Table of Contents

- Executive Summary

- Tax Analysis by Country

- Penalties for Non-Compliance

- Merchant of Record (MoR) Model

- Stripe Tax Limitations

- Conclusion & Recommendations

- References

Executive Summary

This report provides a comprehensive analysis of global tax regulations affecting SaaS developers and indie software publishers selling digital products and subscriptions across international markets. It examines tax obligations in ten major countries, penalties for non-compliance, and compares tax management approaches through the Merchant of Record model versus Stripe Tax.

Key Findings

- Complex Global Landscape: Tax regulations for digital products vary significantly across jurisdictions, with different registration thresholds, rates, and filing requirements.

- Increasing Enforcement: Tax authorities worldwide are becoming more aggressive in enforcing digital tax compliance, with substantial penalties for non-compliance.

- Legal Responsibility: The Merchant of Record (MoR) model legally shifts tax responsibilities from developers to the MoR provider, while Stripe Tax leaves all legal obligations with the developer.

- Resource Requirements: Managing tax compliance independently requires significant expertise, time, and financial resources that most small teams cannot efficiently allocate.

- Risk Assessment: Certain jurisdictions (EU, UK, Brazil, Australia, Canada) pose greater compliance risks due to aggressive enforcement, low thresholds, or severe penalties.

Recommendations

For solo developers, indie publishers, and small SaaS teams operating internationally, the Merchant of Record model provides the most effective solution for tax compliance. The legal protection, resource efficiency, and focus on core business activities outweigh the higher percentage fees, particularly when accounting for the true costs of compliance.

- Solo Developers and Micro-SaaS: Fungies.io or LemonSqueezy recommended

- AI Startups: Fungies.io recommended

- Small SaaS Teams: LemonSqueezy or Paddle recommended

- Digital Content Creators: Gumroad recommended

Stripe Tax may be suitable for specific scenarios including single-jurisdiction operations, businesses with existing tax infrastructure, or as part of hybrid approaches.

This report provides detailed country-specific analyses, practical implementation guidance, and strategic considerations to help SaaS developers and indie publishers navigate the complex world of global tax compliance while minimizing risk and maximizing focus on their core business.

Tax Analysis by Country

Detailed analyses for each country are provided in separate files, covering registration requirements, thresholds, reporting obligations, and applicable taxes for both B2C and B2B transactions.

United States

The United States has a complex sales tax system that varies by state, county, and city, with no federal VAT or GST. Foreign sellers may need to register based on economic nexus thresholds established after the South Dakota v. Wayfair Supreme Court decision.

United Kingdom

The UK requires non-UK businesses selling digital services to UK consumers to register for VAT regardless of turnover threshold. The standard VAT rate is 20%, with specific reporting requirements through the UK VAT MOSS system.

Germany

Germany applies a 19% standard VAT rate to digital services, with no registration threshold for non-EU businesses. B2B transactions typically apply the reverse charge mechanism, shifting tax responsibility to the business customer.

Finland

Finland imposes a 24% VAT rate on digital services, with no threshold for non-EU businesses. Registration and compliance are managed through the Finnish Tax Administration, with quarterly filing requirements.

France

France applies a 20% VAT rate to digital services, with no threshold for non-EU businesses. The French tax authority has been particularly aggressive in enforcing digital service tax compliance.

Australia

Australia requires registration for GST (10%) when sales to Australian consumers exceed AUD 75,000. The Australian Taxation Office has implemented specific provisions for digital products and services.

New Zealand

New Zealand applies a 15% GST rate to digital services, with a NZD 60,000 registration threshold. Remote sellers must register and collect GST on digital products sold to New Zealand consumers.

Canada

Canada has both federal GST (5%) and provincial sales taxes or HST (up to 15% combined). Registration thresholds and requirements vary by province, creating a complex compliance landscape.

Japan

Japan applies a 10% consumption tax to digital services, with a registration threshold of JPY 10 million. The Japanese tax system distinguishes between B2C and B2B transactions for digital services.

