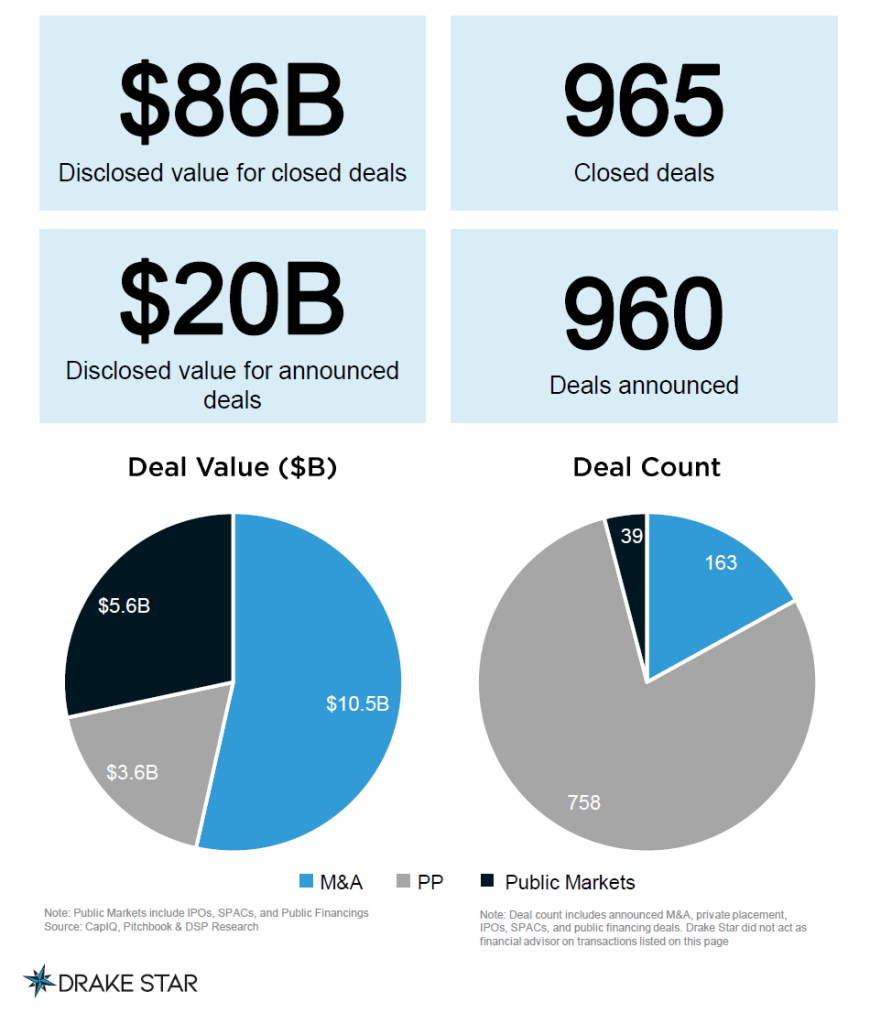

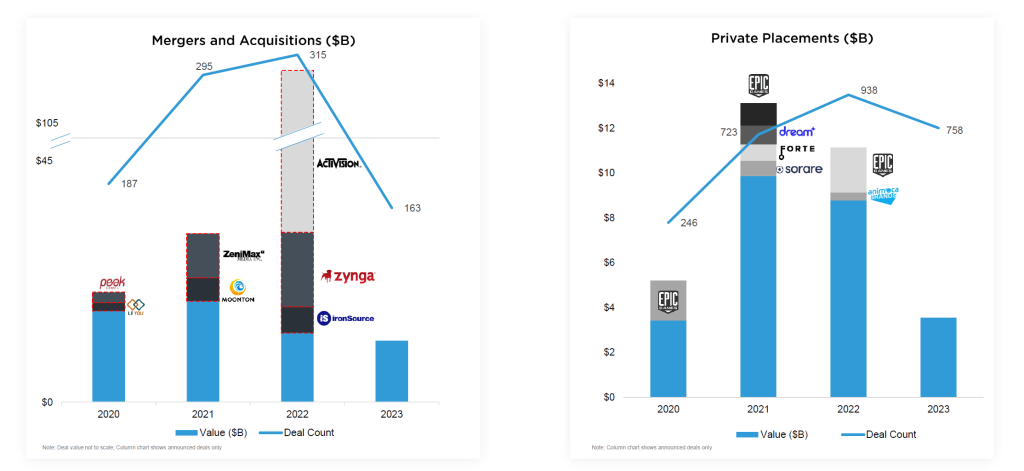

2023 marked an unprecedented milestone in the gaming industry, with a whopping $86 billion in disclosed value for closed deals according to Drakestar, setting a new record from a deal value perspective. This surge was significantly propelled by the highly anticipated completion of Microsoft’s acquisition of Activision in the final quarter, overcoming more than a year of regulatory hurdles. The year witnessed over $20 billion in announced deals across 960 transactions, mirroring pre-pandemic activity levels.

