In the fast-paced world of SaaS and digital downloads, your focus is on creating an exceptional product and building a loyal customer base. You’re a creator, an innovator, a problem-solver. But as your business grows, a new set of challenges emerges, a silent and complex web of administrative tasks that can quickly become a major roadblock to your success. We’re talking about payment processing, tax compliance, fraud management, and a host of other legal and financial hurdles that come with selling to a global audience.

This is where a Merchant of Record (MoR) comes in. An MoR is a legal entity that acts as a reseller of your products, taking on the full financial and legal responsibility for all your customer transactions. It’s the unseen engine that powers your growth, allowing you to focus on what you do best while ensuring your business remains compliant and profitable.

This article will be your comprehensive guide to understanding the critical role of a Merchant of Record in today’s digital economy. We’ll delve into the complexities of global tax compliance, explore the myriad benefits of partnering with an MoR, and take a close look at how a platform like Fungies.io can be the perfect partner for your SaaS or digital download business. We’ll provide you with the numbers, the data, and the insights you need to make an informed decision and unlock your business’s full potential.

The Hidden Costs of Going It Alone: The Burden of Tax Compliance

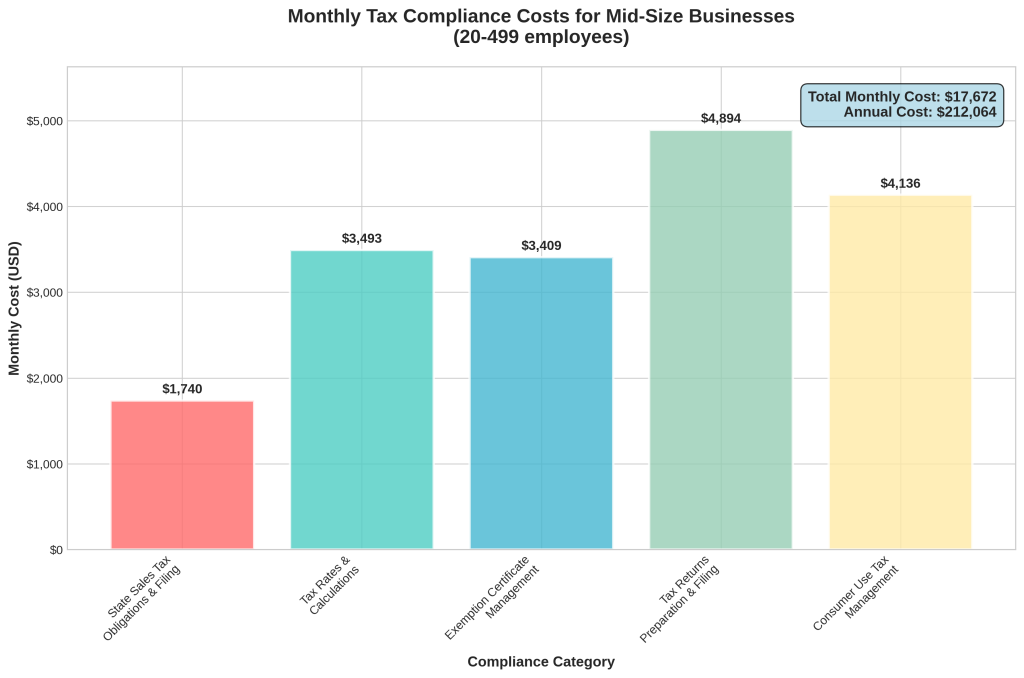

For many small to medium-sized SaaS and digital businesses, the idea of handling payments and taxes in-house seems like a cost-saving measure. However, the reality is often the opposite. The administrative burden of tax compliance can quickly spiral into a significant drain on your resources, both in terms of time and money. According to a survey by Avalara, businesses with 20-499 employees spend an average of $17,672 per month on tax compliance activities [1]. That’s over $212,000 a year that could be invested in product development, marketing, or customer support.

