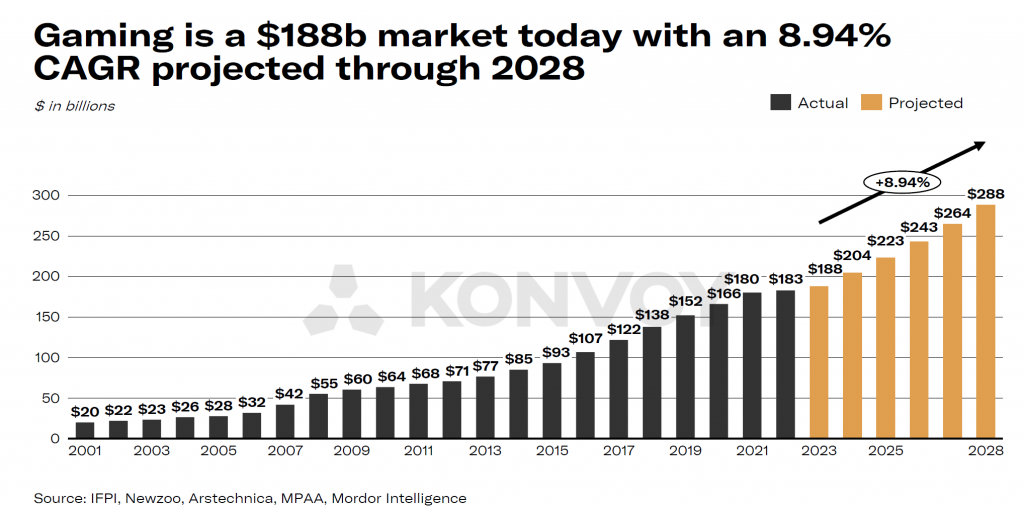

Hey there, game developers and publishers! Welcome to the most in-depth analysis you’ll find on the Q3 2023 gaming investment landscape. Not only are we unpacking the latest numbers on venture capital (VC), but we’re also exploring the future of cloud gaming, indie game publishing trends, and the existing gaps in strategies against dominant digital marketplaces like Steam. If you’re looking to maximize your gains, this report is your ultimate resource. This report was based on Konvoy’s report.