Brazil

Brazil has one of the most complex tax systems globally, with multiple taxes applicable to digital services including ISS, PIS, COFINS, and CIDE. Recent reforms are simplifying the system for digital service providers.

Penalties for Non-Compliance

Tax authorities worldwide are increasingly enforcing compliance for digital services, with penalties varying by jurisdiction:

- United States: Penalties vary by state, typically 5-25% of unpaid tax plus interest, with potential criminal charges for willful evasion

- United Kingdom: Penalties up to 100% of unpaid tax for careless or deliberate errors, plus interest

- Germany: Penalties up to 10% of unpaid tax (maximum €50,000) plus interest at 6% annually

- Finland: Late payment penalties of up to 15% plus interest at 7% annually

- France: Penalties of 40-80% of unpaid tax for deliberate non-compliance, plus interest

- Australia: Penalties up to 75% of unpaid tax for intentional disregard, plus interest

- New Zealand: Penalties up to 150% for tax evasion, plus interest

- Canada: Penalties of 5-10% of unpaid tax plus interest, with higher penalties for repeated violations

- Japan: Penalties of 10-40% of unpaid tax plus interest at 7.3% annually

- Brazil: Penalties of 75-150% of unpaid tax plus inflation-indexed interest

Real-world examples of enforcement actions against non-compliant digital service providers are documented in the detailed country files.

Merchant of Record (MoR) Model

The Merchant of Record model provides a comprehensive solution for tax compliance by legally shifting tax responsibilities from the developer to the MoR provider:

Legal Structure and Transaction Flow

When a SaaS company uses an MoR service, two distinct transactions occur:

- The end customer purchases from the MoR (not directly from the SaaS developer)

- The MoR pays the SaaS developer (minus fees and taxes)

This structure creates a legal separation that shifts tax and compliance responsibilities from the developer to the MoR provider.

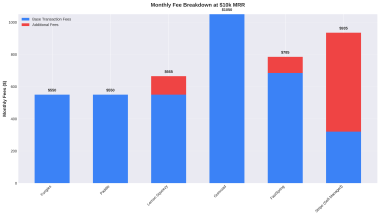

Provider Comparison

| Feature | Paddle | Gumroad | LemonSqueezy | Fungies.io |

|---|---|---|---|---|

| Base Fee | 5-10% + $0.50 per transaction | 3.5% + $0.30 per transaction | 5% + $0.50 per transaction | 4% + $0.30 per transaction |

| Subscription Management | Advanced | Basic | Advanced | Advanced |

| Countries Supported | 245+ | 200+ | 200+ | 190+ |

| Tax Jurisdictions | 200+ | 180+ | 190+ | 170+ |

| Checkout Experience | Overlay, Embedded, Hosted | Hosted | Overlay, Hosted | Overlay, Embedded, Hosted |

| Ideal For | Enterprise SaaS | Digital creators | Small-medium SaaS | Indie developers & AI startups |

With MoR vs. Without MoR

| Responsibility | With MoR | Without MoR (Direct Selling) |

|---|---|---|

| Tax Registration | MoR handles in all jurisdictions | Developer must register in each jurisdiction where sales exceed thresholds |

| Tax Calculation | Automatic by MoR | Developer must implement tax calculation logic or use third-party services |

| Tax Filing | Handled by MoR | Developer must file in each jurisdiction or hire accountants |

| Legal Liability | MoR assumes primary liability | Developer bears full liability |

Stripe Tax Limitations

While Stripe Tax offers powerful features for calculating and collecting taxes on digital products and subscriptions, it fundamentally differs from the Merchant of Record model in terms of legal responsibility and liability:

Legal Responsibility Remains with the Developer

The most significant limitation of Stripe Tax compared to a Merchant of Record is that the legal responsibility for tax compliance remains entirely with the SaaS developer or indie publisher. As Stripe’s documentation explicitly states:

“To be tax compliant, you need to:

- Understand which locations require you to collect tax.

- Register for tax in those locations.

- Calculate and collect tax.

- Report, file, and remit the tax you collected.”

While Stripe Tax helps with steps 1 and 3, and provides tools to assist with steps 2 and 4, the legal obligation and liability remain with the developer.

