The mobile gaming industry, after facing a period of challenges, is poised for a resurgence. In this article (based on a report by AppTopia), we will explore the emerging trends that are shaping the future of mobile gaming. We will delve into the varied landscape of game genres and their unique dynamics. Additionally, the ramifications of the Digital Markets Act on this sector will be scrutinized to understand its broader implications.

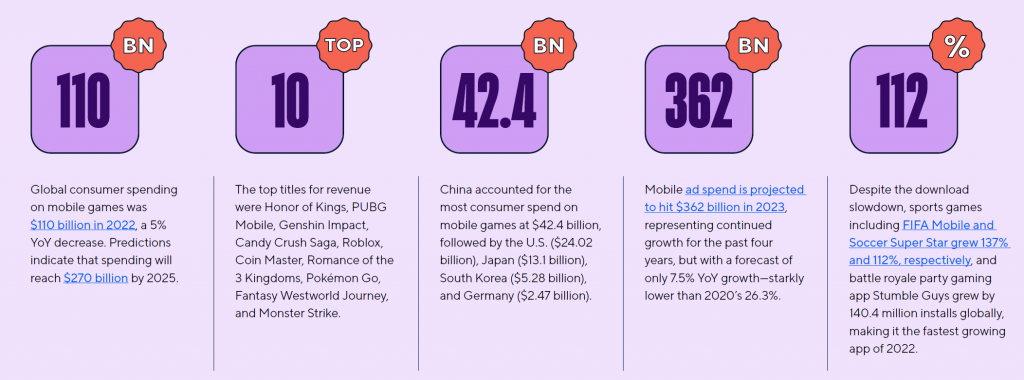

1. The Resurgence of Mobile Gaming 2023 marks a pivotal year for mobile gaming. After a brief slowdown, the industry is witnessing a significant uptick in user engagement and revenue. The global consumer spending on mobile games was $110 billion in 2022, and predictions indicate it will reach $270 billion by 2025. Notably, genres like music and educational games have seen over 100% year-on-year growth, with racing, word, sports, and arcade games following suit.

After a period of stagnation, the mobile gaming industry is booming once again. In 2023, the industry is witnessing a remarkable upswing, with a projected revenue increase from $110 billion in 2022 to a staggering $270 billion by 2025. This growth can be attributed to several factors:

- Technological Advancements: The advent of advanced mobile technology has made games more accessible and visually appealing, attracting a wider audience.

- Pandemic Aftermath: The COVID-19 pandemic led to a surge in mobile game downloads and engagement, a trend that continues post-pandemic.

- Diversification of Game Genres: The emergence of varied game genres, including educational and music games, has broadened the appeal of mobile gaming to encompass a more diverse user base.

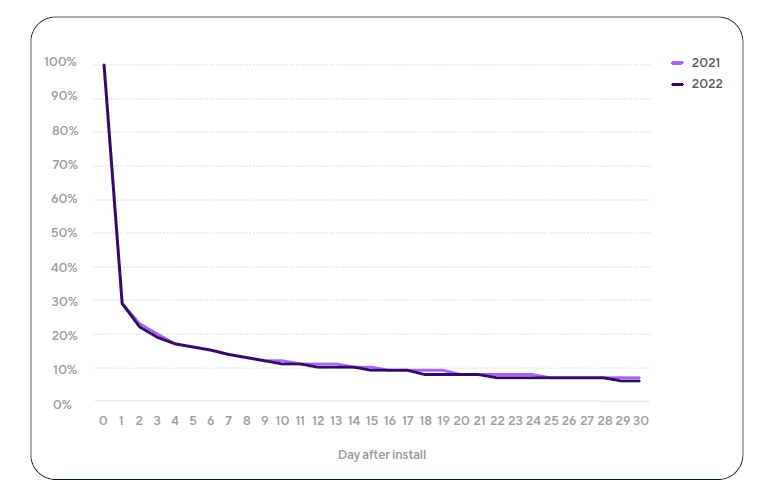

Core KPIs in Mobile Gaming In this rejuvenated landscape, two core KPIs stand out in measuring the success and sustainability of mobile games: D1 and D30 retention rates.

