Creating amazing games is a dream for many small developers, but it’s not all fun and code. They also face challenges like dealing with payments, following tax regulations, and whatnot.

Wouldn’t it be amazing to focus on creating epic adventures while someone else handles the financial stuff? Enter the concept of what is a Merchant of Record (MoR) – a superhero for small businesses that sell online!

This article will explain an MoR and how it can supercharge your indie game development business! So let’s get into business!

What is a Merchant of Record?

A Merchant of Record (MoR) is a superhero that handles the financial nitty-gritty for businesses. Instead of you, the developer, dealing with all the financial stuff, the MoR takes care of it.

Here’s what an MoR typically does:

- Processes payments: The MoR collects money from your customers using credit cards or other payment methods.

- Keeps things compliant: There are rules about handling financial transactions. MoR makes sure everything is done according to the regulations.

- Deals with taxes: The MoR handles things like sales tax and other fees, saving you a headache.

- Stops fraudsters: Unfortunately, some people try to steal online. The MoR has ways to fight fraud and protect your business.

- Handles customer support: If a customer has a question about their payment, the MoR deals with it, freeing you up to focus on your product.

In short, an MoR takes the weight of financial stuff off your shoulders, so you can concentrate on what you do best: creating awesome software!

How Does the Merchant of Record Model Work?

Imagine a customer clicks “buy” on your awesome new software. Here’s what happens behind the scenes when you use a Merchant of Record (MoR):

- MoR Steps In: MoR acts like a middleman. It takes the customer’s payment (usually via credit card or another method).

- Funds Secured: The MoR securely holds onto the money until everything checks out.

- Tax Time: The MoR figures out the sales tax or other fees based on your location and the customers. They collect this tax and hold onto it for now.

- Compliance Check: It makes sure everything follows the rules for online transactions. It’s like having a financial superhero keeping an eye on things!

- Your Share: Once everything is settled, the MoR sends you your earnings minus any MoR fees and the taxes they collected.

- Chargeback Defense: If a customer claims they didn’t authorize the purchase (called a chargeback), the MoR deals with it, not you. This saves you time and hassle.

MoR basically handles the entire financial process, from collecting money to dealing with taxes. This lets you focus on what you do best – building amazing software!

How Does MoR Differ from Payment Processor?

If you’ve understood what is a Merchant of Records (MoRs)? Great! Now, let’s compare them to another key player: the payment processor.

A payment processor is kind of like a middleman too, but for a different part of the transaction. They handle the technical stuff of moving money between your customer’s bank and your account. Imagine them as the secure tunnel that gets the money from point A to point B.

So, how do MoRs and payment processors differ? Here’s the breakdown:

- MoR: Takes on the whole financial shebang! They handle payments, taxes, compliance, and even customer support related to payments. Basically, they’re your financial superhero.

- Payment Processor: Focuses on the technical side. They securely move the money from your customer to you, but don’t deal with taxes, regulations, or customer issues.

Here’s an analogy: An MoR is like a full-service restaurant that takes your order, cooks the food, cleans up, and even entertains you with a magic trick. A payment processor is just the chef who cooks the meal (moves the money).

In short, MoRs take on a wider range of responsibilities, while payment processors focus on the technical side of transactions.

Benefits of Using a Merchant of Record for Small Developers

So, you’re a small developer with a killer SaaS product, but all this payment stuff is slowing you down? Here’s where a Merchant of Record (MoR) can be a game-changer. MoRs offer a bunch of benefits that let you focus on what you do best: coding!

- Efficiency Boost: Remember all that juggling we talked about earlier (payments, taxes, compliance)? An MoR takes care of it all, freeing up your time and energy. You can spend less time wrestling with financial stuff and more time building awesome features for your software.

- Focus on Development: With an MoR handling the financial side of things, you can dedicate yourself to developing your software! No more getting bogged down in regulations or tax headaches.

- Reduced Risk: MoRs are experts in dealing with financial regulations and fraud prevention. They can help keep your business safe and secure, so you can focus on creating a great product.

