizing the value of the gaming audience. These brands are strategically leveraging intellectual properties from the gaming world to attract gamers. This strategy is proving successful as long as the brand activations are non-disruptive and seamlessly integrate into the gaming experience.

Beyond Playing: Diverse Ways Gamers Engage with Content

The Global Gamer Study also highlighted that more than half (54%) of the online population watched video game content within the past year. Furthermore, about a third of the respondents engage in gaming-related activities beyond playing and viewing. This includes participating in online gaming communities, discussing video games in real life, attending gaming conventions, and listening to gaming podcasts.

Gaming Industry in 2023: A Year of Significant Developments and Future Projections

Noteworthy Events and Trends Shaping the Year

The gaming industry in 2023 was a whirlwind of activity, marked by significant developments, strategic shifts, and evolving market dynamics. Here’s a recap of some key stories that defined the year in gaming:

1. Industry Restructuring and Job Losses

Gaming companies of various sizes underwent considerable restructuring, leading to a significant loss of jobs, estimated between 6,500 and 9,000. This upheaval resulted in a considerable exodus of talent from the industry.

2. Sony’s Live-Service Strategy and Acquisitions

Sony showcased its commitment to live-service games in May 2023, presenting multiple upcoming titles set to shape its strategy for 2024 and beyond. This initiative followed a series of strategic acquisitions to bolster PlayStation Studios. However, there’s been a lull in news about Sony’s live services lately, with speculations of internal challenges emerging.

3. Playtika’s Strategic Shift

Playtika’s president stated a shift away from significant investments in new game development, mirroring challenges faced by other developers like Supercell and Voodoo.

4. Mobile Developers Eyeing PC and Console Markets

In an interesting turn, mobile game developers are expanding into PC gaming to diversify their revenue streams amid growing challenges in the mobile sector. Supercell’s move to bring popular titles to PC via Google’s Play Games platform is a prime example.

5. Unity’s Pricing Model Changes

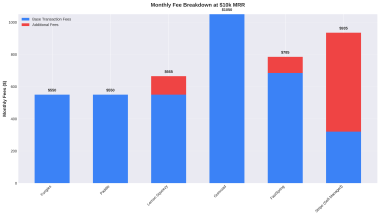

Unity faced backlash and later revised its pricing model twice in September, sparking mixed reactions among developers. Despite the controversy, Unity remains a dominant engine, powering a vast majority of mobile games.

6. Changes in Subscription Pricing Models

Xbox Game Pass and PlayStation Plus shifted their focus from growth to user retention, leading to increased subscription prices and fewer promotions.

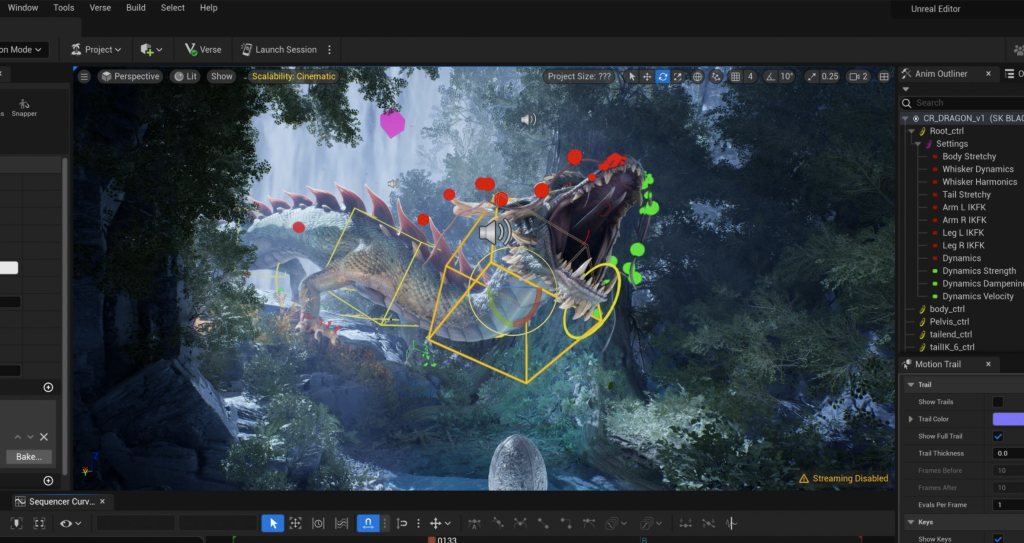

7. User-Generated Content Takes Center Stage

At GDC 2023, Epic Games unveiled Unreal Editor for Fortnite, highlighting the growing importance of user-generated content (UGC) in the gaming industry. This move aligns with the industry’s response to the increasing demand for new content in live service games.

8. Epic Games’ New Ventures

Epic Games continued to expand Fortnite as a platform, introducing LEGO Fortnite as part of a collaboration with LEGO, furthering their platform development ambitions.

9. The End of E3

E3 2023 was canceled, marking the end of an era for one of the gaming industry’s most significant events.

10. Google Play Store Monopoly Ruling

A major legal development occurred when a jury ruled that the Google Play Store operated as a monopoly, engaging in anti-competitive practices.

Looking Ahead: The Future of Gaming

As we bid farewell to an eventful 2023, the focus now shifts to what lies ahead for the gaming market. Despite the highs and lows of 2023, growth is expected to continue, albeit at a moderated pace as the industry adapts to an uncertain financial climate.

Projections for 2026 and Beyond

- The global games market is projected to generate $205.7 billion in revenue.

- The player count is expected to reach approximately 3.79 billion globally.

- Payer numbers are anticipated to increase to 1.66 billion.

- While full game revenues will grow, digital game sales will outpace them.

- Cloud gaming is poised to attract 80.4 million paying users by 2025, with steady growth in 2026.

As the gaming industry evolves, key questions about engagement and revenue growth remain. Stay tuned for a detailed analysis of what’s next in the world of gaming.