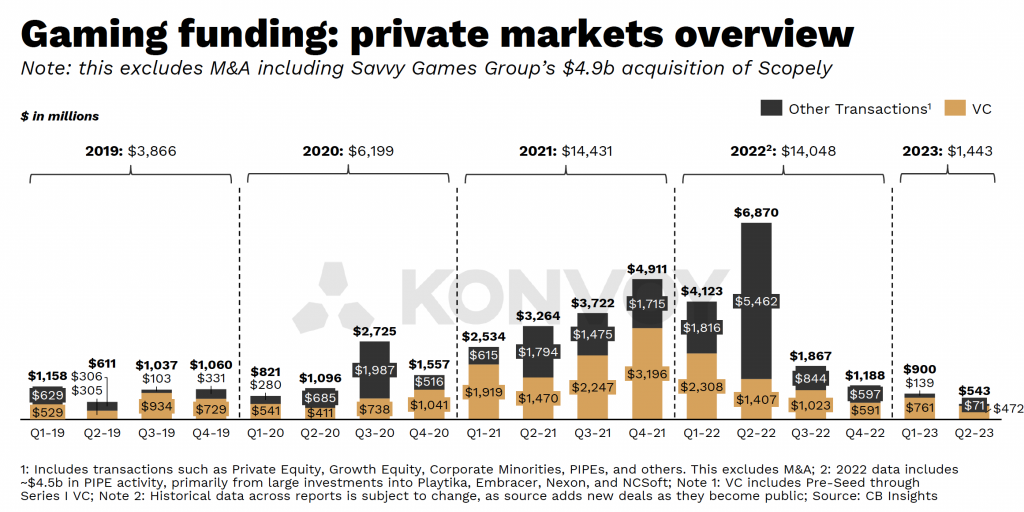

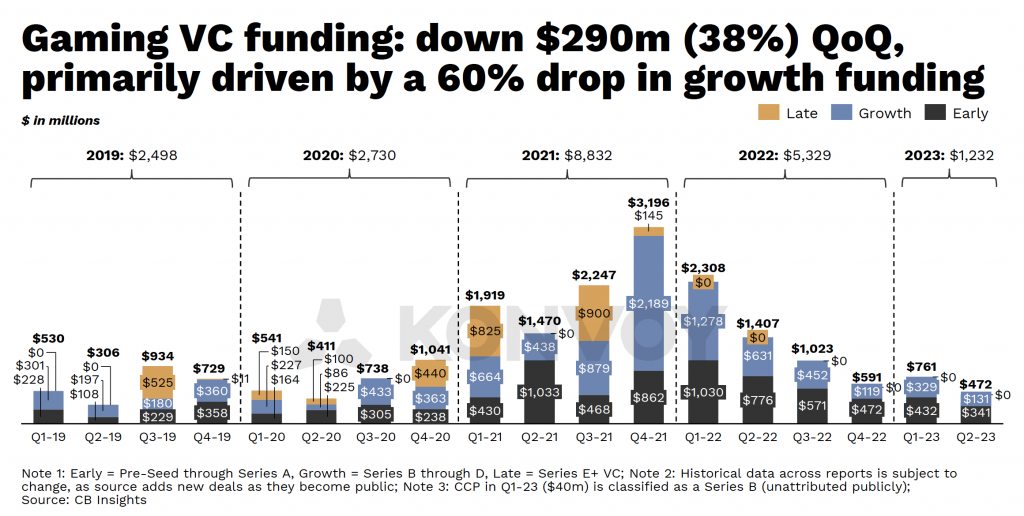

The games industry experienced a significant downturn in venture capital (VC) funding during the second quarter of 2023, according to the latest Gaming Industry report by Konvoy.

The report reveals a sharp 38% quarter-on-quarter decline, with total funding amounting to a mere $472 million, compared to $761 million in the previous quarter. The decrease in growth funding played a major role in this downturn, plummeting by 60% from $329 million to $131 million. Notably, for the sixth consecutive quarter, Konvoy did not report any late-stage funding. This article explores the implications of this decline and highlights the industry’s resilience in the face of these challenges.