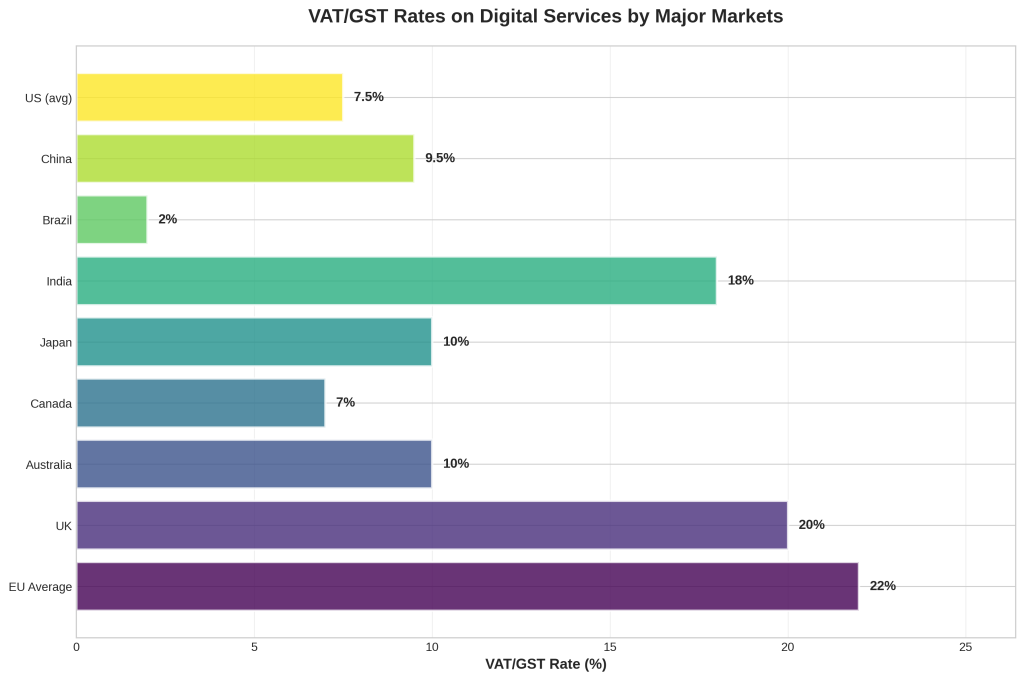

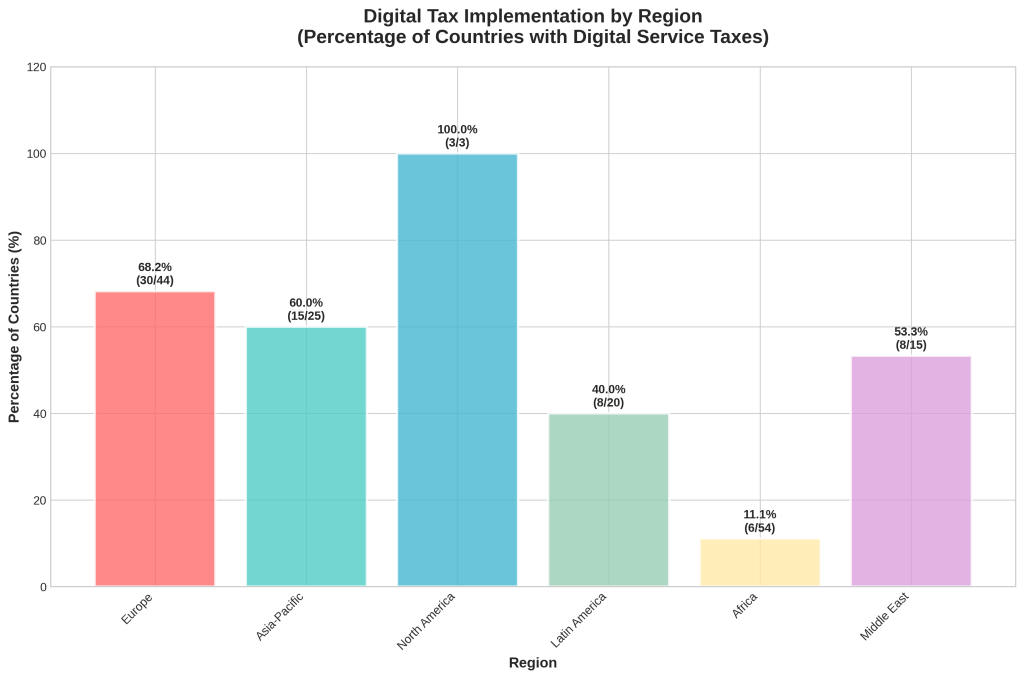

The complexities of global tax compliance are staggering. With over 70 countries now applying VAT/GST to digital services, each with its own set of rules, rates, and registration thresholds, it’s a full-time job just to keep up. The tax rates can range from 3% to 27%, and most countries have a nil registration threshold for non-resident providers, meaning you’re liable for taxes from your very first sale.

Here’s a breakdown of the key challenges that contribute to these hidden costs:

•Tax Obligation Tracking: Determining where you have a tax obligation (nexus) is a complex process that involves tracking sales thresholds, inventory locations, remote employees, and constantly changing legislation.

•Tax Rate Management: Applying the correct tax rate for each transaction is a minefield of product classifications, jurisdiction-specific rates, and frequent legislative changes.

•Documentation Requirements: Collecting, validating, and storing exemption certificates is a critical but often overlooked task that can lead to significant penalties if not handled correctly.

•Filing Complexity: Each jurisdiction has its own filing schedule, format, and payment process, creating a logistical nightmare for businesses selling globally.

•Use Tax Liability: Self-assessing use tax on out-of-state purchases and repurposed inventory is a tricky process that requires constant coordination between multiple departments.

When you add it all up, the cost of going it alone is far greater than just the financial outlay. It’s the opportunity cost of diverting your focus from your core business, the risk of non-compliance penalties, and the barrier to global expansion. This is where a Merchant of Record can be a game-changer.

What is a Merchant of Record and How Does It Work?

A Merchant of Record (MoR) is a legal entity that acts as a reseller of your products, taking on the full financial and legal responsibility for all your customer transactions. In simple terms, the MoR becomes the seller of record for your products, while you remain the creator and owner of the product itself. This arrangement allows you to offload the entire burden of payment processing, tax compliance, and fraud management to a third-party expert.