Visual Comparison: Stripe Tax vs. Merchant of Record

┌─────────────────────────────────────────────────────────────────┐

│ TAX RESPONSIBILITY FLOW │

└─────────────────────────────────────────────────────────────────┘

┌─────────────────────────┐ ┌─────────────────────────┐

│ STRIPE TAX │ │ MERCHANT OF RECORD │

└─────────────────────────┘ └─────────────────────────┘

┌─────────────┐ ┌─────────────┐

│ Customer │ │ Customer │

└──────┬──────┘ └──────┬──────┘

│ │

│ Payment │ Payment

│ + Tax │ + Tax

▼ ▼

┌─────────────┐ ┌─────────────┐

│ Stripe │ │ Merchant of │

│ Tax │ │ Record │

└──────┬──────┘ └──────┬──────┘

│ │

│ Calculation │ Handles ALL

│ & Collection │ Tax Obligations

▼ ▼

┌─────────────┐ ┌─────────────┐

│ Developer/ │◄─── Legal │ Developer/ │◄─── NO Legal

│ Publisher │ Responsibility│ Publisher │ Responsibility

└──────┬──────┘ for Tax └─────────────┘ for Tax

│

│ Must Handle

│

▼

┌─────────────────────────┐

│ • Tax Registration │

│ • Tax Filing │

│ • Tax Remittance │

│ • Audit Defense │

│ • Compliance Updates │

└─────────────────────────┘

Conclusion & Recommendations

Key Findings

- Global Variation: Tax regulations for digital products vary dramatically across jurisdictions, with different registration thresholds, rates, filing requirements, and enforcement approaches.

- Increasing Enforcement: Tax authorities worldwide are becoming more aggressive in enforcing digital tax compliance, with many implementing specialized digital service tax regimes.

- Severe Penalties: Non-compliance penalties can be substantial, including:

- Financial penalties up to 150% of unpaid tax

- Interest charges on unpaid amounts

- Business restrictions and reputational damage

- Potential criminal liability in cases of willful non-compliance

- Resource Intensity: Managing tax compliance independently requires significant expertise, time, and financial resources that most small teams and indie developers cannot efficiently allocate.

When to Use a Merchant of Record

The Merchant of Record model is strongly recommended for:

- Solo Developers and Micro-SaaS (1-3 people):

- Limited resources to dedicate to compliance

- Need to focus entirely on product development

- Desire for immediate global market access

- Lack of in-house tax expertise

- Small SaaS Teams (4-20 employees):

- Growing internationally across multiple jurisdictions

- Limited finance/tax department resources

- Need for predictable compliance costs

- Focus on scaling product and customer acquisition

- Risk-Averse Businesses:

- Companies seeking to minimize compliance risk exposure

- Businesses entering high-enforcement jurisdictions

- Organizations with limited appetite for tax audits

- Startups without resources for potential penalties

When Stripe Tax May Be Appropriate

Stripe Tax may be suitable in specific scenarios:

- Single-Jurisdiction Operations: Companies selling only in their home country with no international customers

- High-Volume/Low-Margin: Businesses where MoR fees would significantly impact profitability and that can afford dedicated tax resources

- Existing Tax Infrastructure: Companies with established tax departments and existing registrations

- Hybrid Approaches: Using MoR for international sales while managing domestic tax compliance with Stripe Tax

Highest-Risk Countries for Non-Compliance

Based on our analysis, these jurisdictions pose the greatest risk due to aggressive enforcement, low thresholds, or severe penalties:

- European Union: Particularly Germany, France, and Italy

- United Kingdom: Zero threshold for non-EU businesses

- Brazil: Extremely complex tax system with severe penalties

- Australia: Active enforcement of GST on digital products

- Canada: Provincial and federal tax requirements

References

This report is based on comprehensive research of tax regulations, penalties, and compliance models across ten major markets, with information drawn from tax authorities, legal experts, accounting firms, and service providers. Detailed sources are cited in each country-specific file.

For specific questions or situations, we recommend consulting with a qualified tax professional familiar with digital product taxation in your target markets.