Find the best billing solutions for your SaaS business in 2024. Compare the top 7 options for features and pricing, and find the best fit for your business.

Are you losing sleep over complex billing, subscription headaches, and the never-ending tax maze? You’re not alone. Many SaaS businesses are bogged down by these issues which results in lost revenue, unhappy customers, and countless hours of admin work. But it doesn’t have to be this way.

Many SaaS companies struggle with billing because it’s complex. Managing subscriptions is difficult, and keeping up with tax rules is a headache. These problems lead to losing money, frustrating customers, and wasting hours on paperwork. But worry not.

In this article, we will dive deep into the top options available this year. We will discuss their key features, benefits, and why they stand out. By the end, you’ll have a clear understanding of the best SaaS billing solutions for your needs.

How Do SaaS Billing Solutions Work?

So, you’ve chosen a killer SaaS billing solution – awesome! But how exactly does it work? Let’s take a peek behind the curtain and see how these platforms handle the nitty-gritty of billing your customers.

1. Tracking Usage:

This is where the magic starts! The billing solution keeps tabs on how your customers are using your software. This could involve tracking things like storage space used, the number of users, or even the number of features they’re using.

2. Subscription Management:

SaaS billing platforms are whizzes at handling subscriptions. They can charge customers at the beginning of their billing cycle (monthly, yearly, etc.) and keep track of any changes they make to their plans.

3. Sending Invoices:

No more scrambling to create invoices! The billing solution generates clear and professional invoices for your customers. These invoices typically show what services were used, the amount owed, and the due date.

4. Payment Collection:

This is where the money flows in! The billing solution allows customers to pay their invoices online, often through credit cards or ACH transfers. The platform handles the whole process, making it easy for your customers and saving you time.

5. Dun-Dunning (Optional):

Uh oh, a late payment! Some SaaS billing platforms can even send gentle reminders to customers who forget to pay their invoices. This helps you get paid on time and keeps your cash flow healthy.

6. Reporting and Analytics:

These clever platforms don’t just collect money, they also provide valuable insights. You can see reports on things like revenue trends, customer churn (customers who stop using your service), and which plans are most popular. This data helps you make informed decisions about your business.

That’s the basic flow of how a SaaS billing solution works! By automating these tasks, these platforms free you up to focus on what matters most – growing your business!

Types of SaaS Billing Systems

So, you know how a SaaS billing solution works, but what kind of billing system should you use? There are actually a few different options, each with its own pros and cons. Let’s break down the three most common types:

1. Subscription Billing:

This is probably the most familiar type of billing. Customers pay a fixed amount at regular intervals (monthly, yearly, etc.) to access your software. Think of it like a Netflix subscription – you pay a set fee each month to watch all the shows and movies you want. Subscription billing is a good option for businesses with predictable usage patterns.

2. Usage-Based Billing:

This type of billing charges customers based on how much they actually use your software. So, if you use a lot of features or store a lot of data, you’ll pay more. It’s kind of like paying for electricity – the more you use, the higher your bill.

3. Hybrid Billing:

This is a mix of subscription and usage-based billing. Customers might pay a base subscription fee for core features. They get charged extra for using premium features or exceeding usage limits. It’s similar to a cell phone plan. You pay a monthly fee for basic service. Extra charges apply for data overages or international calls. Hybrid billing can be a good option for businesses that offer a variety of features and usage levels.

Choosing the right billing system depends on your business model and how your customers use your software. Think about what will provide the best value for your customers and make it easy for them to pay.

How to Choose The Right SaaS Billing Solution?

So, you’ve seen how SaaS billing software work and the different types available. Now it’s time to pick the perfect one for your business! But with so many options, where do you even start? Don’t worry, we’ve got you covered. Here are some key factors to consider when choosing your billing bestie:

1. Ease of Use:

You don’t want to spend hours figuring out how to use your billing system. Look for a platform that’s easy to navigate and set up, even if you’re not a tech whiz.

2. Integration Capabilities:

Does the billing solution play well with others? Make sure it integrates smoothly with the other tools you use, like your accounting software or CRM system.

3. Pricing:

Of course, cost matters! Consider the pricing structure of each solution and see which one fits your budget. Some charge a monthly fee, while others take a percentage of your transactions.

4. Features and Functionality:

Does the platform have the features you need? Think about things like subscription management, invoicing, payment collection, and reporting. Make sure the solution can handle all your billing needs.

5. Customer Support:

Let’s face it, sometimes things go wrong. Pick a billing solution that offers reliable customer support in case you need help. Look for options with live chat, email support, or even phone support if that’s important to you.