- Day 1 Retention (D1): This KPI measures the percentage of players who return to a game one day after their first session. It is a crucial indicator of the initial appeal and user experience of a game. For casual and hyper-casual games, an average D1 retention rate ranges from 25% to 40%.

- Day 30 Retention (D30): This longer-term metric measures the percentage of players who return to a game 30 days after their first play. It reflects the game’s ability to maintain interest and engagement over time. An average D30 retention rate for successful games is typically around 10%.

Maintaining Player Engagement To sustain high retention rates, several strategies are crucial:

- Regular Content Updates: Frequent introduction of new levels, characters, or challenges keeps the game fresh and engaging.

- Community Building: Social features like leaderboards, multiplayer modes, and in-game chat encourage a sense of community and competition.

- Personalization: Tailoring experiences to individual players’ preferences increases engagement and loyalty.

Monetization Framework for Casual and Hyper-Casual Games Casual and hyper-casual games rely heavily on advertising and in-app purchases (IAP) for revenue. A successful monetization framework includes:

- Advertising: Integrate non-intrusive ads such as rewarded videos, where players opt to watch an ad in exchange for in-game rewards, and interstitial ads, which appear at natural transition points in the game.

- In-App Purchases (IAP): Offer cosmetic items, power-ups, or additional content. Ensure these purchases enhance the gaming experience without making the game pay-to-win.

- Balancing Monetization with User Experience: It’s crucial to balance monetization efforts with a positive user experience to avoid high churn rates.

2. Genres of Games: A Diverse Landscape Each genre within the mobile gaming universe offers a unique experience and caters to distinct player preferences:

- Casual Games: These games are known for their simple mechanics and ease of play. Titles like ‘Candy Crush Saga’ dominate this genre, attracting a broad demographic.

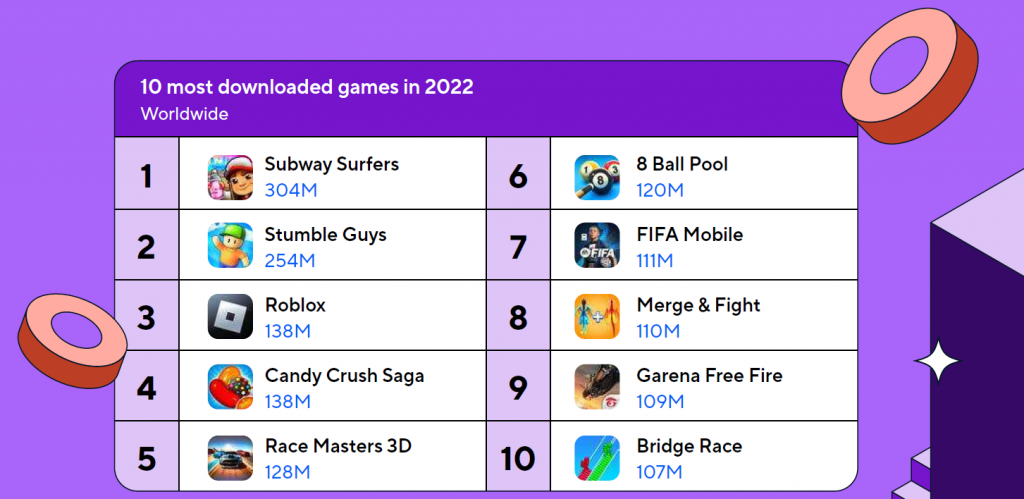

- Hyper-Casual Games: Characterized by their minimalistic design and short play sessions, hyper-casual games like ‘Subway Surfers’ have a significant share of downloads but lower session lengths.