The VC Funding Picture: A Reset in Focus

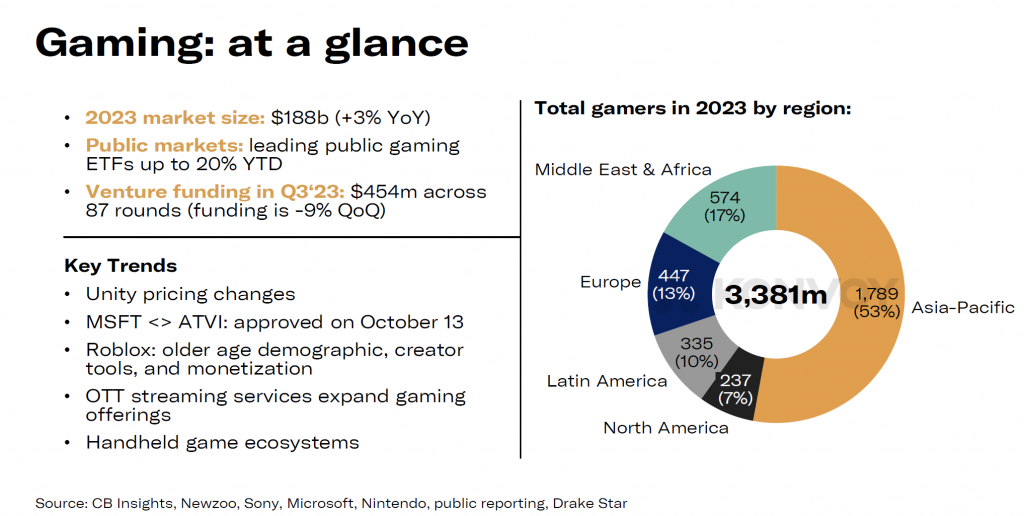

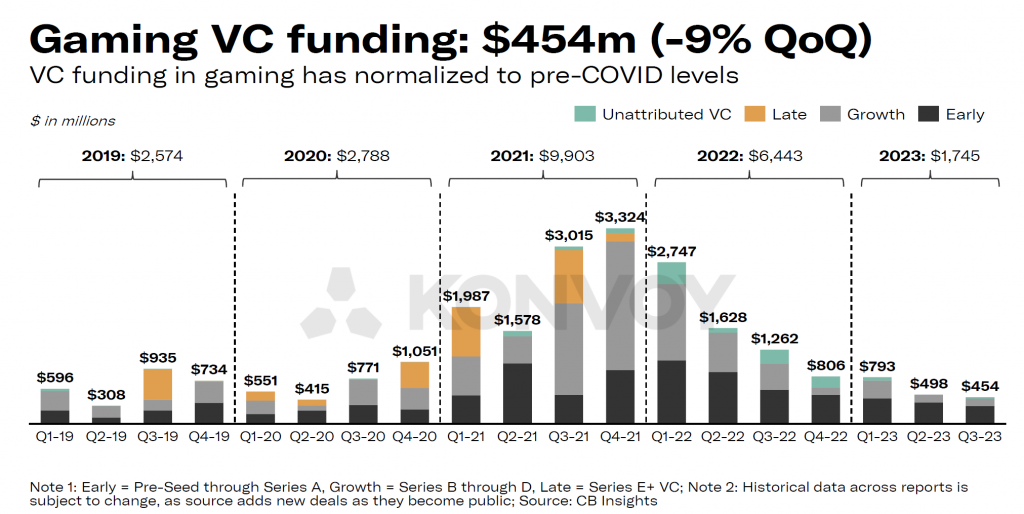

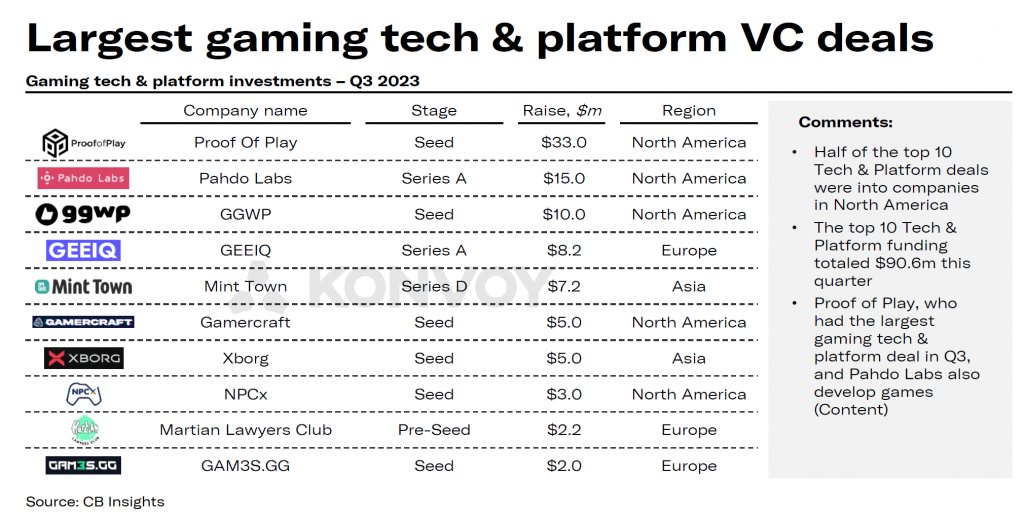

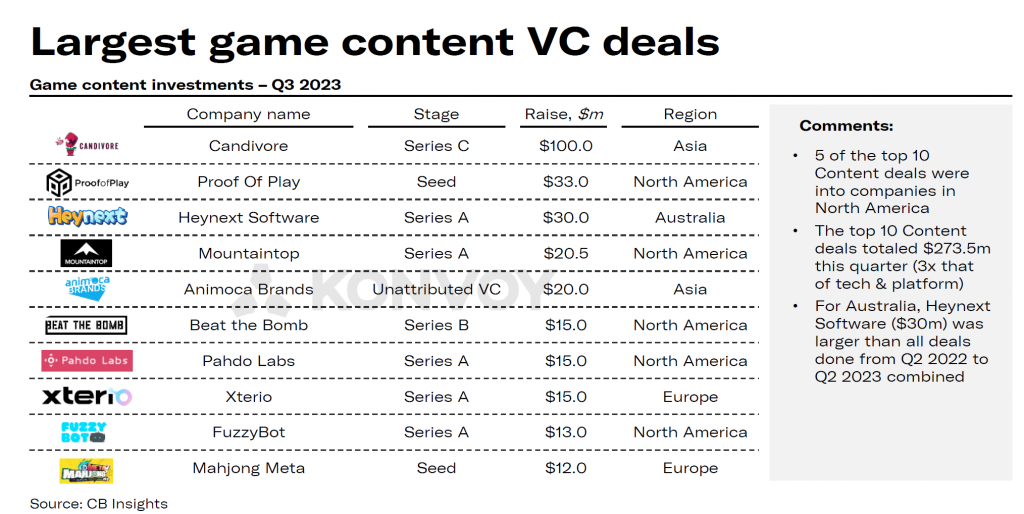

The VC landscape for gaming in Q3 2023 showed a slight dip of 9%, with the investment figures standing at $454 million. But it’s not just about the numbers; the focal point has shifted. Game development studios raked in approximately $275 million, overshadowing the $90 million channeled into game tech and platforms.

