Discover the top 20 cross-border payment providers that streamline global transactions with multiple gateways, low processing fees, and other billing solutions.

Nearly 48% of surveyed businesses report losing up to 10% of their international revenue due to limited payment options from their vendors. This revenue loss often stems from customers abandoning their carts when their preferred payment methods or currencies aren’t available—affecting revenue growth and expansion.

Cross-border payment providers provide three main benefits to address these issues:

- Multiple payment gateways to personalize your customer’s buying experience.

- Lower transaction fees to maximize revenue from every sale.

- Automated billing cycles so you can focus on product development instead of manual approvals.

We’ve compiled a list of the 20 top cross-border payment platforms that include these benefits and more to help you find the right one for your business needs.

TL;DR

This article compares the 20 best cross-border payment providers, with Fungies as the #1 choice for its simplified billing, cost-effectiveness, and customization options.

Fungies offers 250+ global payment gateways, multi-currency support, automated recurring billing, global tax compliance, and highly customizable checkout options. It’s an excellent choice for SaaS businesses, digital product sellers, and gaming asset developers looking for scalable and user-friendly solutions.

The platform charges a low commission-based fee (5% + $0.50) and includes features like automated invoicing, fraud prevention, no-code website builder, and subscription management.

With Fungies, you can simplify global payments, automate day-to-day tasks, boost customer trust, and scale your business effortlessly.

Top 20 Cross-Border Payment Providers With Features and Pricing Comparison

1. Fungies

Best for – automated payments, global compliance, and customizable checkouts

Fungies is a Merchant of Record at its core that streamlines payments, invoicing, tax compliance, and other billing operations for SaaS companies, digital product/subscription sellers, and gaming asset developers.

We’ve built our platform to be highly customizable to fit any business size.

Here’s why you should consider our platform:

- From customizable checkout integrations on your website to personalized billing cycles for your customers, Fungies makes selling your digital product easy.

- Its built-in features simplify day-to-day billing tasks such as sending payment reminders or failures, automating daily payouts, identifying fraudulent intentions, and more.

- The onboarding setup is easy with a simple interface, and no technical skills are required.

Let’s look at Fungies’ core features that make it the #1 cross-border payment provider:

Fungies Provides 250+ Payment Getaways for Localized Transactions

Fungies provides 250+ payment getaways including Apple Pay, Google Pay, Visa, Mastercard, Buy Now Pay Later, cryptocurrencies, and more. This allows businesses to personalize their customer’s buying experience from anywhere in the world.

A distinct feature that sets Fungies apart is its regional pricing support. You can customize regional prices according to currency and tax rates so your international customers can choose their preferred currency. This helps you increase sales and retention rates.

With Fungies, you don’t need to manually add these payment options. We use Stripe as our financial provider so you simply connect your Stripe account via our Dashboard, and the platform automatically sends you daily payouts once you make a sale through any payment gateway.

In case Stripe isn’t available in your region, you can sign up for a sub-merchant account through our Dashboard based on this list of countries.

Fungies Streamlines Global Tax Handling and Fraud Prevention

Managing payments for an international customer base means you should comply with local tax laws while employing measures to combat fraud. A Barnard Institute study shows that 25% of users abandon carts because they don’t trust sharing their credit card information with a retailer.

Fungies addresses this by offering:

- 3D Secure transactions for advanced fraud prevention.

- Complete management of disputes, chargebacks, and taxes, ensuring compliance and customer trust.

- Meets PCI compliance to meet international standards.

The platform streamlines the whole payment process with complete global compliance while building trust among your customers.

Customizable Checkouts Personalize Customer Buying Experience More

The checkout process is one of the most critical points in your customer’s buying journey. A clunky, generic checkout experience can severely impact sales. Research by Gartner shows that addressing usability issues in the checkout process can result in an average 35% increase in conversion rates.

Fungies offers two customizable checkout solutions to improve your customers’ purchasing experience:

- Hosted: Customers access this via a link, directing them to a secure, Fungies-hosted site to complete their purchase without needing to embed it on your website.

- Overlay: An embeddable option that appears as a pop-up or inline frame within your existing website or app.

The onboarding process is quite simple as well. You can customize the checkout –like color schemes, brand logos, and theme settings, according to your branding identity – from its Dashboard.