- Strategy and Role-Playing Games (RPGs): These games, such as ‘Clash of Clans’ and ‘Genshin Impact’, offer complex gameplay and long-term engagement. They maintain high session lengths and strong player retention.

- Educational and Music Games: Surging in popularity, these genres have seen over 100% growth, indicating a shift towards more value-driven gaming experiences.

- Sports and Racing Games: Titles like ‘FIFA Mobile’ have shown robust growth, suggesting a rising interest in more immersive and graphics-intensive games.

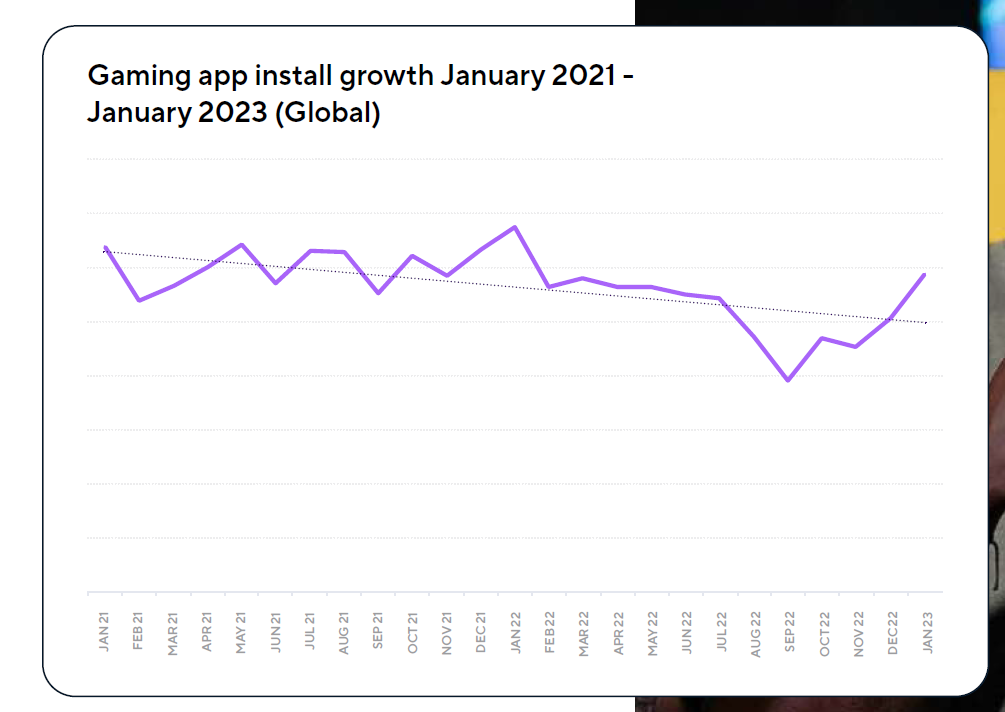

In 2022, the mobile gaming sector experienced a significant downturn, diverging from the optimistic trends seen in other industries. According to data from Adjust, this period marked a historic low for mobile gaming, with a notable 12% year-over-year decrease in global game installs. The decline was most pronounced in North America, where installs plummeted by 20%, while Latin America experienced a relatively milder impact with a 6% reduction. This downturn was the result of a combination of cultural and economic factors worldwide, challenging the longstanding dominance of mobile gaming in the app market. Despite this setback, early signs in 2023 are promising, indicating a robust recovery. January saw a remarkable 23% increase in game installs compared to the final quarter of 2022, and a 10% rise over the 2022 average, suggesting a resurgence in the mobile gaming landscape.

3. Mobile Gaming Trends: What’s Next? Several key trends are shaping the future of mobile gaming:

- Increased Monetization: In-app purchases and ad revenues are driving the financial growth of the sector. Games are becoming more sophisticated in balancing user experience with monetization strategies.

- Technological Innovations: Advancements in mobile technology, including AR and VR, are set to revolutionize gaming experiences, making them more immersive and interactive.