Key Takeaways:

- Overall VC Funding: Declined from $498 million in Q2 to $454 million in Q3 2023.

- Investment Focus: Predominantly on game content development studios.

The New Angles: Debt Financing and M&A Revival

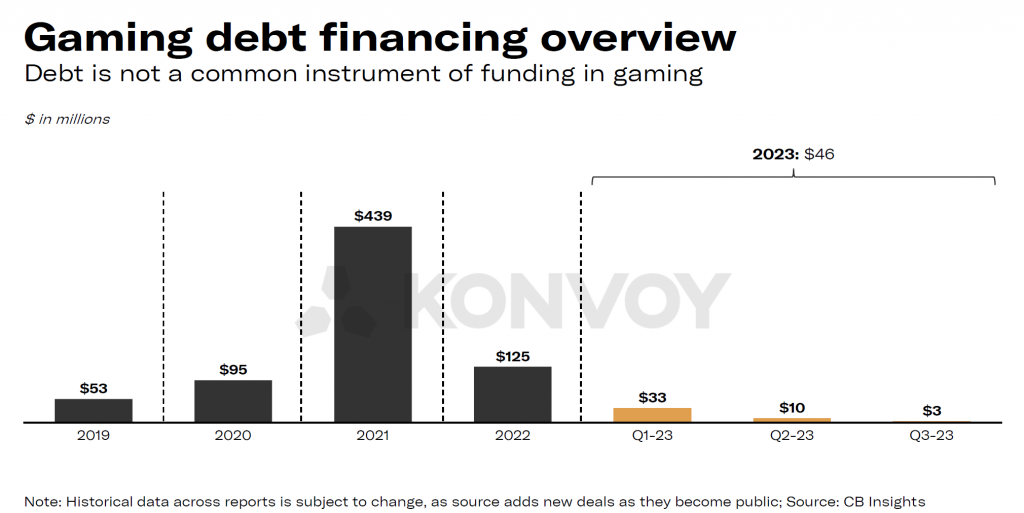

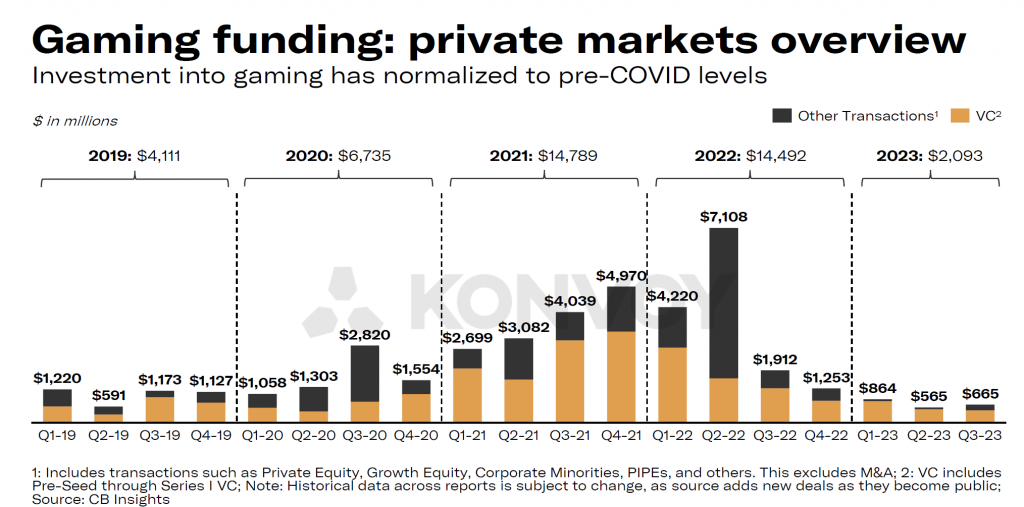

Gone are the days when VC funding was the only number to track. In this report, we’ve incorporated debt financing and M&A data to give you a comprehensive view.