Paste the provided code snippet into the HTML of your website where you want the checkout to appear. This will embed the checkout overlay directly into your site.

Fungies’ Automated Billing with Multiple Pricing Tiers to Increase Customer Retention

When managing subscriptions, you need a robust payment provider to help you set multiple pricing tiers with recurring billing solutions. With Fungies, you can offer a custom tiered pricing model to upsell customers with higher-value plans.

You can structure tiers based on features or usage levels, so your customers pay in proportion to the value they receive. This can help you increase customer satisfaction and high retention rates.

Fungies streamlines billing and invoicing with a simple, yet unified interface. The system charges customers based on their preferred payment method, either partially or in full. You can also allow them to pick a billing cycle for your subscription products by weekly, monthly, annually, or customized.

Our customers love the easy-to-use dashboard that not only lets you adjust your billing preferences but also reports on customer purchasing behavior.

Reporting Dashboard for Customer Analysis

Many businesses complain that most payment providers don’t give them ownership over customer data to analyze their revenue growth. Fungies’ dashboard gives you real-time reports on sales metrics, payouts, and dispute management.

The platform handles all financial administrative tasks like sending billing updates or invoices to customers as well, all controlled from a single dashboard. Everything is pre-built for you to create, customize, and resolve without any technical skills required.

To improve your revenue, you can view reporting analytics to analyze your customer’s buying patterns. And if you use Fungies’ website builder, you can get more detailed updates like website traffic, product performance, etc.

Fungies Pros and Cons

Pros

- 250+ payment gateways, 50+ currencies, and regional pricing support

- Merchant of Record for global tax compliance

- Low commission-based pricing gives maximum revenue to owners

- Multi-language support international customer base

- Regional currency support with 50+ currencies personalizes customer buying experience

- Beginner-friendly interface makes onboarding easy

- Customizable checkouts improve branding identity

- Web3 integration for crypto payments

Cons

- Learning curve for advanced features, but the help center is there to resolve those issues.

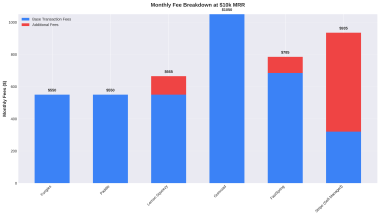

Fungies Pricing

Fungies’ pricing model is quite straightforward. We charge a 5%+$0.50 commission on every sale you make through our platform. Other than that, everything else is completely free forever.

Customer Reviews

- Review #1: “We developed our game and wanted a quick and cheap solution to build our own customizable storefront. Fungies did just that.” – James, Founder of MagicCraft.

- Review #2: “Fungies.io is a game-changer! They’re carving a niche as the premier solution for indie devs seeking a personalized storefront and asset marketplace. Their team’s commitment to continuous improvement and openness to feedback is unparalleled. With user-friendly features and value-packed subscription options, Fungies.io is the ace in the deck for any game development journey.” – Gatis Parols, Founder of DoRaC Game.

2. PayPal

PayPal is a popular global payment provider to send and receive payments across 200 countries in 120+ currencies. Many customers prefer using PayPal due to secure transactions and buyer protection.

Key Features

- Offers checkout solution with country-specific payment options

- Customers can pay via cryptocurrency

- Automates recurring billing and invoicing

- Safeguards users’ financial details during transactions

- Accepts 200+ payment gateways

- Integrates with popular e-commerce platforms

PayPal Pros and Cons

Pros

- User-friendly interface

- Globally recognized payment provider

- Highly responsive customer support and community

- High-speed transactions

Cons

- Complex fee structure

- Resolving disputes can be lengthy

- Often favors buyer disputes over seller claims

PayPal Pricing

PayPal pricing structure is quite complex to figure out at first. It adjusts charges according to the transaction type.

Customer Reviews

“PayPal is easy to use and pretty intuitive. I was able to easily set up a business account and hit the ground running.” – Karen B.

Customer Rating

3. Wise

Wise, or TransferWise, is an all-in-one payment processor with cross-border compliance across 65+ countries. Wise serves over 12.8 million users worldwide by simplifying day-to-day transactions for business and personal.