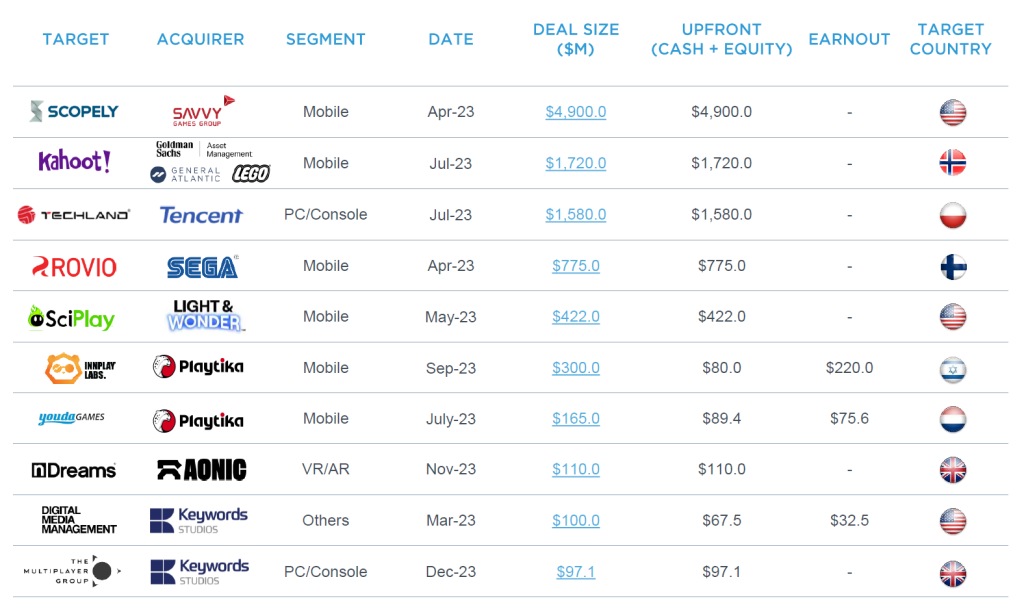

A total of 163 mergers and acquisitions were unveiled in 2023, amassing over $10.5 billion in disclosed deal value. The acquisition of Scopely by Savvy Games Group/PIF, valued at $4.9 billion, topped the charts, followed by noteworthy billion-dollar transactions such as Kahoot’s acquisition by a Goldman Sachs-led consortium for $1.7 billion, and Tencent’s majority stake purchase in Techland for $1.6 billion. The financial details for many mid-sized and smaller transactions remained under wraps.