By considering these factors, you can narrow down your options and choose a SaaS billing platform for your growing business! Remember, the best SaaS billing solution is the one that helps you streamline your billing process, save time, and keep your cash flow flowing.

Top 7 Billing Systems for SaaS Businesses in 2024

Finding the right billing system for your SaaS business is like finding the perfect superhero sidekick. It needs to be powerful, reliable, and work seamlessly with your team. To help you navigate the options, we’ve compiled a list of the top 7 billing systems for SaaS businesses in 2024. Let’s dive in and see what each one offers!

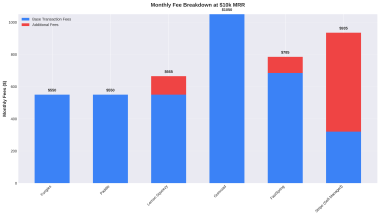

Here’s a quick comparison table to get you started:

| Billing Solution | Ease of Use | Features | Pricing | Focus |

| Fungies Billing API | Easy | Built for SaaS, with billing, tax, and checkout | 5% + $0.50 per transaction | Streamlining SaaS billing |

| Stripe Billing | Easy | Wide range of features, including subscriptions and invoicing | Transaction fees + optional monthly fees | All-around player |

| Chargebee | Moderate | Powerful for recurring billing and revenue recognition | Starts at $250/month | Complex billing needs |

| Ordway (New from Chargebee & SaaSOptics Merger) | To be updated | To be updated | To be updated | Complex billing needs (anticipated) |

| Recurly | Easy | User-friendly for subscription billing and dunning | Starts at $199/month | Recurring subscriptions |

| Zuora | Complex | Enterprise-grade solution for high-volume transactions | Custom quotes | Large businesses |

| Chargify (Merged into Ordway) | Moderate | Powerful for recurring billing, revenue recognition, and customization | Starts at $250/month | Complex billing needs |

- Fungies Billing API (Newcomer):

If you’re looking to simplify your SaaS billing without getting tangled up in complicated processes, Fungies Billing API is your new best friend!

Fungies stands out with its easy-to-use API that seamlessly integrates with your existing tools, creating a smooth bridge between your software and billing system. No more juggling multiple solutions—Fungies covers everything from subscriptions and one-time payments to tax compliance, all in one place.

What Makes Fungies Billing API a Great Choice?

- Supercharge Your Billing: Fungies offers an easy-to-use API that connects with your existing tools. Think of it as a magic bridge that lets your software talk to the billing system.

- All Your Billing Needs Covered: No more cobbling together different solutions! Fungies handles things like subscriptions, one-time payments, and even tax compliance. That’s a lot of weight off your shoulders!

- Frictionless Payments: Make it easy for your customers to pay with Fungies’ embedded checkout feature. They can pay directly within your software, without having to jump through hoops.

- Built for Busy Bees: Short on time and coding skills? No worries! Fungies’ API documentation is clear and easy to understand. Their Webhooks make integrating Fungies with your SaaS business a breeze. You’ll be up and running in minutes, not days.

Plus, Fungies offers a budget-friendly pricing plan – no monthly costs just 5%+$0.50 per transaction. That’s a steal for all the features you get.

But wait, there’s more! Fungies isn’t just about billing. We also offer a fantastic no-code website builder. This means you can easily create a storefront to sell your digital downloads, subscriptions, and software keys – all in one place!

2. Stripe Billing:

You might already recognize Stripe – they’re a big name in the payment processing world. Their Stripe Billing platform offers an easy interface and a wide range of features to help you manage your SaaS business finances.

Here’s a quick look at what Stripe Billing can do:

- Subscription Master: Stripe Billing makes handling subscriptions a breeze. You can easily set up recurring payments, manage different pricing tiers, and even offer free trials.

- Invoice All Day: No more scrambling to create invoices! Stripe Billing automatically generates clear and professional invoices for your customers.

- Global Reach: Thinking of selling your software worldwide? Stripe Billing can handle payments from customers all over the globe. This is a great option if you’re looking to expand your reach.

While Stripe Billing’s pricing structure is based on transaction fees. Stripe doesn’t have monthly fees, but they make money by charging a fee for every transaction you process. This fee is usually 2.9% of the transaction amount, plus an additional 30 cents.

3. Chargebee:

If you’re dealing with complex billing needs, Chargebee might be the perfect fit for you. This platform is known for its powerful features. Especially when it comes to recurring billing and revenue recognition.