- Social Gaming: The integration of social elements, like multiplayer modes and community features, is increasing, fostering engagement and long-term player retention.

- Diverse Game Development: There’s a trend towards diversifying the pool of game developers, including more representation from women, which is expected to bring fresh perspectives to game design and storytelling.

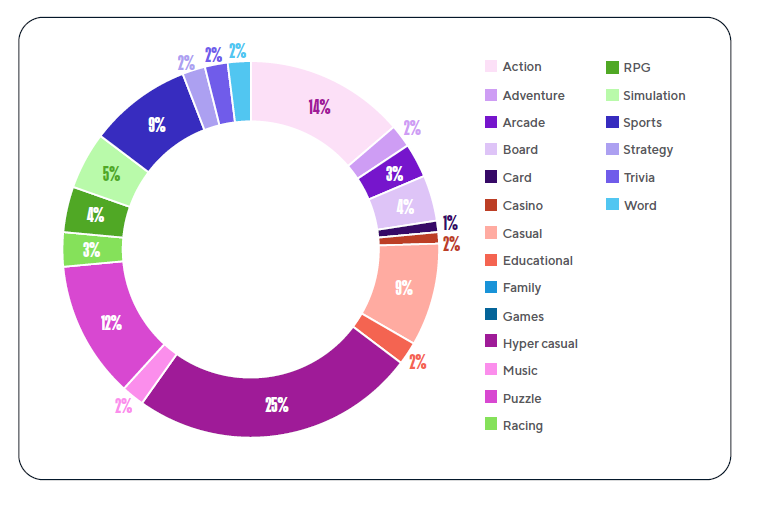

Hyper casual games continued to lead in the mobile gaming sector in terms of install percentages, capturing 25% of all gaming app installs. However, this figure showed a slight decline from the 27% share observed in 2020 and 2021. In the ranking of popular genres, action games secured the second spot with 14% of installs, followed closely by puzzle games at 12%, and sports and casual games each garnering 9%.

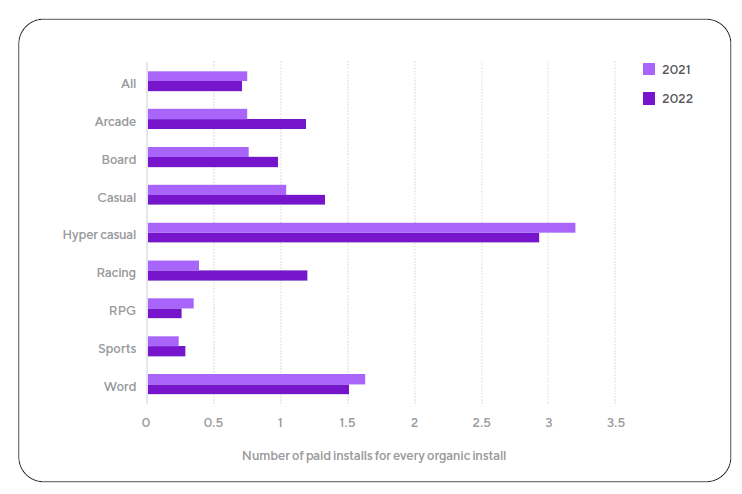

The ratio of paid versus organic installs for gaming apps experienced a slight dip in 2022, moving from 0.75 to 0.71. This decrease can be primarily attributed to a reduction in paid campaigns, driven by escalating user acquisition costs, especially in the second half of the year. Notably, even the hyper casual genre, which traditionally depends on high-volume paid user acquisition campaigns, witnessed a significant fall in its ratio, dropping from 3.2 to 2.93.

4. The Impact of the Digital Markets Act The Digital Markets Act (DMA) in the European Union is set to have significant implications for the mobile gaming industry. It aims to ensure fair competition and user privacy in digital markets. Key impacts include:

- Market Fairness: The DMA will enforce a more level playing field, potentially breaking down monopolistic practices and offering opportunities for smaller developers to emerge.