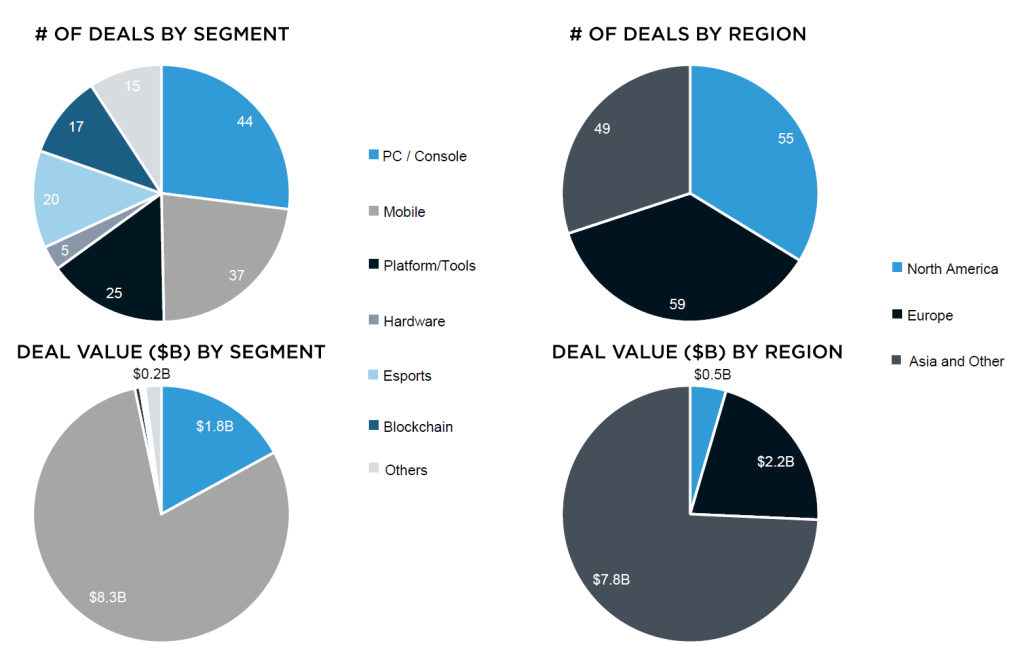

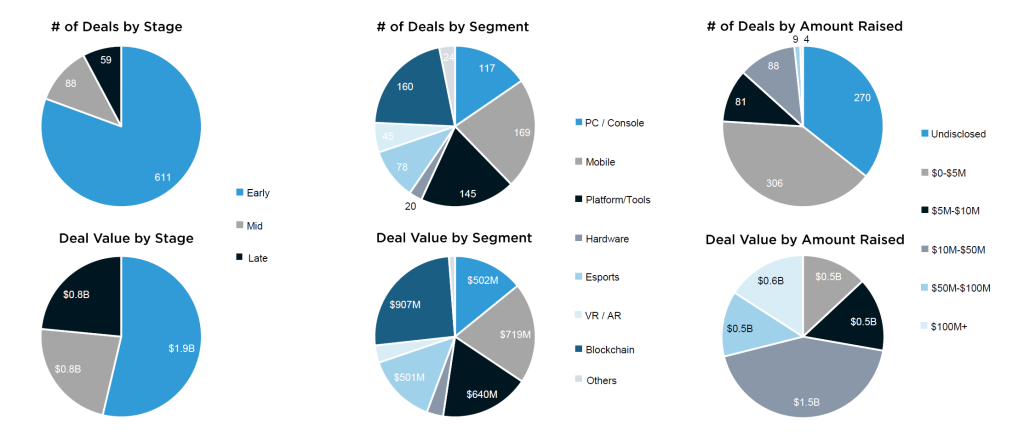

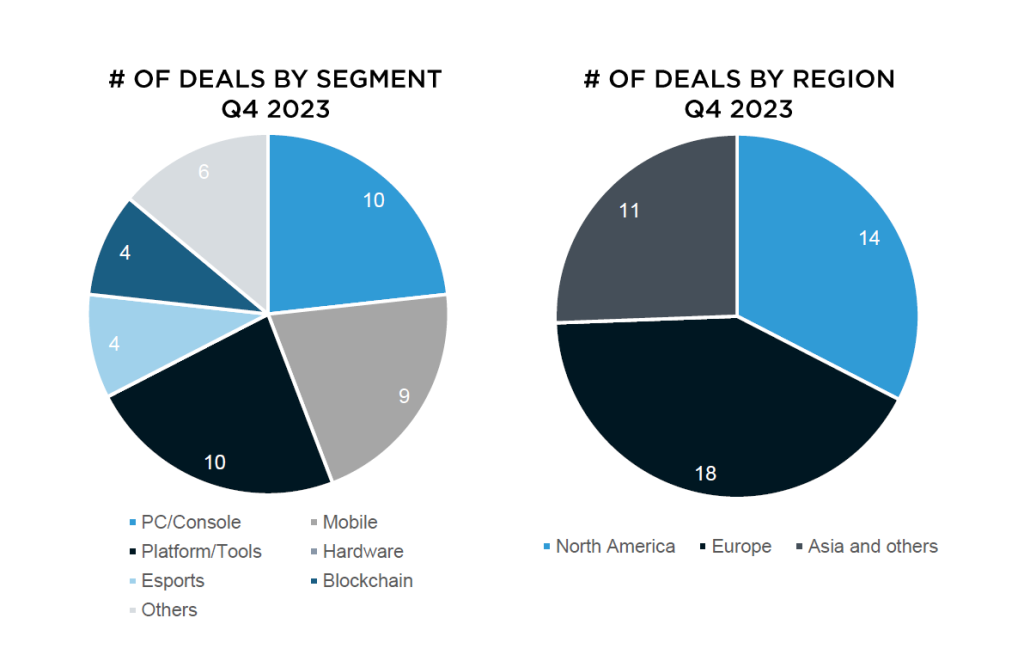

The PC/console sector led the M&A activity with 44 deals, closely followed by mobile with 37 transactions, and platform/tools with 25. Deal activity rebounded to pre-pandemic levels as early as the first quarter, with the third quarter observing the least number of deals. However, a 30% quarterly increase in the fourth quarter highlighted a robust finish to the year.