Here’s how the MoR model works in practice:

1.Your customer makes a purchase: A customer visits your website or online store and decides to buy your product.

2.The MoR processes the payment: The MoR’s checkout process is seamlessly integrated into your website. The MoR processes the payment, handling all the complexities of different currencies, payment methods, and local regulations.

3.The MoR becomes the seller of record: The MoR’s name appears on the customer’s credit card statement, and they become the legally liable party for the transaction.

4.The MoR handles all post-sale responsibilities: This includes calculating, collecting, and remitting sales taxes, managing refunds and chargebacks, and ensuring compliance with all relevant regulations.

5.You receive your revenue: The MoR pays you your share of the revenue, minus their fees, in a single, consolidated payment.

The beauty of the MoR model is its simplicity. It allows you to sell your products to a global audience without having to worry about the complexities of international commerce. You can focus on creating great products and building your brand, while the MoR takes care of the rest.

The Transformative Benefits of Partnering with a Merchant of Record

The decision to partner with a Merchant of Record is not just about offloading administrative tasks; it’s a strategic move that can transform your business. By freeing yourself from the complexities of payment processing and tax compliance, you can unlock new opportunities for growth and innovation. Here are some of the key benefits of partnering with an MoR:

•Accelerated Global Expansion: With an MoR, you can instantly sell your products to a global audience without having to worry about setting up local entities, opening foreign bank accounts, or navigating complex international regulations. This allows you to enter new markets quickly and efficiently, giving you a significant competitive advantage.