The State of Gaming Funding

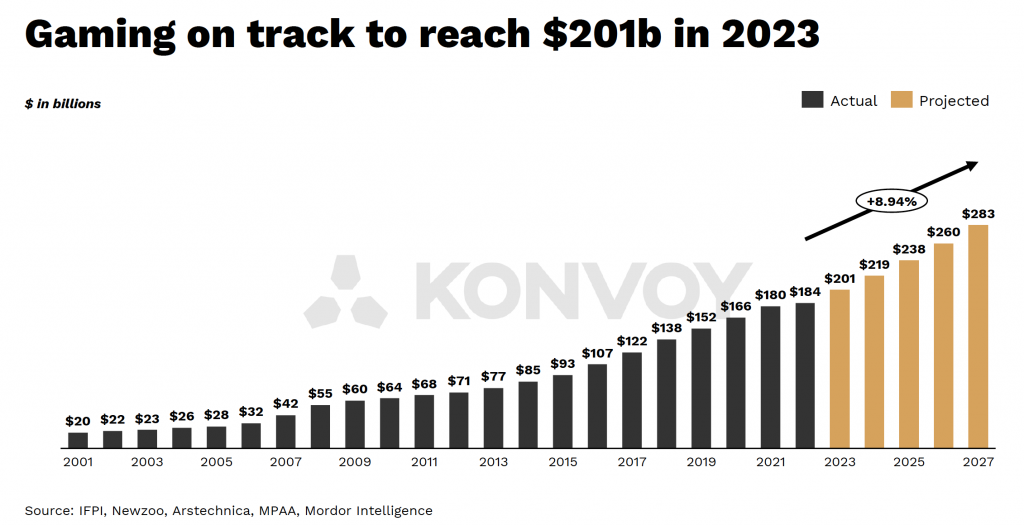

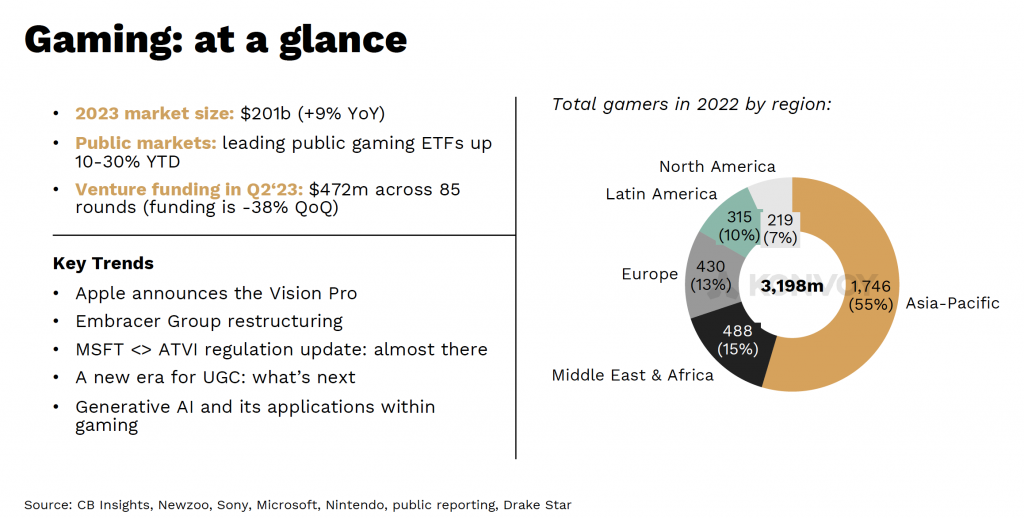

In addition to the decline in VC funding, gaming funding also witnessed a substantial drop of 40% from $900 million to $543 million. This figure represents the lowest funding level since before 2019. However, it is important to note that this data does not include merger and acquisition (M&A) activity. Despite the decline in funding, the report presents an optimistic outlook by forecasting a 9% increase in the industry’s market valuation, reaching $201 billion in 2023, compared to the previous year.

Decrease in VC Deals

The second quarter of 2023 saw the lowest number of VC deals in the games industry since Q3 2020. A total of 85 deals were signed during this period, consisting of 77 early-stage deals and eight growth deals. In contrast, the first quarter witnessed 103 early-stage deals and six growth deals. Thus, the cumulative number of deals for the year reached 194.