Key Features

- Offers real-time exchange rates for 160 countries

- Allows batch payments for up to 1,000 billings at once

- Provides a borderless debit card with multi-currency support and a low conversion fee

- Users can hold and manage funds in multiple currencies within a single account

- Gives Multi-user access with permission control

Wise Pros and Cons

Pros

- low transaction fees

- Faster payouts

- User-friendly interface

Cons

- Initial setup can be hard

- Customer support can be unresponsive

- Accounts get frozen or closed without prior notice

Wise Pricing

Wise’s pricing is based on a cost-plus model, where fees depend on the currency exchange rate and transfers.

Customer Reviews

“I do use Wise literally daily from almost three years. I have to travel a lot, and I find their rates to be the best with no questions.” – Gustavo B.

Customer Rating

4. PPRO

PPRO, as a cross-border payment processor, facilitates localized payment methods to increase customer satisfaction and revenue growth.

Key Features

- Supports 85+ countries for cross-border payments

- Localized payment solutions to increase customer satisfaction

- Easy integration with e-commerce and accounting platforms

- Strong security features such as Fraud Alerts API to detect fraudulent activities

- Manages multiple payment methods under one contract

- Merchant of Record services

- Offers an embeddable checkout solution

PPRO Pros and Cons

Pros

- 24/7 customer support

- Multi-currency support

- Offers reporting and analytics tools

- Developer-friendly API

Cons

- Occasional delays for certain transactions

- Complex user interface

- High fees for some transaction types

- Integration issues with third-party apps

Customer Reviews

“I love this payment platform, it is very easy to use, very simple and above all very safe…” – Franklin M.

Customer Rating

5. Payoneer

Payoneer is a cross-border payment solution that allows you to do business in multiple currencies all at once.

Key Features

- Supports 22 languages and over 70 currencies.

- Automates tax handling and calculations

- Allows multi-currency accounts to send, accept, and manage funds

- Offers a prepaid debit card for online and in-store purchasing

- Checkout integration with third-party apps like Shopify

Payoneer Pros and Cons

Pros

- Easy interface for quick onboarding

- Multi-currency and Multi-language support

- Quick customer service

Cons

- Delayed fund access

- Complex fee structure

- Limited availability in certain regions

Payoneer Pricing

Payoneer pricing depends on the type of transaction.

Customer Reviews

“Very secure platform that allows you to receive payments from anywhere.” – Luciana S.

Customer Rating

6. Opayo

Opayo by Elavon allows you to send, manage, and receive money from cross-border wires from a single platform, simplifying billing and invoicing, with maximum revenue return.

Key Features

- Available in 100+ countries

- Handles $558 billion in commerce transactions annually

- Integrates with multiple platforms, semi-integrated and turn-key hosted solutions

- Secure transactions with encryption and tokenization

- Supports major credit and debit cards

- Customizable checkout pages for branding layouts

Opayo Pros and Cons

Pros

- Advanced security for fraud prevention

- Easy to set up

- Wide range of payment solutions

- Customizable checkout options

- Responsive customer service

Cons

- Inability to access payment history beyond a pre-set time frame.

- Lack of pricing transparency

- Fewer analytical tools for individual clients

- Occasional payment failures

Opayo Pricing

Contact the sales team for pricing.

Customer Reviews

“We implemented the checkout in Opayo method, which was really simple to set up, they’ve got a nice design editor, minimal options, but still enough to make it feel apart of your brand.” – Lee F.

Customer Rating

7. Braintree

Braintree, now acquired by PayPal, is a global payment processor that allows businesses to receive and accept payments, helping you increase customers and manage cash flow risks.

Key Features

- Supports 200+ markets and 50+ currencies worldwide

- Single-touch payment feature for faster transactions

- Mobile SDK to integrate with apps

- Integrates with Credit/Debit cards, Digital wallets, PayPal, Venmo, etc.

- Integrates Paypal and other payment vendors into a single ecosystem

Braintree Pros and Cons

Pros

- Easy developer-friendly API integration

- Intuitive UI/UX interface

- Wide range of payment methods

- Advanced security features

- Searchable user and transaction data

Cons

- Customers find customer service unresponsive sometimes

- Expensive chargebacks

Braintree Pricing

Braintree charges a standard transaction fee of 2.59% + $0.49 per transaction.

Customer Reviews

“I have had a great experience overall. They fill the gap between the business owner and paypal, plus they offer integration with SO MANY other payment options. Being able to accept digital wallets is a very future focused offerring.” – Joseph V.

