Are you a SaaS founder juggling payment processors, tax compliance, and international regulations while trying to scale your business? If you’re nodding in agreement, you’re not alone. Many SaaS entrepreneurs find themselves drowning in payment complexities that distract from their core mission: building exceptional software.

Enter the Merchant of Record provider – a solution that could transform how you handle payments and compliance. But here’s the critical insight many founders miss: integrating a Merchant of Record early in your SaaS journey isn’t just convenient; it’s a strategic advantage that can significantly impact your growth trajectory.

The decision to implement a Merchant of Record solution is often postponed until payment challenges become overwhelming. By then, the cost of integration – both in terms of resources and opportunity – has multiplied. This article explores why early adoption of a Merchant of Record provider is not merely a technical decision but a strategic one that can position your SaaS business for sustainable success.

Throughout this comprehensive guide, we’ll examine what a Merchant of Record is, why timing matters in implementation, and how to seamlessly integrate a solution like Fungies.io into your SaaS business. We’ll also provide a step-by-step integration guide that transforms this potentially complex process into manageable steps.

Whether you’re launching a new SaaS product or looking to optimize your existing payment infrastructure, understanding how to integrate a Merchant of Record in SaaS effectively could be the difference between struggling with payment complexities and focusing on what truly matters – delivering value to your customers and growing your business.

Let’s dive into why the Merchant of Record model deserves your attention sooner rather than later, and how making this strategic decision early can set your SaaS business on a path to simplified operations and accelerated growth.

In the complex landscape of digital commerce, the term “Merchant of Record” (MoR) has emerged as a critical concept for SaaS businesses looking to streamline their payment operations. But what exactly is a Merchant of Record provider, and why should SaaS companies care about this model?

What is a Merchant of Record?

A Merchant of Record is a legal entity that takes full responsibility for processing customer payments and assumes liability for the entire transaction process. When you partner with a Merchant of Record provider, they become the official seller of record for your products or services in the eyes of both customers and regulatory authorities.

This means the MoR handles not just the processing of payments but also takes on crucial responsibilities including:

- Managing tax calculation and remittance across different jurisdictions

- Ensuring compliance with local and international regulations

- Processing refunds and handling chargebacks

- Securing customer payment data

- Managing fraud prevention

- Handling subscription billing and renewals

Think of a Merchant of Record as a trusted intermediary that stands between your SaaS business and the complex world of payment processing, taxation, and compliance.

How the Merchant of Record Model Works

To understand the MoR model in practice, let’s walk through a typical customer transaction:

- Customer Checkout: A customer visits your SaaS platform and decides to purchase your subscription service. They enter their payment details on your website.

- Behind the Scenes: Instead of your company directly processing the payment, the transaction is handled by your Merchant of Record partner.

- MoR Takes Charge: The MoR processes the payment, validates the transaction, and ensures all security protocols are followed.

- Tax Calculation and Compliance: The MoR automatically calculates applicable taxes based on the customer’s location and handles all compliance requirements.

- Revenue Transfer: After deducting their fees, the MoR transfers the revenue to your business.

- Ongoing Management: For subscription services, the MoR continues to manage recurring billing, potential upgrades/downgrades, and eventual cancellations.

Throughout this process, the customer experience remains seamless, with your branding front and center, while the MoR works invisibly in the background to ensure everything runs smoothly.

MoR vs. Payment Processors vs. Payment Gateways

It’s important to distinguish between a Merchant of Record and other payment solutions:

| Feature | Merchant of Record | Payment Processor | Payment Gateway |

| Processes payments | ✓ | ✓ | ✓ |

| Legal seller of record | ✓ | ✗ | ✗ |

| Handles tax compliance | ✓ | ✗ | ✗ |

| Manages chargebacks | ✓ | Partial | ✗ |

| Handles subscription billing | ✓ | Partial | ✗ |

| Takes on regulatory compliance | ✓ | ✗ | ✗ |

| Assumes fraud liability | ✓ | ✗ | ✗ |

While payment processors and gateways focus primarily on the technical aspects of moving money from point A to point B, a Merchant of Record provider takes on a much broader set of responsibilities that extend far beyond simple payment processing.