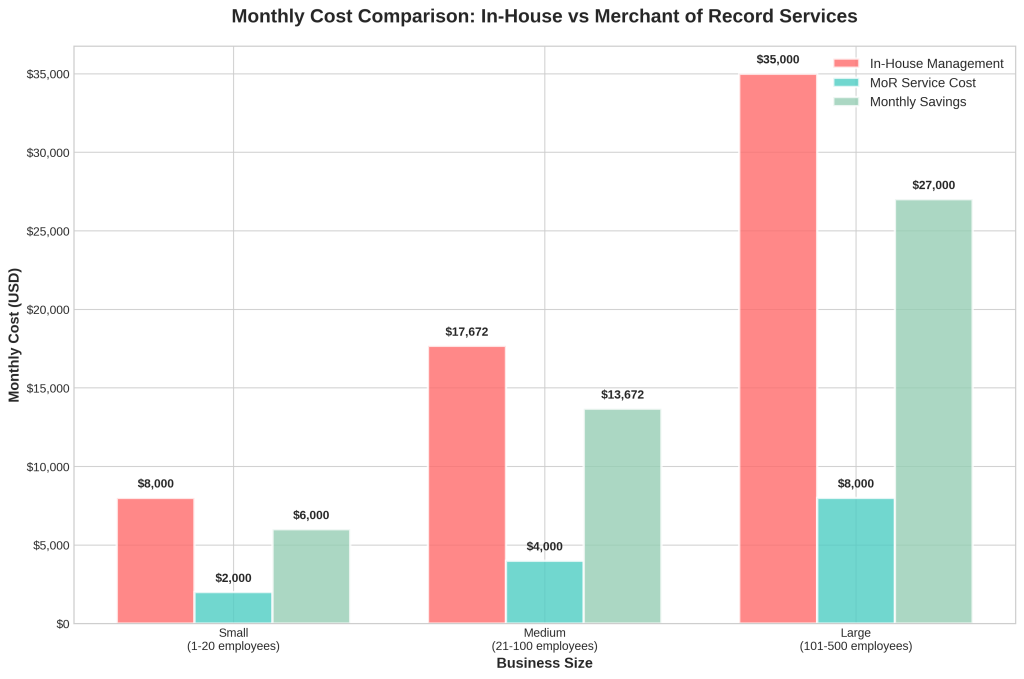

•Reduced Operational Costs: As we’ve already seen, the cost of in-house tax compliance can be substantial. By partnering with an MoR, you can significantly reduce these costs, freeing up valuable resources that can be reinvested in your core business. The chart below illustrates the potential cost savings for businesses of different sizes.

Enhanced Customer Experience: A good MoR will offer a seamless and localized checkout experience for your customers, with support for multiple currencies and payment methods. This can significantly improve your conversion rates and customer satisfaction.

•Improved Focus on Core Business: By offloading the administrative burden of payment processing and tax compliance, you can focus on what you do best: creating great products and building your brand. This allows you to innovate faster, respond more quickly to market changes, and ultimately, build a more successful business.

•Reduced Risk and Liability: An MoR takes on the full legal and financial responsibility for all your customer transactions. This means you’re protected from the risks of fraud, chargebacks, and non-compliance penalties, giving you peace of mind and allowing you to focus on growth.

The benefits of partnering with an MoR are clear. It’s a strategic investment that can pay for itself many times over, both in terms of cost savings and new opportunities for growth. In the next section, we’ll take a closer look at how a platform like Fungies.io can help you realize these benefits.

Fungies.io: The Ideal Merchant of Record for Your SaaS and Digital Business

Now that we’ve established the critical importance of a Merchant of Record, the question becomes: which MoR is the right partner for your business? While there are several options available, Fungies.io stands out as a particularly compelling choice for SaaS and digital download businesses, especially for small to medium-sized enterprises and independent developers.