Customer Rating

8. Airwallex

Airwallex simplifies global payments and financial operations by offering powerful solutions to support international growth.

Key Features

- Operates in 180+ countries with 20+ currencies support

- Manage payment and finances from a single account

- Offers multi-currency Visa-supported borderless card

- Has 60+ licenses and permits to operate globally

- Provides low-code checkout solution with hosted pages

Airwallex Pros and Cons

Pros

- Straightforward interface

- Automatic currency conversions

- Multi-currency transfers via digital wallet

- Easy drop-in editor for checkout customizations

- Good customer service

Cons

- Initial setup can be lengthy

- Very basic options for complex financial tasks

- Lack of role-based permissions control

Airwallex Pricing

Airwallex charges a monthly fee starting from $29/month to as high as $499, depending on your transaction volume. But, if you deposit $5,000 or more per month or maintain a minimum balance of $10,000, the monthly fee is waived.

Customer Reviews

“Excellent way to manage multiple currency transactions and transfer and make payments across globe with less fee and with great security to wired money.” – Stacey A.

Customer Rating

9. Checkout.com

Checkout.com is a cloud-based cross-border payment processing platform. With a presence in more than 50 countries, it helps manage payments in over 150 currencies, serving popular clients such as IKEA, Sony, and Shein.

Key Features

- Offers a suite of payment options from a single API

- Uses machine learning algorithms for fraud prevention

- Allows hosted payment pages for customization

- Built-in AI-powered optimizations to boost conversions

- Offers customer’s preferred payment method

- Does video-based identity verification

- Provides insights via analytics tools

Checkout.com Pros and Cons

Pros

- User-friendly interface

- Multi-language and multi-currency support

- Easy integration with a copy-and-paste of code

Cons

- Poor customer service

- Occasional issues with managing funds

- Lack of advanced financial analytics features

- Complex fee structure

Checkout.com Pricing

Checkout.com charges a fully flat rate based on your business size and risk category. Contact the sales team for pricing.

Customer Reviews

“Checkout.com, despite some minor limitations, has been a solid platform for us to receive payments in multiple forms, from multiple countries and in multiple currencies.” – Khai F.

Customer Rating

10. Currencycloud

Currencycloud, acquired by Visa, helps you collect and manage funds globally, streamlining multi-currency payment infrastructure for you and your customers. You can adjust pricing, direct funds, track transactions, transfer money, and access detailed reports—all with just a few clicks.

Key Features

- Operates in over 180 countries with 33 currencies support

- Provides end-to-end control from transfers to pricing margins

- Offers access to real-time FX rates

- Self-service solutions for customer-preferred payment option

- Provides pre-built or custom analytics reports

- Gives complete control of pricing management

CurrencyCloud Pros and Cons

Pros

- User-friendly interface

- Visa-supported platform

- Developer-friendly API

- Allows bulk payments

- Follows global regulatory standards

Cons

- Transaction fees can be expensive

- Complex onboarding process

Currencycloud Pricing

Contact the sales team.

Customer Reviews

“Used Currencycloud for a number of years. Their systems are superior to competitors. The payment cycle is extremely efficient – you are notified instantly when you confirm a trade, funds are received and a payment is made.” – Ed.

11. Stripe

Stripe provides a global financial infrastructure for businesses to accept and receive payments offline and online. The platform facilitates users with essential products to grow revenue.

Key Features

- 100+ payment methods with online and offline support

- Invoicing and revenue recognition products

- Banking-as-service to support fintech models

- Machine learning algorithms for fraud prevention

- Developer toolkit to customize payment processes

- Analytics tools to track customer churn rates and revenue resources

- Third-party integration such as WooCommerce, Magento, and Shopify

Stripe Pros and Cons

Pros

- Faster payouts

- Easy interface

- Beginner-friendly setup

- 24/7 chat and live customer support

Cons

- Occasional account disputes or holds

- High fees for high-volume transactions

- Cannot handle global tax compliance

Stripe Pricing

Stripe implements a pay-as-you-go pricing model for online and offline transactions. The standard pricing is 2.9% + 30¢ per transaction on local cards. For country-specific or volume-based rates, contact the sales team.

Customer Reviews

“Stripe was super easy to integrate, easy for clients to pay, and never have issues.” – Maria D.