- User Privacy and Data Protection: With stringent data protection rules, game developers will need to adapt their data collection and processing practices, ensuring user privacy and compliance.

- App Store Dynamics: The Act may lead to changes in how games are distributed and monetized through app stores, affecting revenue models for many developers.

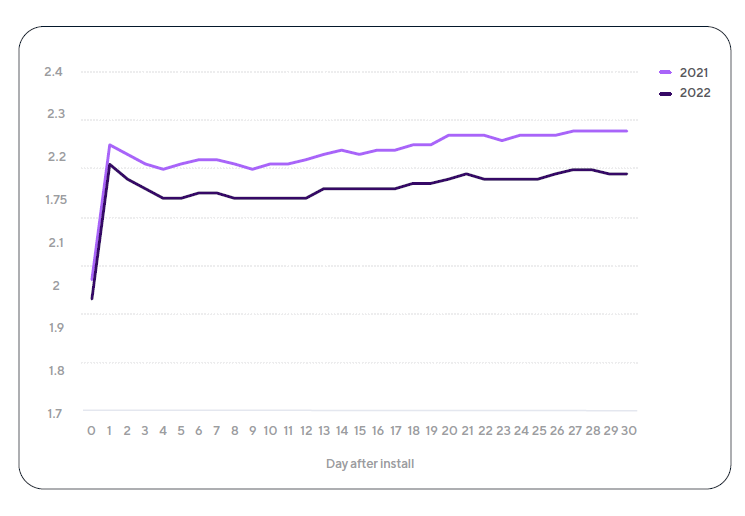

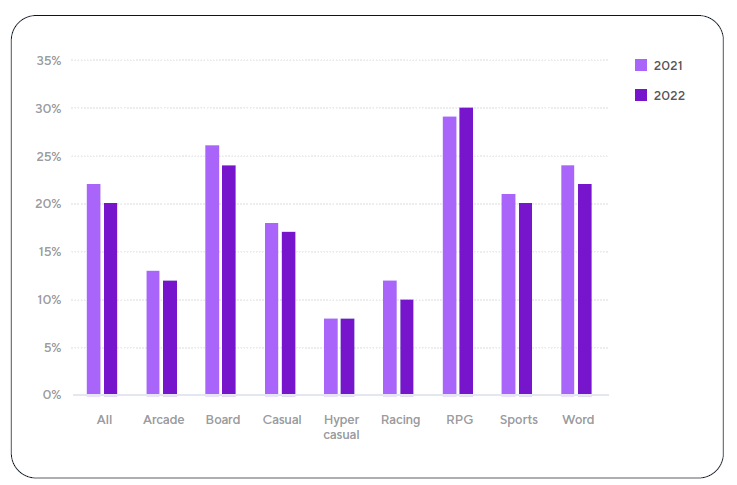

In 2022, the mobile gaming industry observed a pattern in user engagement that closely mirrored the trends of the previous year. There was a noticeable drop in sessions per user after the first day, which then gradually increased from Day 3 to Day 30. However, the overall benchmarks for 2022 were lower compared to 2021. The average number of sessions per user on the first day fell slightly from 2.25 to 2.21, and by Day 30, this number settled at 2.19, a decrease from 2021’s average of 2.28.

In line with these trends, the stickiness metric, which measures user engagement over time, also experienced a decline in 2022. The median stickiness dropped from 22% to 20%. On a more positive note, the hyper casual genre successfully maintained its stickiness benchmark at 8%. Additionally, the Role-Playing Game (RPG) category showed a promising increase in user engagement, with its stickiness rising from 29% to 30%.

5. Conclusion The future of mobile gaming looks bright, with a resurgence in growth, innovation in game genres, and technological advancements. The industry must navigate the complexities of the Digital Markets Act, adapting to a changing regulatory landscape while capitalizing on emerging trends. As mobile gaming evolves, it continues to offer a dynamic and engaging form of entertainment for millions worldwide.