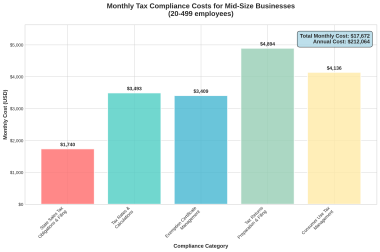

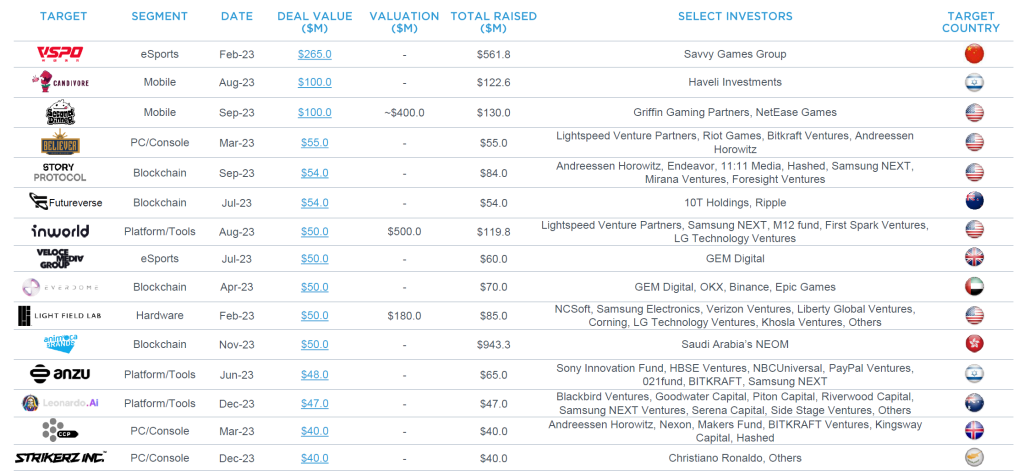

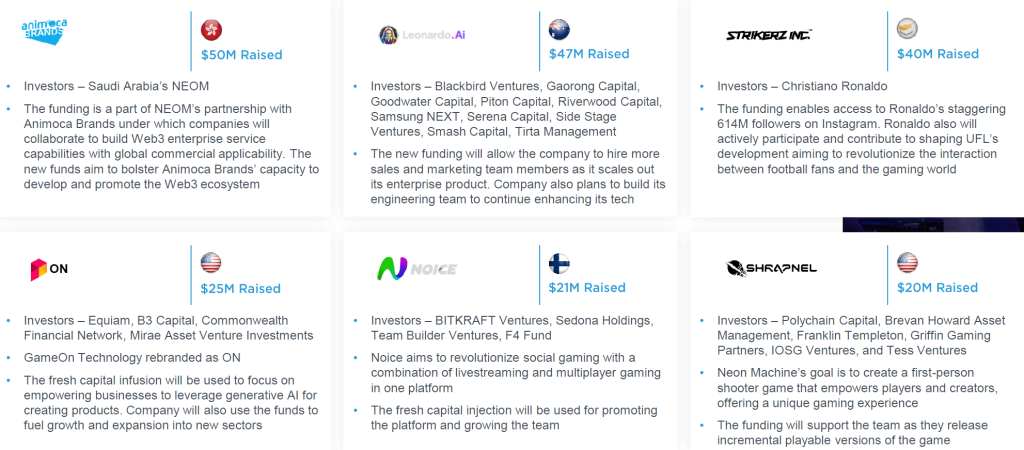

In terms of financing, over $3.5 billion was raised through more than 750 funding rounds by private companies, on par with the $3.4 billion raised in 2020, Epic Games’ large deal notwithstanding. The mobile segment saw the most action with 168 rounds, followed by blockchain with 159 and platform/tools with 143. Leading financings included VSPO at $265 million, Candivore and Second Dinner each raising $100 million. In the venture capital arena, Bitkraft, a16z, Play Ventures, and Griffin Gaming were the most active in early to late-stage investments, while Goodwater Capital, 1Up Ventures, Sfermion, and Shima Capital led the seed-stage domain.