Common Misconceptions About Merchant of Record Services

Despite their value, several misconceptions persist about MoR services:

Misconception 1: “MoRs are just expensive payment processors.”Reality: While MoRs do process payments, they provide significantly more value through tax management, compliance handling, and legal liability assumption.

Misconception 2: “We can just add an MoR later when we need it.”Reality: Late integration often requires costly re-architecture of your payment infrastructure and can disrupt customer experiences.

Misconception 3: “Using an MoR means losing control of the customer relationship.”Reality: Modern MoR solutions like Fungies.io offer white-labeled checkout experiences that maintain your brand identity while handling the complex backend processes.

Misconception 4: “Our payment processor already handles everything we need.”Reality: Payment processors typically don’t handle tax compliance, legal liability, or the full scope of subscription management that MoRs provide.

Understanding these distinctions is crucial for SaaS businesses making decisions about their payment infrastructure. A Merchant of Record is not merely a payment solution but a comprehensive business partner that can significantly reduce operational complexity and legal exposure while enabling global growth.

In the fast-paced world of SaaS development, timing is everything. While many founders understand the value of a Merchant of Record provider in theory, they often postpone integration until payment challenges become overwhelming. This section explores why early integration of a Merchant of Record solution is not just beneficial but critical for long-term SaaS success.

Avoiding Technical Debt and Costly Re-Architecture

One of the most compelling reasons to integrate a Merchant of Record provider early is to avoid accumulating technical debt in your payment infrastructure. When SaaS companies build their initial payment systems without considering a future MoR integration, they often create architectures that become increasingly difficult and expensive to modify later.

Consider this scenario: You launch your SaaS product using a basic payment processor. As you grow, you add custom code for tax calculations, subscription management, and regional payment methods. Two years later, when international compliance issues force you to adopt an MoR solution, you face a daunting challenge – your entire payment infrastructure needs to be rebuilt to accommodate the new system.

Early integration eliminates this problem by establishing a scalable payment foundation from the start. Rather than building temporary solutions that will eventually be discarded, you implement a system designed for long-term growth.

Streamlining Global Expansion from Day One

The modern SaaS market is inherently global. Even if you initially focus on a single region, international customers will likely discover your product sooner than you expect. Without a Merchant of Record provider, expanding into new markets requires:

- Researching tax regulations for each new jurisdiction

- Registering for VAT/GST in multiple countries

- Implementing region-specific payment methods

- Adapting to local consumer protection laws

- Managing currency conversion and foreign exchange risks

Each of these tasks diverts valuable resources from your core business. By integrating an MoR early, you establish the infrastructure for global sales from day one. When opportunity knocks in a new market, you can respond immediately rather than scrambling to build the necessary payment and compliance systems.

Simplifying Compliance and Reducing Legal Risks

The regulatory landscape for digital services is increasingly complex and constantly evolving. New tax regulations, data protection laws, and consumer rights directives emerge regularly across different jurisdictions.

Early MoR integration transfers much of this compliance burden to a specialized partner whose core business is staying current with global regulations. This approach:

- Reduces your exposure to non-compliance penalties

- Minimizes the risk of unexpected tax liabilities

- Protects against regulatory changes that might otherwise require emergency system updates

- Provides peace of mind that legal requirements are being met across all markets

The alternative – attempting to manage compliance in-house – typically leads to either excessive caution (limiting market entry) or insufficient attention to regulatory details (creating legal exposure).

Enabling Focus on Core Product Development

Perhaps the most significant benefit of early MoR integration is the ability to maintain focus on what truly matters – developing an exceptional product and delivering value to customers.

Without an MoR, SaaS teams often find themselves dividing attention between product innovation and payment infrastructure management. Engineering resources get allocated to building and maintaining payment systems rather than enhancing core product features. Customer support teams split their efforts between product assistance and payment troubleshooting.

By implementing a Merchant of Record provider from the beginning, you effectively outsource an entire category of technical and operational challenges. This allows your team to maintain laser focus on the activities that directly contribute to product excellence and market differentiation.