Customer Rating

12. GoCardless

GoCardless, based in the UK, collects instant payments by providing a wide range of financial products, from instant billing to recurring payments.

Key Features

- Operates in 30+ countries for local bank debit payments

- Easy setup for recurring direct debits

- Provides a real-time exchange rate calculator

- Third-party integration with accounting software

- Implements features such as Verified Mandates and Protect+ for fraud prevention

GoCardless Pros and Cons

Pros

- Easy-to-use interface

- Transparent pricing

- Flexible payment option

Cons

- Unresponsive customer service

- Complex onboarding process

- Occasional account disputes or disruptions

- Limited customization options

GoCardless Pricing

GoCardless has three types of pricing plans: Standard, Advanced, and Pro, depending on transaction volume and features. The platform also charges an additional commission for international transactions.

Customer Reviews

“Seamless. After some admin to set it up to suit my business, it ran on it’s own. I never needed to think of it again.” – Carolyne M.

Customer Rating

13. Worldpay

Worldpay helps businesses accept and manage payments across 180 markets worldwide from a single platform. Whether you’re a small business or a 500 Fortune company, Worldpay simplifies billing solutions with industry-specific solutions.

Key Features

- Operates in 68 countries with multi-currency support

- Toolkit for international and domestic payment methods

- Dynamic routing capabilities

- Provides checkout-hosted pages

- Offers credential management services

Worldpay Pros and Cons

Pros

- Instant payouts

- User-friendly interface

- Advanced reporting tools

Cons

- Poor customer support

- Unclear pricing structure

- Requires long-term contracts with expensive termination fees

Worldpay Pricing

Contact the sales team for a custom pricing plan.

Customer Reviews

“Accessibility from any computer or mobile device, can recharge an account from a previous transaction, and refund an account quickly and easily.” – Vincent P.

Customer Rating

14. Jeeves

Jeeves streamlines cross-border wires by providing a comprehensive financial infrastructure to receive, send, and manage international billing processes.

Key Features

- Operates in 25+ countries

- Provides financial and inventory management solutions

- Automates billing and invoicing

- Advanced reporting capabilities

- Data security features for fraud prevention and security

- Employee expense management tools

- Reporting analytics to support revenue growth

Jeeves Pros and Cons

Pros

- Beginner-friendly interface

- Real-time FX rates

- Free card issuance for global transactions

- Developer tools for customization

Cons

- The initial setup is complex

- Too many features complicate usage

Jeeves Pricing

Contact the sales team for pricing.

Customer Reviews

“The cost savings on Jeeves are pretty good. FX rates are significantly better than traditional banks.” – Gaetano R.

Customer Rating

15. TransferMate

TransferMate features a global payment infrastructure with financial-related products for businesses to improve customer buying experience.

Key Features

- Operates in over 200 countries with 92 regulatory licenses

- Advanced data security features for protection and fraud prevention

- White-labeled solution for automated online payments

- Offers multiple accounts for multi-currencies

- Provides powerful API integrations with financial institutions

- Real-time data analytics tools

TransferMate Pros and Cons

Pros

- Easy onboarding and setup process

- Low transfer fee for high-volume transactions

- Better FX rates than banks

Cons

- Limited customization options

- Slow customer service

- Expensive for small businesses or low-volume transactions

TransferMate Pricing

Contact the sales team for pricing.

Customer Reviews

“Embedding TransferMate’s global payment capabilities within Coupa Pay means customers are now spending smarter and paying smarter…” – John P.

16. Banking Circle

Banking Circle is a next-gen global payment provider that solves traditional banking problems by facilitating cross-border transactions for financial institutions and businesses.

Key Features

- Access 24 currencies and settle payments locally

- Instant payments within the network

- Cashflow and liquidity management solutions

- Follows European compliance standards

- Flexible payment integration options

Banking Circle Pros and Cons

Pros

- Streamlines payments and billing

- Cost-effective transaction fees

- Faster transactions and payouts

Cons

- Primarily serves financial institutions

- Might not be suitable for business

- Fewer customization options for individual customers

Banking Circle Pricing

For a custom pricing structure, contact the sales team.

Customer Reviews

“Banking Circle have been a long standing partner for CAB with their unique solutions and flexible approach to correspondent banking and payments…” Lain S.

17. Adyen

Adyen provides end-to-end payment solutions across borders by streamlining billing and administrative tasks for businesses of all sizes.

