Overview of Stripe Tax

Stripe Tax is a tax calculation and collection service that helps businesses automate tax compliance processes. While it offers powerful features for calculating and collecting taxes on digital products and subscriptions, it fundamentally differs from the Merchant of Record (MoR) model in terms of legal responsibility and liability.

How Stripe Tax Works

Stripe Tax provides a comprehensive set of tools to help with tax compliance, including:

- Tax Obligation Monitoring: Tracks transactions against tax thresholds in various jurisdictions

- Tax Calculation: Automatically calculates the correct tax rates based on customer location and product type

- Tax Collection: Adds the appropriate tax to customer invoices and payments

- Tax Reporting: Generates reports to assist with tax filing requirements

- Registration Assistance: Helps manage tax registrations with pre-filled application details

Key Limitations of Stripe Tax Compared to MoR

Legal Responsibility Remains with the Developer

The most significant limitation of Stripe Tax compared to a Merchant of Record is that the legal responsibility for tax compliance remains entirely with the SaaS developer or indie publisher. As Stripe’s documentation explicitly states:

“To be tax compliant, you need to:

- Understand which locations require you to collect tax.

- Register for tax in those locations.

- Calculate and collect tax.

- Report, file, and remit the tax you collected.”

While Stripe Tax helps with steps 1 and 3, and provides tools to assist with steps 2 and 4, the legal obligation and liability remain with the developer.

Registration Requirements

With Stripe Tax:

- You must register with tax authorities in each jurisdiction where you have tax obligations

- You must maintain these registrations and keep them current

- You must understand the specific requirements and thresholds for each jurisdiction

- You must add these registrations to Stripe to enable tax collection

In contrast, with a Merchant of Record:

- The MoR is already registered in relevant jurisdictions

- No registration is required by the developer

- The MoR maintains all necessary registrations

Filing and Remittance Obligations

With Stripe Tax:

- You must file tax returns in each jurisdiction where you’re registered

- You must remit (transfer) collected taxes to the appropriate authorities

- You must adhere to different filing schedules and requirements

- You can use Stripe’s reports or partner services, but the legal obligation remains yours

With a Merchant of Record:

- The MoR handles all filing requirements

- The MoR remits all taxes to the appropriate authorities

- The developer has no filing or remittance obligations

Audit and Compliance Risk

With Stripe Tax:

- You bear the risk of tax audits

- You are liable for penalties and interest if errors occur

- You must defend your tax positions if challenged

- You must stay current with changing regulations

With a Merchant of Record:

- The MoR bears the risk of tax audits

- The MoR is liable for penalties and interest

- The MoR defends tax positions if challenged

- The MoR stays current with changing regulations

Visual Comparison: Stripe Tax vs. Merchant of Record

┌─────────────────────────────────────────────────────────────────┐

│ TAX RESPONSIBILITY FLOW │

└─────────────────────────────────────────────────────────────────┘

┌─────────────────────────┐ ┌─────────────────────────┐

│ STRIPE TAX │ │ MERCHANT OF RECORD │

└─────────────────────────┘ └─────────────────────────┘

┌─────────────┐ ┌─────────────┐

│ Customer │ │ Customer │

└──────┬──────┘ └──────┬──────┘

│ │

│ Payment │ Payment

│ + Tax │ + Tax

▼ ▼

┌─────────────┐ ┌─────────────┐

│ Stripe │ │ Merchant of │

│ Tax │ │ Record │

└──────┬──────┘ └──────┬──────┘

│ │

│ Calculation │ Handles ALL

│ & Collection │ Tax Obligations

▼ ▼

┌─────────────┐ ┌─────────────┐

│ Developer/ │◄─── Legal │ Developer/ │◄─── NO Legal

│ Publisher │ Responsibility│ Publisher │ Responsibility

└──────┬──────┘ for Tax └─────────────┘ for Tax

│

│ Must Handle

│

▼

┌─────────────────────────┐

│ • Tax Registration │

│ • Tax Filing │

│ • Tax Remittance │

│ • Audit Defense │

│ • Compliance Updates │

└─────────────────────────┘

Practical Implications for SaaS Developers and Indie Publishers

Resource Requirements with Stripe Tax

Using Stripe Tax still requires significant resources:

- Tax Expertise: You need internal tax knowledge or external consultants

- Registration Management: You must manage registrations in multiple jurisdictions

- Filing Processes: You need processes for regular tax filings

- Compliance Monitoring: You must stay current with changing regulations

- Audit Preparation: You need to maintain records for potential audits

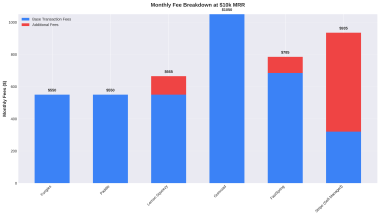

Cost Implications

While Stripe Tax’s pricing model (0.5-2% of transaction value) may appear lower than MoR fees (3.5-10%), this comparison doesn’t account for:

- Registration Costs: $500-$5,000 per jurisdiction

- Filing Costs: $200-$1,000 per filing per jurisdiction

- Consultant Fees: $5,000-$50,000+ annually for tax expertise

- Compliance Software: Additional tools beyond Stripe Tax

- Internal Resources: Staff time dedicated to tax management

Risk Exposure

Using Stripe Tax instead of an MoR exposes the business to:

- Direct Liability: Financial penalties for non-compliance

- Audit Risk: Time and expense of tax authority audits

- Scaling Challenges: Increasing complexity as you enter new markets

- Regulatory Uncertainty: Exposure to changing tax laws

- Personal Liability: Potential personal liability for company officers

Real-World Scenarios: Stripe Tax vs. MoR

Scenario 1: US-Based SaaS Selling Globally

With Stripe Tax:

- Must register for VAT in EU countries when exceeding thresholds

- Must register for GST in Australia, New Zealand, etc.

- Must file returns in each jurisdiction

- Must monitor changing regulations in dozens of countries

- Estimated annual compliance cost: $50,000-$100,000+

With MoR:

- No registration requirements

- No filing requirements

- No regulatory monitoring needed

- Estimated annual compliance cost: MoR fee percentage only

Scenario 2: Growing Indie Developer

With Stripe Tax:

- Must track sales against thresholds in all jurisdictions

- Must register as thresholds are exceeded

- Must divert development time to compliance

- Risk of unexpected tax liabilities

- Limited ability to focus on core product

With MoR:

- Immediate global compliance

- No threshold monitoring required

- Full focus on product development

- Predictable fee structure

- Scalable solution as business grows

When Stripe Tax May Be Appropriate

Despite its limitations, Stripe Tax may be suitable in certain scenarios:

- Single-Jurisdiction Businesses: Companies selling only in their home country

- High-Volume/Low-Margin: Businesses where MoR fees significantly impact profitability

- Existing Tax Infrastructure: Companies with established tax departments

- Hybrid Approaches: Using MoR for international sales and Stripe Tax domestically

- Specific Integration Requirements: When Stripe’s ecosystem offers unique advantages

Executive Summary

This analysis has examined global tax regulations for digital products and subscriptions across ten major markets, with a focus on the implications for SaaS developers and indie software publishers. We’ve explored tax obligations, penalties for non-compliance, and compared two primary approaches to tax management: the Merchant of Record (MoR) model and Stripe Tax.

The findings clearly demonstrate that tax compliance for digital products is complex, constantly evolving, and carries significant legal and financial risks. For small teams and indie developers operating internationally, the Merchant of Record model offers substantial advantages by legally shifting tax responsibilities away from the developer, allowing focus on core business activities while minimizing compliance risks.