- Faster Growth: By streamlining your financial processes, an MoR can help you scale your business faster. You won’t be held back by the complexities of handling payments and compliance on your own.

In short, a Merchant of Record is like having a financial assistant for your small business. They take care of the nitty-gritty stuff, so you can focus on what truly matters: developing amazing software!

Simplified Payment Processing

Imagine your customers want to pay for your software in different ways – credit card, PayPal, maybe even a local mobile wallet. An MoR can handle all these multiple payment methods, making checkout a breeze for your customers. Plus, if you ever want to expand globally and accept different currencies, the MoR takes care of the exchange rates and keeps things smooth.

Compliance and Tax Management

Selling software across borders can get complicated fast. Different countries have different rules about taxes, like VAT or GST. Keeping track of all that can be a nightmare for a small developer. But fear not! MoRs are experts in navigating these global tax complexities. They’ll figure out what taxes you owe and handle the compliance side of things, so you don’t have to worry about getting in trouble with the taxman.

Fraud Prevention and Chargeback Management

Unfortunately, some people try to steal online. MoRs have advanced security measures to prevent fraud and protect your business from financial losses. They’ll also deal with chargebacks when a customer disputes a payment. This saves you the hassle of fighting these issues yourself.

Customer Support and Dispute Resolution

Sometimes, customers might have questions about their payments. An MoR can handle all customer support related to transactions. This frees you up to focus on what you do best – building your software!

In short, an MoR takes a big chunk of work off your plate, allowing you to focus on what truly matters: developing amazing software for your customers!

Popular Merchant of Record Providers

So, you’re convinced an MoR can be a game-changer for your small developer business? Here are some well-known merchant of record providers to consider:

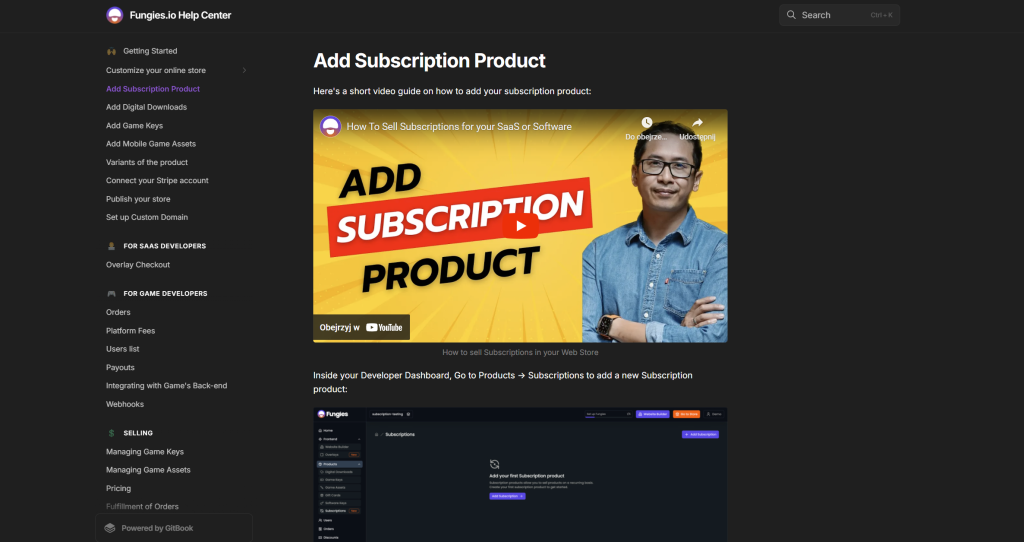

- Fungies: They are merchant of record providers and they cater specifically to businesses selling software online (SaaS). They offer features like subscription management, metered billing, and built-in analytics.

- Paddle: This MoR is known for its ease of use and global reach. They offer support for multiple payment methods and currencies. This makes a good option for businesses selling internationally.

- FastSpring: FastSpring specializes in helping businesses sell digital products and subscriptions. They offer features like automated recurring billing and fraud prevention.