M&As are Back and Thriving

The M&A landscape is flourishing, picking up pace from Q2’s memorable acquisitions like Take-Two’s $12.7 billion takeover of Zynga. Sega put its stamp on Q3 with a $776 million acquisition of Rovio.

The Regional Spotlight: Investment Geography

Asia: The Epicenter of Game Investment

Asia remained an investment powerhouse, although it showed a slight decrease in average deal sizes by 15%.

North America and Europe: Mixed Fortunes

While North America showed modest growth, Europe’s investments hit a roadblock, declining sharply by 40%.

Unity’s Price Tug-of-War: The Community Strikes Back

Unity’s decision to introduce per-download fees drew backlash from developers, forcing them to revise their fee structure. While Unity’s CEO John Riccitiello stepped down, the platform remains a major player.

The Future of Cloud Gaming: What’s on the Horizon?

Cloud gaming is poised for massive growth, mainly due to improvements in internet speed and the proliferation of 5G. Companies like Microsoft and Google are already vying for a piece of this lucrative pie. However, challenges such as latency issues and data security remain. The recent acquisition strategies hint that bigger players like Microsoft are looking to consolidate their cloud gaming services, providing an integrated gaming ecosystem that can be accessed across multiple devices.

Key Takeaways:

- Rapid Growth: Cloud gaming market expected to grow at a CAGR of around 48% through 2027.

- Major Players: Companies like Microsoft, Google, and Sony are investing heavily in cloud infrastructure.

- Challenges: Latency and data security remain as significant barriers.

Indie Game Publishing: The New Wave

Indie gaming is no longer the underdog. With platforms like Itch.io and Epic Games Store offering more generous revenue splits, indie developers have more avenues to publish their games. The democratization of game development tools is also helping solo developers and small studios bring their ideas to life. However, the flood of indie games in the market has made discoverability a significant challenge. Crowdfunding platforms and influencer collaborations are emerging as vital tools for indie game marketing.

Key Takeaways:

- Multiple Avenues: New platforms and tools are empowering indie developers.

- Discoverability: Getting noticed is a significant challenge.

- Marketing Strategies: Crowdfunding and influencer marketing are becoming essential.

The Elephant in the Room: Lacking a Competitive Strategy Against Marketplaces

Digital marketplaces like Steam have built an almost insurmountable moat around their business, and most game publishers have done little to challenge this. The lack of a strategic moat has made it difficult for new entrants to compete effectively. Steam’s robust community features, vast game library, and user-friendly interface make it a one-stop-shop for gamers, creating a significant barrier for competition.

For publishers, not having a strategic moat means they are often subjected to the terms set by these dominant platforms. Revenue splits and visibility are usually at the mercy of the marketplace algorithms. In the long run, publishers must focus on building a strategic advantage that could include exclusive titles, better revenue splits, or unique features that make their platforms more appealing to both developers and gamers.

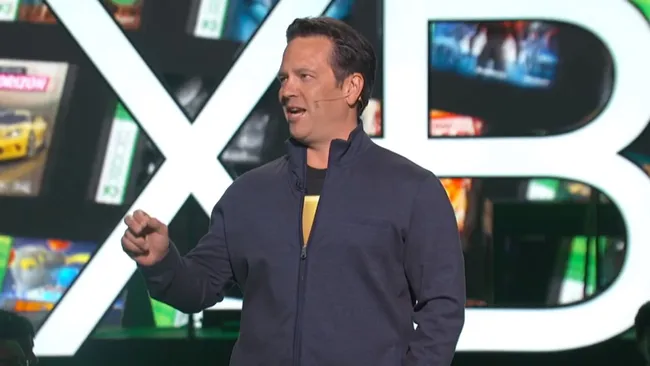

In the days before digital distribution platforms like Steam dominated the landscape, physical stores were the primary channel for selling video games. Back then, getting your game onto a physical shelf was imperative for success. Without a prime spot in stores, your game’s chances of gaining traction, especially during the holiday season, were slim. Enter the large publishers—through their scale and influence, they could secure that critical retail space that indie developers couldn’t dream of acquiring. In a leaked email, Spencer highlighted the necessity of collaborating with a major publisher if you wanted your game to have a presence at retail outlets like Egghead Software.