Improving Customer Experience with Professional Checkout

First impressions matter, especially in SaaS where customers make quick judgments about your professionalism and trustworthiness. A polished, secure checkout experience signals reliability and builds confidence in your service.

Early MoR integration gives you access to professionally designed checkout flows that:

- Support multiple payment methods from launch

- Offer localized experiences (language, currency, payment options)

- Provide clear tax and pricing information

- Handle complex scenarios like upgrades, downgrades, and prorations

- Reduce abandonment through optimized conversion paths

Rather than iterating through multiple checkout implementations as your business grows, you start with a mature solution designed to convert and retain customers across global markets.

Setting Up Scalable Financial Operations

As SaaS businesses grow, financial operations become increasingly complex. Early MoR integration establishes scalable financial workflows that grow with your business:

| Financial Operation | Without Early MoR Integration | With Early MoR Integration |

Real-World Success Stories

The benefits of early MoR integration aren’t theoretical – they’re demonstrated by numerous SaaS success stories:

Case Study 1: StartupXThis project management SaaS integrated Fungies as their MoR before launch. Within 18 months, they had customers in 43 countries without adding any finance or tax compliance staff. Their engineering team remained focused entirely on product development, contributing to their rapid market adoption.

Case Study 2: DataFlow AnalyticsAfter struggling with payment and tax issues for their first two years, DataFlow Analytics switched to an MoR solution. While the benefits were substantial, they estimated the delayed integration cost them over $300,000 in technical refactoring and lost an entire quarter of product development velocity during the transition.

Case Study 3: CloudSecureThis security SaaS implemented an MoR from their beta phase. When GDPR and similar regulations emerged, they continued normal operations while competitors scrambled to adapt their payment systems. This regulatory advantage helped them capture significant market share during a critical growth period.

The evidence is clear: early integration of a Merchant of Record provider isn’t just a convenience—it’s a strategic advantage that can significantly impact your SaaS company’s growth trajectory and operational efficiency. By making this investment early, you position your business for smoother scaling, faster market expansion, and more focused product development.

While the benefits of integrating a Merchant of Record provider are clear, understanding the specific challenges that SaaS businesses face without one can further illuminate why early adoption is so critical. This section explores the common pain points that SaaS companies encounter when managing payments and compliance on their own.