- Digital River: They provide many services, including tax management and international customer support.

Important Note:

When choosing an MoR, it’s important to compare features, pricing plans, and customer support options.

How to Choose the Right Merchant of Record for Your Business

Finding the perfect MoR is like finding the right teammate for your coding dream team! Here’s why choosing the right MoR matters:

- Features: Different MoRs offer different features. Think about your specific needs. Do you need global support? Subscription management? Make sure the MoR you choose has the features that are important to you.

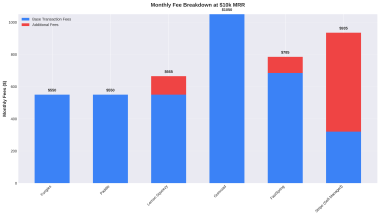

- Pricing: MoR pricing can vary. Some charge a flat fee, while others take a percentage of your sales. Compare plans and find one that fits your budget.

- Customer Support: What happens if you run into an issue? Make sure the MoR offers reliable customer support that can answer your questions and help you troubleshoot any problems.

- Business Focus: Some MoRs cater to specific industries, like Fungies, which focuses on SaaS businesses. Consider if there’s an MoR that specializes in your area, as they might have features and expertise that align well with your needs.

Considering these factors, you can choose an MoR that becomes a valuable asset to your small developer business. Now you can focus on building fantastic software, while your MoR handles all the financial nitty-gritty!

Finding the perfect MoR takes a little detective work, but it’s worth it! Here are some key factors to consider:

Key Factors to Consider

- Reliability: This is a no-brainer! Your MoR should be a stable and trustworthy partner. Look for providers with a proven track record and positive customer reviews.

- Range of Services: Not all MoRs offer the same features. Do you need global support for multiple currencies? Subscription management for recurring payments? Make sure the MoR you choose has the features that are crucial for your business.

- Pricing: MoR pricing can vary. Some charge a flat monthly fee, while others take a percentage of your sales. Compare plans and find one that’s budget-friendly for your small development business.

- Integration Capabilities: A smooth integration is essential in your existing software. Look for MoRs that offer easy-to-use APIs or plugins that make connecting your systems a breeze.

- Customer Support: What happens if you hit a snag? Reliable customer support is key. Choose an MoR that offers helpful and responsive support options, in case you have questions or need troubleshooting.

Steps to Integrate MoR into Your Development Business

Integrating an MoR doesn’t have to be a coding headache! Here’s a basic roadmap to get you started:

- Choose Your MoR: This article has equipped you with some great options! Consider the factors mentioned above and pick the MoR that best suits your needs.

- Sign Up and Get Onboarded: Most MoRs have a straightforward signup process. Their team will guide you through onboarding and get you set up with their system.

- Integration: Here’s where things can get technical, but don’t worry! Many MoRs, like Fungies, offer user-friendly integration capabilities. They might have pre-built plugins or APIs that connect seamlessly with popular development tools. This can make integrating the MoR into your workflow smooth and efficient.

- Testing and Launch: Once integrated, take some time to test everything thoroughly. Make sure payments are processed correctly and your software interacts smoothly with the MoR’s system. Once you’re confident, it’s time to launch your awesome software with a streamlined payment system!

By following these steps and considering the key factors, you can choose and integrate an MoR. Now you can focus on what you do best – coding amazing software – while your MoR takes care of the financial side of things!

Final Thoughts

There you have it! Now you’ve got a solid understanding of what a Merchant of Record (MoR) is and how it can supercharge your small development business. You can free up your time and energy by letting an MoR handle the financial nitty-gritty.

If you’re looking for a top-notch MoR that understands the unique needs of software developers, look no further than Fungies.io. Specializing in businesses selling software online, Fungies.io offers features like subscription management, metered billing, and built-in analytics. With their expertise and comprehensive services, you can focus on developing your next great game or software while they handle the rest. Check out Fungies.io and see how they can help elevate your business!