Key Features

- Manage payments across online, in-app, and in-store channels

- Uses machine learning algorithms for fraud prevention

- Operates as both a payment gateway and acquirer

- Improve authorization rates for smooth global transactions

- Recurring payment options for subscriptions

Adyen Pros and Cons

Pros

- Omnichannel support

- Easy-to-use interface

- Developer-friendly API

- Cost-effective

Cons

- Occasional transaction errors

- Account management issues

- The implementation process can get lengthy

Adyen Pricing

Adyen charges a fixed transaction fee of €0.11 + fee based on the chosen payment method.

Customer Reviews

“Adyen support and knowledge base is very helpful. Replacing terminal or setting up new terminal is very easy.” –Meenakshi M.

Customer Rating

18. Nium

Nium moves money worldwide by providing real-time payment solutions for businesses to streamline their billing, invoicing, and other financial processes effectively.

Key Features

- Operates in 220+ markets for international customers

- Provides real-time foreign currency rates

- Mitigates fraud risks with advanced technology

- Includes creator economy solutions

- Single-view dashboard to manage multi-currency accounts

- Powerful API for faster integrations

Nium Pros and Cons

Pros

- Localizes payment processes for global customers

- Simple interface

- Instant global payouts and payins

Cons

- FX rates can be higher than other payment providers

- Limited customization options

Nium Pricing

Nium charges a markup fee based on your transaction type and business. You can contact the sales team for a custom pricing quote.

Customer Reviews

“This application I used to transfer outward remittances from India to Germany and their methodology of transfer was good and quite fast in comparison to international transfers via banks” – Sanjana V.

Customer Rating

19. Corpay

Corpay, previously known as NovicePay, manages payments worldwide with customized solutions and a wide range of pricing options for digital businesses.

Key Features

- Provides risk management tools to protect cash flows

- Automated reconciliation and reporting solutions

- Supports integration with ERP and accounting systems

- Help reduce currency risk with real-time FX rates and strategies

Corpay Pros and Cons

Pros

- Quick setup and onboarding process

- Easy interface

- Highly-responsive customer support

- Reduces risks on currency exchange rates

Cons

- The integration process can be complex

- Occasional payment delays

Corpay Pricing

Contact the Corpay team for a custom quote.

Customer Reviews

“Overall, I am very satisfied with the payment method. It saves our time & helps us to get payment from any platform efficiently.” – MD Abu K.

Customer Rating

20. Authorize.net

Authorize.net by Visa streamlines online payments, equipping global businesses with a suite of financial tools to collect and manage their e-billing processes.

Key Features

- Accepts a variety of payment options

- Provides Developer toolkits like API, SDKs, etc.

- Checkout solutions

- Third-party integrations with e-commerce platforms

- Central dashboard to manage customer data

- Virtual Point of Sale feature

- Advanced fraud detection tools

- Digital invoicing solutions for global customers

Authorize.net Pros and Cons

Pros

- Easy to navigate

- Good customer service

- Faster payouts

- Easy to integrate

Cons

- Requires a merchant account for merchants

- Outdated UI design

- Limited customization for e-invoicing

Authorize.net Pricing

Authorize.net has different pricing plans based on required services. The All-in-One plan charges 2.9% + 30¢ per transaction with $25 for a monthly gateway.

Customer Reviews

“It is very easy to implement and has a perfect reporting interface.” – Francesca G.

Customer Rating

Quick Comparison Table

| # | Platform | Pros | Cons | Key Features | Pricing |

| 1 | Fungies | 250+ gateways, customizable checkouts, tax compliance | Learning curve for advanced features | Multi-currency support, automated payouts, fraud prevention, customizable checkouts | 5% + $0.50 per sale |

| 2 | PayPal | Global reach, secure transactions, user-friendly | Complex fees, lengthy dispute resolution | Supports 200+ countries, recurring billing, checkout integration | 3.49% + $0.49 per transaction |

| 3 | Wise | Low fees, real-time exchange rates, batch payments | Setup challenges, occasional account freezes | Multi-currency accounts, borderless debit card, permission control | Based on transfer amount |

| 4 | PPRO | Localized payments, strong security, reporting tools | High fees for some transactions, complex UI | Fraud alerts, merchant services, checkout solutions | Custom |