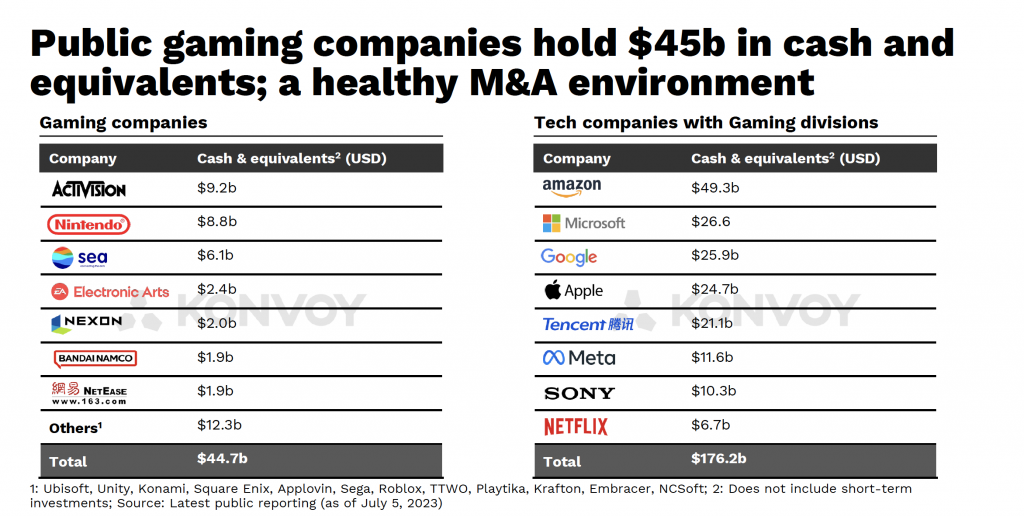

M&A Environment in the Games Industry

While VC funding faced challenges, the M&A environment in the games industry remained healthy. Public gaming companies boasted a significant amount of cash and cash equivalents, totaling $44.7 billion. Activision Blizzard, the parent company of King, topped the list with the highest cash reserves of $9.2 billion, followed by Nintendo with $8.8 billion and Sea Group with $6.1 billion. Other major players in the mobile gaming industry, such as Electronic Arts ($2.4 billion), Nexon ($2 billion), Bandai Namco, and NetEase (each with $1.9 billion), also demonstrated robust financial positions.

Leveraging Cash Reserves: Tech Companies

In comparison to gaming companies, tech companies displayed even greater financial prowess, accumulating a cumulative total of $176.2 billion in cash and equivalents. Amazon secured the top spot with an impressive $49.3 billion, nearly twice as much as Microsoft, which held $26.6 billion. Google followed closely in third place with a total of $25.9 billion. Notably, top mobile game makers Tencent ($2.1 billion) and Netflix ($6.7 billion) showcased their financial strength, alongside phone manufacturer Apple ($24.7 billion) and Sony, which is actively establishing its own mobile division ($10.3 billion).

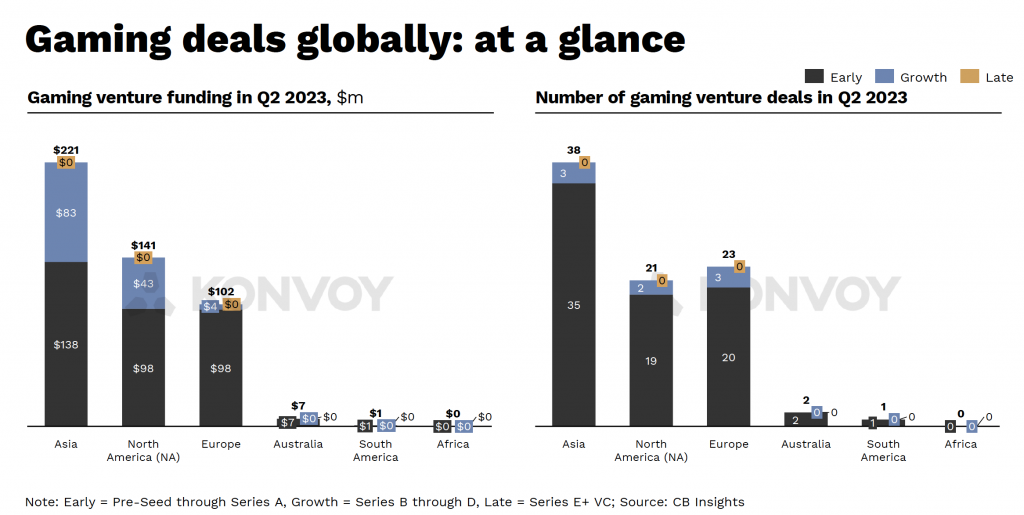

Success Across Regions

The report also highlights the success of different regions in terms of investment. Asia emerged as an exceptionally lucrative market for investment in Q2 2023, securing a total of $221 million in venture funding. Out of this amount, $138 million was directed towards early-stage funding, while $83 million went to growth funding. North America claimed the second position, attracting $141 million, with $98 million for early-stage investments and $43 million for growth. Europe was the only other region to surpass $100 million, with a total of $102 million, allocated as $98 million for early-stage investment and $4 million for growth. On the other hand, Australia only drew $7 million in early-stage investment, while South America received just $1 million, with neither region witnessing any growth investment. No deals were reported in any other markets.

Additionally, Asia recorded the highest number of deals at 38, resulting in an average deal value of $5.8 million. Europe secured 23 deals with an average value of $4.4 million, while North America, with 21 deals, had the highest average deal value at $6.7 million.

Looking Ahead

Despite the decline in VC funding during Q2 2023, the gaming industry remains resilient. The report suggests that the industry is on track to reach a market valuation of $201 billion by the end of the year, reflecting a 9% increase compared to 2022. While VC funding may have experienced a setback, the healthy M&A environment, coupled with the strong financial positions of leading gaming and tech companies, bodes well for future growth and investment opportunities.

Conclusion

The second quarter of 2023 witnessed a significant decline in venture capital funding for the games industry. The report by Konvoy reveals a 38% decrease in funding, primarily driven by a drop in growth funding. However, the industry remains optimistic about its future prospects, with expectations of reaching a market valuation of $201 billion in 2023. The M&A environment remains robust, supported by the substantial cash reserves of public gaming companies and tech giants. With Asia leading the way in terms of investment and deal activity, it is clear that the games industry continues to attract attention and opportunities for growth. The unveiling of the top 50 mobile game makers of 2023 will undoubtedly shed further light on the industry’s evolving landscape.