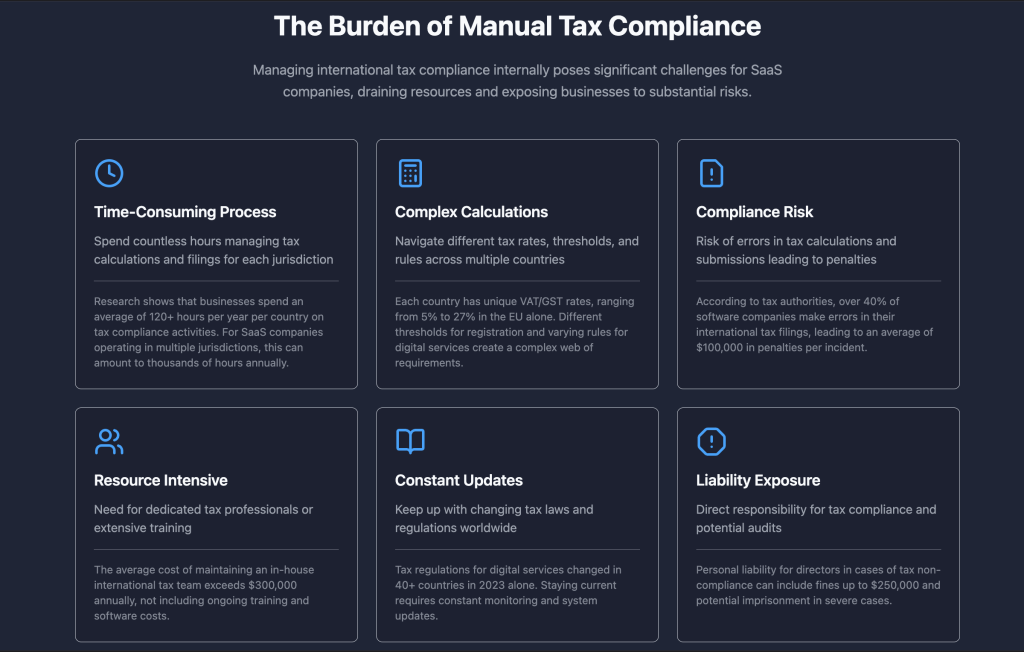

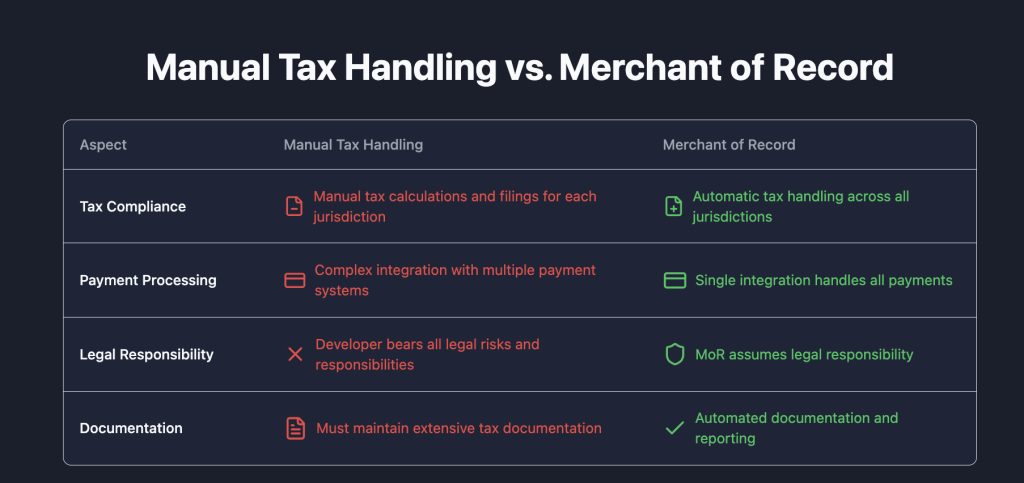

Managing Tax Compliance Across Multiple Jurisdictions

Perhaps the most daunting challenge for growing SaaS businesses is navigating the complex web of international tax regulations. Without a Merchant of Record provider, your company becomes directly responsible for:

- Determining tax nexus: Understanding where your business has sufficient presence to trigger tax obligations

- Calculating correct tax rates: Managing the ever-changing rates across countries, states, and even cities

- Filing tax returns: Submitting the appropriate documentation to each tax authority

- Remitting collected taxes: Ensuring timely payments to avoid penalties

- Maintaining compliance records: Keeping detailed documentation for potential audits

The complexity compounds exponentially with each new market you enter. For example, in the United States alone, there are over 11,000 sales tax jurisdictions, each with its own rates and rules. In the European Union, VAT rates and regulations differ across 27 member states.

Many SaaS companies attempt to manage this internally, only to discover that the resources required for proper compliance quickly outpace their expectations. A dedicated finance team member can easily spend 30-40 hours per month solely on tax compliance activities – time that could otherwise be invested in strategic financial planning.

Handling Payment Processing Complexities

Beyond tax compliance, payment processing itself presents numerous challenges:

Payment Method Proliferation

Global customers expect to pay using their preferred local methods. While credit cards dominate in North America, European customers often prefer bank transfers, Asian markets have adopted mobile payments, and Latin American countries frequently use local payment networks.

Without an MoR, SaaS companies must:

- Integrate multiple payment processors

- Manage separate settlement processes

- Reconcile transactions across different systems

- Handle currency conversion and foreign exchange risks

- Maintain compliance with each payment network’s requirements

Failed Payment Recovery

Subscription businesses live and die by their ability to recover failed payments. Credit cards expire, have insufficient funds, or get flagged for fraud – all resulting in failed transactions that can terminate otherwise healthy customer relationships.

Effective dunning management (the process of communicating with customers about payment issues) requires sophisticated systems that:

- Detect different failure reasons

- Apply appropriate retry logic

- Communicate effectively with customers

- Provide easy update mechanisms for payment methods

Building these recovery systems in-house is resource-intensive and diverts focus from core product development.