| 5 | Payoneer | Multi-language/currency support, easy onboarding | Delayed fund access, region restrictions | Prepaid debit card, multi-currency accounts, tax automation | Based on transaction type |

| 6 | Opayo | Secure transactions, customizable checkout, global presence | Limited analytics, occasional payment failures | Tokenized transactions, major card support, branding layout customization | Custom |

| 7 | Braintree | Developer-friendly, wide payment options, robust security | Expensive chargebacks, limited customer service | Mobile SDKs, digital wallets, PayPal/Venmo integration | 2.59% + $0.49 per transaction |

| 8 | Airwallex | Low fees, multi-currency transfers, intuitive dashboard | Basic features for complex needs, role-permission limitations | Borderless cards, compliance with PCI DSS/SOC2, hosted checkout | $29-$499/month; free if thresholds met |

| 9 | Checkout.com | Advanced fraud detection, multi-language/currency support | Customer support issues, complex fees | AI-powered optimizations, video-based ID verification, analytics tools | Custom |

| 10 | Currencycloud | Real-time FX rates, bulk payments, Visa-supported | Expensive fees, onboarding challenges | End-to-end pricing control, custom analytics, API integrations | Custom |

| 11 | Stripe | Easy integration, global acceptance, developer tools | Account holds, limited tax compliance | Custom APIs, subscription management, third-party e-commerce integrations | 2.9% + $0.30 per transaction |

| 12 | GoCardless | Transparent fees, easy setup, real-time exchange calculator | Customer service issues, limited customization | Local bank payments, direct debit automation, Protect+ fraud tools | Standard/Advanced/Pro tiers |

| 13 | Worldpay | Fast payouts, robust reporting, dynamic routing | Long-term contracts, termination fees | Multi-currency toolkit, hosted checkout, payment credential management | Custom |

| 14 | Jeeves | Real-time FX rates, employee expense management | Complex interface, too many features | Billing/invoicing automation, global transactions, advanced security | Custom |

| 15 | TransferMate | Low transfer fees, real-time analytics, global compliance | Limited customization, slow customer service | White-labeled payment solutions, API integrations, multi-currency accounts | Custom |

| 16 | Banking Circle | Cost-effective fees, fast payouts, European standards | Limited to institutions, fewer customer tools | Local settlement in 24 currencies, instant network payments, cashflow management | Custom |

| 17 | Adyen | Omnichannel support, advanced fraud prevention | Lengthy implementation, occasional transaction errors | Acquirer/payment gateway, machine learning fraud tools, subscription support | €0.11 + variable per payment method |

| 18 | Nium | Localized payments, instant payouts, single dashboard | High FX fees, limited customization | Global reach in 220+ markets, advanced fraud tech, API integrations | Based on transaction type |

| 19 | Corpay | Quick setup, responsive support, risk management tools | Integration complexity, occasional delays | Automated reconciliation, real-time FX rates, ERP/accounting system integrations | Custom |

| 20 | Authorize.net | Developer tools, variety of payment options, fraud detection | Requires merchant account, limited customization | E-invoicing solutions, virtual POS, third-party e-commerce integrations | 2.9% + $0.30 per transaction |

How to Choose the Right Cross-Border Payment Provider

As you can see, there are many options in the market, but each payment provider caters to certain business needs.

B2B cross-border payments refer to transactions between businesses in different countries. These payments often involve processing in multiple currencies, ensuring compliance with international tax laws, and using secure payment gateways to minimize FX risks.

When choosing the best cross-border payment provider for your business, you need to consider the following features:

- Multiple Payment Options and Localized Support: Choose a provider with multiple payment gateways and local currency support to ensure seamless global transactions and cater to diverse customer needs.

- Tax Compliance and Fraud Prevention: Opt for platforms that handle global tax compliance and use advanced fraud detection to secure transactions and reduce disputes.

- Customization and Branding: Look for customizable checkout options that align with your branding and provide flexible integration methods for a seamless customer experience.

- Subscription Management and Pricing Tiers: Select a provider with tools for flexible billing cycles and tiered pricing to upsell customers and increase retention rates.

- Automated Billing and Real-Time Analytics: Pick a platform with automated billing processes and detailed analytics dashboards to streamline operations and track performance effectively.

Bonus Tip: Look for online reviews on each provider to help you decide whether they’re suitable for your business or not.