Here’s what makes Chargebee a powerhouse:

Recurring Billing Rockstar: Chargebee handles all recurring billing tasks. This includes managing subscriptions and dealing with late payments.

Revenue Recognition Ready: Tracking revenue can be tricky. Chargebee helps you recognize revenue according to accounting standards. This makes tax season easier.

Customization Champs: Chargebee offers high customization levels. You can tailor the platform to fit your specific business needs.

However, Chargebee’s pricing starts at $250 per month, making it a bit more expensive than some other options. This platform is a good fit for businesses with complex billing needs and the budget to match.

4. Chargify (Merged into Ordway):

Hold on a sec! Chargify recently merged with SaaSOptics to form a new company named Ordway. While Ordway is still under development, Chargify is still around for now.

Here’s what Chargify was known for (and may still offer under the Ordway umbrella):

- Recurring Billing Master: Chargify masters at handling subscriptions. They are great in setting them up to managing changes.

- Revenue Recognition Ready: Keeping track of your income can get confusing. Chargify helped ensure your revenue recognition followed proper accounting standards.

- Customization Champs: Chargify offered a good amount of customization. This allows you to bend the platform to fit your specific needs.

However, Chargify’s pricing started at $250 per month, making it a pricier option. This platform was a good fit for businesses with complex billing needs and the budget to match.

Since Chargify is now part of Ordway, we’ll need to wait and see what the new platform offers in terms of features and pricing. We’ll update this section in the future to reflect the changes with Ordway.

5. Ordway (formerly Chargify and SaaSOptics):

Ordway is a result of a merger between two established billing platforms, Chargify and SaaSOptics. This powerful solution offers a comprehensive suite of features. It helps manage your SaaS business finances.

We’ll explore Ordway’s specific features and pricing in a future update. The platform is still changing the merger.

6. Recurly:

If you’re looking for a user-friendly platform, designed for subscription billing, Recurly is a great option.

Here’s what makes Recurly a subscription champion:

- Subscription Central: Recurly makes managing subscriptions easy. You can set up recurring payments, offer free trials, and even handle subscription changes with ease.

- Dunning Done Right: Sometimes customers forget to pay. Recurly’s dunning system sends automated reminders in a friendly way, helping you get paid on time.

- Built for Integration: Recurly integrates smoothly with many popular tools. It makes it easy to connect your billing system with other business software.

Recurly’s pricing starts at $199 per month. This makes it a good mid-range option for businesses that primarily focus on recurring subscriptions.

7. Zuora:

If you’re a large enterprise with high-volume transactions, Zuora might be the billing system for you. This platform is built for complex billing scenarios and offers a robust set of features.

Here’s a glimpse into Zuora’s world:

- Enterprise-Grade Billing Power: Zuora can handle even the most complex billing situations. This makes it ideal for large businesses with many moving parts.

Customization Champs: Zuora allows for a high degree of customization. You can tailor the platform to fit your specific business needs. - Built for Scale: Zuora is built to handle high transaction volumes, making it a good choice for businesses that are processing a lot of payments.

However, Zuora’s pricing is based on custom quotes. This means you’ll need to contact them directly to get a price estimate. Since it’s designed for large businesses, Zuora might be a bit overkill for smaller SaaS startups.

Final Thoughts

Choosing the right billing solution is important for the success of your SaaS business. In this article, we’ve covered the 7 Best Billing Systems for SaaS Business in 2024. Each option offers unique features to help streamline your billing processes.

As you evaluate these options, consider your specific needs and goals. Whether you want flexibility, automation, security, or customer support, there is something right for you. With the right billing software, you can enhance efficiency. It helps improve customer satisfaction and drive profitability in your business.

FAQ

What are the most important features to look for in SaaS billing software?

When picking a SaaS billing software, key features matter. Flexibility lets you adjust prices and billing times easily. Automation creates invoices automatically, saving time and reducing mistakes. Integration with CRM and accounting tools keeps your business running smoothly.

How do I choose the best billing system for a SaaS business?

Security is crucial; check for PCI-DSS compliance to protect payment data. Responsive customer support resolves issues quickly. Finally, balance cost-effectiveness with features to maximize profitability.

What are the benefits of using a billing API like Fungies?

Using a billing API such as Fungies offers several advantages. Firstly, it streamlines the billing process. Secondly, it enhances flexibility by customizing billing workflows to suit your business needs.

How does Fungies billing API handle tax compliance?

Fungies billing API addresses tax compliance efficiently. It automatically calculates taxes based on customer location and applicable tax laws. Additionally, it updates tax rates automatically. It keeps your billing system current with regulatory changes.