Key Findings

Tax Complexity and Risk

- Global Variation: Tax regulations for digital products vary dramatically across jurisdictions, with different registration thresholds, rates, filing requirements, and enforcement approaches.

- Increasing Enforcement: Tax authorities worldwide are becoming more aggressive in enforcing digital tax compliance, with many implementing specialized digital service tax regimes.

- Severe Penalties: Non-compliance penalties can be substantial, including:

- Financial penalties up to 150% of unpaid tax

- Interest charges on unpaid amounts

- Business restrictions and reputational damage

- Potential criminal liability in cases of willful non-compliance

- Resource Intensity: Managing tax compliance independently requires significant expertise, time, and financial resources that most small teams and indie developers cannot efficiently allocate.

Merchant of Record vs. Stripe Tax

- Legal Responsibility:

- MoR: The Merchant of Record assumes full legal responsibility for tax compliance

- Stripe Tax: The developer retains all legal responsibility and liability

- Registration Requirements:

- MoR: No registration required by the developer

- Stripe Tax: Developer must register in all applicable jurisdictions

- Filing and Remittance:

- MoR: Handled entirely by the MoR

- Stripe Tax: Developer must file and remit taxes in all jurisdictions

- Resource Requirements:

- MoR: Minimal internal resources needed

- Stripe Tax: Requires tax expertise, registration management, filing processes

- Cost Structure:

- MoR: Higher percentage fee (3.5-10%) but includes all compliance costs

- Stripe Tax: Lower percentage fee (0.5-2%) but excludes registration, filing, and expertise costs

Recommendations for SaaS Developers and Indie Publishers

When to Use a Merchant of Record

The Merchant of Record model is strongly recommended for:

- Solo Developers and Micro-SaaS (1-3 people):

- Limited resources to dedicate to compliance

- Need to focus entirely on product development

- Desire for immediate global market access

- Lack of in-house tax expertise

- Small SaaS Teams (4-20 employees):

- Growing internationally across multiple jurisdictions

- Limited finance/tax department resources

- Need for predictable compliance costs

- Focus on scaling product and customer acquisition

- Risk-Averse Businesses:

- Companies seeking to minimize compliance risk exposure

- Businesses entering high-enforcement jurisdictions

- Organizations with limited appetite for tax audits

- Startups without resources for potential penalties

Recommended MoR Providers by Business Type

| Business Type | Recommended Primary MoR | Alternative MoR |

|---|---|---|

| Solo Developers | Fungies.io or LemonSqueezy | Gumroad |

| AI Startups | Fungies.io | Paddle |

| Small SaaS Teams | LemonSqueezy or Paddle | Fungies.io |

| Digital Content Creators | Gumroad | LemonSqueezy |

| Enterprise SaaS | Paddle | FastSpring |

When Stripe Tax May Be Appropriate

Stripe Tax may be suitable in specific scenarios:

- Single-Jurisdiction Operations: Companies selling only in their home country with no international customers

- High-Volume/Low-Margin: Businesses where MoR fees would significantly impact profitability and that can afford dedicated tax resources

- Existing Tax Infrastructure: Companies with established tax departments and existing registrations

- Hybrid Approaches: Using MoR for international sales while managing domestic tax compliance with Stripe Tax

- Specific Integration Requirements: When Stripe’s ecosystem offers unique advantages that outweigh compliance considerations

Highest-Risk Countries for Non-Compliance

Based on our analysis, these jurisdictions pose the greatest risk due to aggressive enforcement, low thresholds, or severe penalties:

- European Union: Particularly Germany, France, and Italy

- Low registration thresholds (€10,000 combined EU-wide sales)

- Aggressive enforcement with cross-border cooperation

- Penalties up to 150% of unpaid tax plus interest

- United Kingdom:

- Zero threshold for non-EU businesses

- Sophisticated digital detection systems

- Penalties up to 100% of tax due plus interest

- Brazil:

- Extremely complex tax system with federal, state, and municipal taxes

- Severe penalties up to 150% of tax due

- Challenging compliance requirements even for experts

- Australia:

- Active enforcement of GST on digital products

- Penalties up to 75% of unpaid tax for intentional disregard

- International information sharing agreements

- Canada:

- Provincial and federal tax requirements

- Increasing focus on digital economy taxation

- Penalties compound with duration of non-compliance

Implementation Roadmap for Tax Compliance

For Those Choosing the MoR Model

- Research and Select Provider:

- Compare features, pricing, and supported countries

- Evaluate checkout experience and customer support

- Consider specific needs (subscriptions, one-time sales, etc.)

- Integration Process:

- Implement checkout solution (overlay, embedded, or hosted)

- Configure product catalog and pricing

- Set up webhook notifications for purchase events

- Operational Adjustments:

- Update terms of service to reflect MoR relationship

- Adjust financial projections to account for MoR fees

- Establish reconciliation processes for MoR payments

- Ongoing Management:

- Monitor MoR performance and customer experience

- Review fee structure as volume increases

- Consider hybrid approaches as business scales

For Those Choosing Stripe Tax

- Preliminary Assessment:

- Conduct nexus analysis across all jurisdictions

- Determine registration requirements

- Estimate compliance costs and resource needs

- Registration Process:

- Register with tax authorities in required jurisdictions

- Add registrations to Stripe Tax dashboard

- Implement product tax codes for your offerings

- Compliance Infrastructure:

- Establish filing calendar for all jurisdictions

- Develop record-keeping systems for audit defense

- Consider tax advisory relationships

- Ongoing Compliance:

- Monitor sales against thresholds in new jurisdictions

- Stay current with regulatory changes

- Conduct periodic compliance reviews

Long-Term Considerations

Evolving Regulatory Landscape

The taxation of digital products continues to evolve rapidly:

- Expanding Digital Taxes: More countries are implementing specific digital service taxes

- Decreasing Thresholds: Registration thresholds are trending downward globally

- Increasing Enforcement: Tax authorities are investing in technology to detect non-compliance

- International Cooperation: Greater information sharing between tax authorities

Business Growth Implications

As your business grows, tax compliance considerations will change:

- Scale Advantages: Higher volume may justify negotiating lower MoR fees or building internal tax infrastructure

- Market Expansion: New markets bring new compliance requirements

- Product Diversification: Different product types may have different tax treatments

- Corporate Structure: Tax optimization may eventually involve entity creation in specific jurisdictions

Final Recommendation

For the vast majority of solo developers, indie publishers, and small SaaS teams operating internationally, the Merchant of Record model provides the most effective solution for tax compliance. The legal protection, resource efficiency, and focus on core business activities outweigh the higher percentage fees, particularly when accounting for the true costs of compliance.

As expressed by one developer who switched to an MoR: “Managing sales tax was a constant headache. It was a complicated and intimidating task.” By adopting the MoR model, developers can eliminate this headache and focus on what they do best—building great software products.

Sources

- Stripe Documentation – “How Tax works” (May 2025)

- Stripe Documentation – “Stripe Tax” (May 2025)

- Paddle – “What is a merchant of record (MoR) + why use one for payments and sales tax?” (August 1, 2024)

- LemonSqueezy – “Everything you need to know about a Merchant of Record vs a Seller of Record” (January 26, 2024)

- Fungies.io – “The Vital Role of Sales Tax Compliance in SaaS Business Success” (September 17, 2024)

- Avalara – “Sales Tax Compliance Guide for SaaS Companies” (March 15, 2025)

- TaxJar – “SaaS Sales Tax: The Ultimate Guide” (February 22, 2025)

- Deloitte – “Digital Services Tax Global Developments” (April 3, 2025)

- EY – “Indirect Tax Guide for Technology Companies” (January 17, 2025)

- KPMG – “Taxation of the Digitalized Economy” (March 28, 2025)