Fungies.io is more than just a payment processor; it’s a comprehensive MoR platform designed to simplify global sales and empower businesses to focus on growth. Here’s what makes Fungies.io the ideal partner for your business:

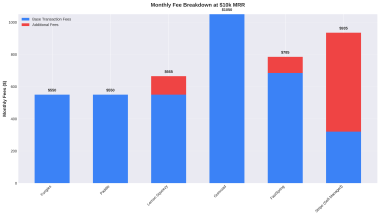

•Transparent and Affordable Pricing: Fungies.io offers a simple and transparent pricing model of 5% + $0.50 per transaction, with no hidden fees or upfront costs. This is in stark contrast to many other MoR providers, who often have complex and opaque pricing structures. With Fungies.io, you only pay when you make a sale, making it a cost-effective solution for businesses of all sizes.

•No-Code Solution for Rapid Deployment: Fungies.io is designed to be incredibly easy to use, with a no-code platform that allows you to start selling in minutes. You don’t need to be a developer to integrate Fungies.io into your website or online store, making it an accessible solution for everyone.

•Global Reach with Localized Experience: Fungies.io supports all world currencies and over 250 payment methods, allowing you to sell to a global audience with a localized checkout experience. This can significantly improve your conversion rates and customer satisfaction.

•Complete Control Over Your Business: Unlike some MoR providers that take control of your customer relationships, Fungies.io gives you full access to your customer data. This allows you to build direct relationships with your customers and maintain control over your brand.

•Comprehensive MoR Services: Fungies.io handles all the complexities of payment processing, tax compliance, fraud management, and chargebacks, so you don’t have to. This includes:

•Tax Filing and Compliance: Fungies.io files taxes under your name, ensuring you remain compliant with all relevant regulations.

•Fraud Prevention: Fungies.io’s built-in fraud detection systems protect you from fraudulent transactions and chargebacks.

•Global Payment Processing: Fungies.io accepts payments in any currency with a wide range of local payment methods.

•Chargeback and Refund Management: Fungies.io handles all disputes and refunds on your behalf, saving you time and hassle.

In a world where digital tax regulations are constantly changing, having a partner like Fungies.io is more important than ever. With their comprehensive MoR services and commitment to transparency and affordability, Fungies.io is the ideal partner to help you navigate the complexities of global commerce and unlock your business’s full potential.

Conclusion: Your Partner in Global Growth

In today’s interconnected world, the opportunities for SaaS and digital businesses are limitless. But with those opportunities come new challenges, particularly in the realm of payment processing and tax compliance. The administrative burden of going it alone can be a significant roadblock to growth, diverting your focus from your core business and exposing you to unnecessary risks.

A Merchant of Record is the solution to this problem. By partnering with an MoR, you can offload the entire burden of payment processing, tax compliance, and fraud management to a third-party expert, allowing you to focus on what you do best: creating great products and building your brand.

Fungies.io is the ideal MoR partner for your SaaS or digital download business. With their transparent pricing, no-code platform, and comprehensive MoR services, Fungies.io empowers you to sell to a global audience with confidence and ease. It’s the unseen engine that will power your growth, allowing you to navigate the complexities of global commerce and unlock your business’s full potential.

Don’t let the complexities of payment processing and tax compliance hold you back. Partner with Fungies.io and start your journey to global growth today.

References

[1] Avalara. (2022, September 22). Where is compliance costing your business (and how much)? Retrieved from https://www.avalara.com/blog/en/north-america/2022/09/where-is-compliance-costing-your-business-and-how-much.html

[2] Paddle. (2024, August 1). What is a merchant of record (MoR) + why use one for payments and sales tax? Retrieved from https://www.paddle.com/blog/what-is-merchant-of-record

[3] Avalara. (n.d.). Global VAT and GST on digital services. Retrieved from https://www.avalara.com/vatlive/en/global-vat-gst-on-e-services.html

[4] Fungies.io. (n.d.). Merchant of Record: Trusted Payment Provider. Retrieved from https://fungies.io/merchant-of-record/