However, the dynamics have shifted in the era of digital marketplaces. The need for physical distribution has become obsolete, allowing major publishers to focus on their other advantage: producing big-budget blockbuster titles. Spencer notes, “Few entities have the resources to spend the $200 million that giants like Activision or Take-Two allocate for marquee titles like Call of Duty or Red Dead Redemption.” The downside to these high-stakes productions is that they create a “hurdle rate” or a minimum required return on investment so high that it stifles innovation and risk-taking.

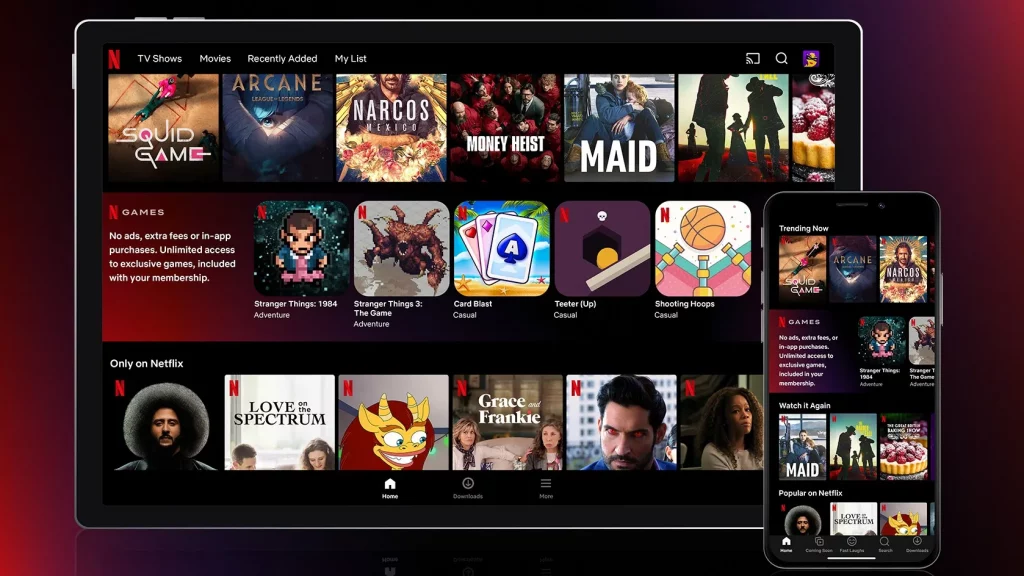

As a solution to offset this risk, AAA publishers have increasingly turned to leasing popular intellectual property. Examples include EA’s partnership with Star Wars, Sony with Spider-Man, and Ubisoft with Avatar. This trend mirrors what’s happening in Hollywood, where Netflix is leading in creating new IPs compared to traditional movie studios. According to Spencer, the end result is a level of stagnation among AAA publishers, who are mainly recycling their golden oldie franchises, many of which were established over a decade ago.

Spencer’s argument centers around the idea that subscription services like Xbox Game Pass could serve as a much-needed lifeline for these big publishers. While companies like EA and Ubisoft are exploring their own subscription services, they are not scaling fast or boldly enough, partly because they lack a native platform like the Xbox. Spencer clarifies that the aim isn’t to eliminate these large publishers but to facilitate their evolution by offering them access to a substantial user base they can monetize according to their strategies.

Spencer’s forecast proved to be somewhat accurate when Electronic Arts incorporated its EA Play subscription service into Game Pass at no additional cost, just six months after his email. However, what’s most compelling is Spencer’s incisive critique of the current state of major publishers. While some, like Take-Two’s Private Division label, are making tentative forays into original content, most continue to double down on proven formulas.

This strategy may guarantee short-term gains—anticipations are high for the next Grand Theft Auto or Call of Duty installment—but it also fosters a complacent atmosphere in high-budget game development. One glaring example is the anticipation for Call of Duty: Modern Warfare 3 in 2023, a game that’s essentially a rehash of an older title, even using recycled maps as a selling point.

Key Takeaways:

- Dominance of Steam: Built a strong moat with community features and a vast game library.

- Lack of Competitive Strategy: Publishers are still to find a way to challenge dominant marketplaces effectively.

- Future Outlook: Building a strategic moat is essential for long-term competition.

Conclusion

From venture capital trends and the re-emergence of M&As to the untapped potential in cloud gaming and indie game publishing, the Q3 2023 landscape is filled with opportunities and challenges. The lack of strategic competitive moves against established digital marketplaces should serve as a wake-up call for game publishers. It’s time for action; either adapt or risk falling by the wayside.