Gaming Investment Highlights: Q4 2023

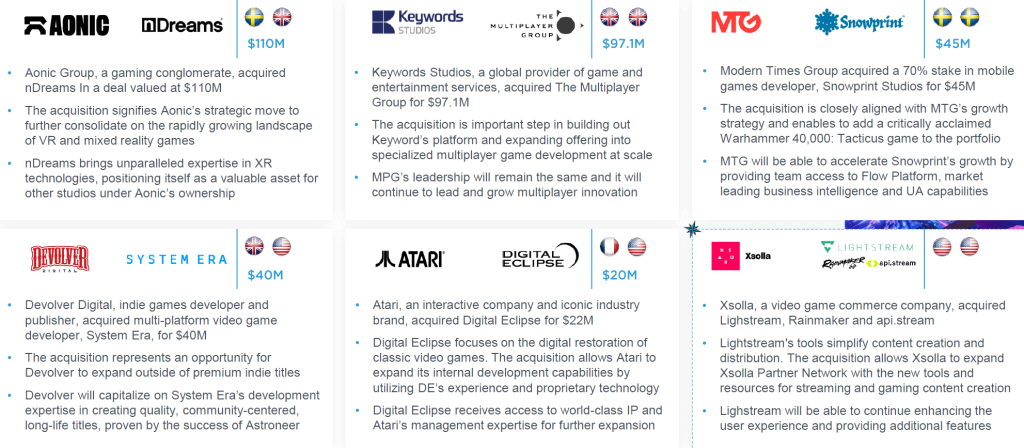

The final quarter of 2023 saw significant investment activities within the gaming industry, marking strategic acquisitions by leading companies aimed at diversifying portfolios and enhancing technological capabilities:

- Aonic Group, a key player in the gaming conglomerate sphere, made a notable acquisition of nDreams, a leading developer in virtual reality gaming, for $110 million. This move is aimed at bolstering Aonic Group’s presence in the VR and mixed reality gaming sector.

- Keywords Studios, renowned globally for its comprehensive game and entertainment services, acquired The Multiplayer Group, a prominent multiplayer game development studio based in the UK, for $97 million. This strategic purchase is intended to enhance its “Create” division, further cementing its role in game development.

- In a move to extend its influence beyond premium indie titles, Devolver Digital acquired System Era Softworks, an award-winning, multiplatform video game developer, for $40 million. This acquisition leverages System Era’s expertise in expandable game-style development.

- Atari, an iconic name in the gaming industry, expanded its internal development capabilities with the purchase of Digital Eclipse, a studio specializing in the preservation and rerelease of retro games for modern platforms, for $20 million.

- Xsolla made a significant expansion in its influencer outreach by acquiring Lightstream, Rainmaker, and api.stream. These acquisitions are aimed at enhancing the Xsolla Partner Network’s reach to influencers, further integrating their influence into Xsolla’s comprehensive gaming ecosystem.

These strategic acquisitions underscore the dynamic nature of the gaming industry, with companies continuously seeking to innovate and expand their influence in various gaming niches as we close out 2023.

Gaming Industry M&A Trends: A Shift Towards Growth Post-COVID

Following the intense activity during the COVID-19 pandemic years (2020-2022), the gaming industry’s deal-making landscape realigned to pre-pandemic levels in 2023, setting the stage for an anticipated rise in mergers and acquisitions (M&A) in 2024. Leading the charge in acquisitions are expected to be heavyweight players such as Tencent, Sony, Scopely/Savvy Games, Keywords Studios, and Take-Two Interactive. On the flip side, ByteDance is poised to divest its gaming division, and Embracer Group may offload some of its studios. Particularly noteworthy is Savvy Games, projected to further invest a significant portion of the $38 billion allocated for gaming M&A and financing this year. Amidst a stricter regulatory framework in China, Tencent and other Chinese companies are predicted to escalate their investment endeavors and acquisitions in Western markets.

The forecast for 2024 includes a blend of high-value M&A transactions alongside a surge in smaller to mid-sized deals. The gaming sector’s current undervalued public companies have caught the eye of private equity firms, with predictions pointing towards several gaming entities transitioning to private ownership.

In terms of financing, a robust influx of seed and early-stage investments is anticipated, albeit with fewer growth or later-stage rounds expected. Artificial Intelligence (AI)/tools and Augmented Reality (AR)/Virtual Reality (VR) are pegged as the sectors to watch.

Entrepreneurs are inclined to prioritize profitability earlier in their company’s lifecycle, with a growing preference for being acquired by larger entities as part of mid-range acquisitions over holding out for blockbuster outcomes.

The cryptocurrency market within the gaming sector experienced a notable rebound in 2023, buoyed by the approval of multiple Bitcoin ETFs and the resurgence of key gaming cryptocurrencies like Solana. This resurgence, coupled with the introduction of engaging blockchain games appealing to a wide audience, hints at an expanded crypto gaming market in 2024.

As the public gaming market shows signs of improvement in the first half of 2024, anticipation builds for IPO-ready gaming companies to reinitiate their public offering plans in the latter half of the year, marking a vibrant and dynamic phase for the gaming industry’s financial landscape.