SaaS businesses that handle payments directly take on significant security responsibilities and fraud risks:

PCI Compliance

Processing credit card data requires compliance with Payment Card Industry Data Security Standards (PCI DSS). Depending on transaction volume, this can involve:

- Annual security assessments

- Quarterly network scans

- Maintaining secure systems and networks

- Implementing strong access control measures

- Regular testing and monitoring

The cost of PCI compliance can range from thousands to tens of thousands of dollars annually, not including the technical resources required to maintain compliant systems.

Fraud Management

Without a Merchant of Record provider, SaaS companies must develop their own fraud detection and prevention systems or risk significant losses. This includes:

- Implementing transaction screening tools

- Setting up IP and device fingerprinting

- Managing 3D Secure authentication

- Balancing fraud prevention against customer friction

- Handling fraud-related chargebacks

Each fraudulent transaction not only results in direct revenue loss but can also increase processing fees and damage relationships with payment providers if chargeback rates exceed acceptable thresholds.

Managing Subscription Billing and Renewals

Subscription management is deceptively complex, especially as businesses scale and offer more sophisticated pricing models:

Billing Logistics

Without an MoR, SaaS companies must build systems to handle:

- Multiple subscription tiers and pricing plans

- Free trials and promotional periods

- Upgrades, downgrades, and plan changes

- Prorations for mid-cycle changes

- Usage-based billing components

- Discounts and coupons

Renewal Challenges

Maintaining high renewal rates requires sophisticated systems for:

- Sending timely renewal notifications

- Processing automatic renewals

- Handling failed renewal payments

- Managing subscription cancellations

- Facilitating subscription pauses or holds

Each of these scenarios requires custom development and ongoing maintenance, creating a significant operational burden that grows with your customer base.

The day-to-day financial operations of a SaaS business without an MoR can quickly become overwhelming:

Revenue Recognition

SaaS revenue recognition follows specific accounting rules that require:

- Distinguishing between recognized and deferred revenue

- Amortizing subscription payments over service periods

- Handling refunds and credits appropriately

- Managing complex multi-year contracts

- Reconciling recognized revenue with cash receipts

Financial Reporting

Accurate financial reporting becomes increasingly complex as you scale:

- Consolidating data from multiple payment processors

- Converting transactions in different currencies

- Separating product revenue from tax collected

- Tracking metrics like MRR, ARR, and churn

- Preparing data for investor reporting or audits

Customer Financial Support

Without an MoR, your team becomes directly responsible for all payment-related customer inquiries:

- Explaining tax charges on invoices

- Resolving payment failures

- Processing refund requests

- Providing detailed billing history

- Issuing compliant invoices and receipts

This support burden can quickly overwhelm small teams and detract from product-focused customer success activities.

Scaling Payment Infrastructure Internationally

As SaaS businesses expand globally, payment infrastructure challenges multiply:

Currency Management

Operating across multiple currencies introduces complexity:

- Setting and updating prices in different currencies

- Managing exchange rate fluctuations

- Handling currency conversion fees

- Reconciling multi-currency transactions

- Reporting revenue in your base currency

Regional Payment Regulations

Each region has unique payment regulations that may require:

- Strong Customer Authentication (SCA) in Europe

- Specific invoice formats in Brazil

- Local data storage in Russia

- Special consumer protection measures in Australia

- Unique refund policies in Japan

Without a Merchant of Record provider, your team must research, implement, and maintain compliance with each of these regional requirements.

The Cumulative Impact

While any one of these challenges might seem manageable in isolation, their cumulative effect can be devastating to a growing SaaS business. Engineering resources get diverted from product development to payment infrastructure. Finance teams spend more time on compliance than strategic planning. Customer support becomes bogged down with billing issues rather than helping customers succeed with your product.

By integrating a Merchant of Record provider early, SaaS businesses can avoid these pitfalls and maintain focus on their core mission: building exceptional software that delivers value to customers.

With a clear understanding of the challenges SaaS businesses face without a Merchant of Record and the benefits of early integration, the next critical step is selecting the right Merchant of Record provider for your business. This section explores the essential features to look for and key factors to consider in your evaluation process.

Essential Features to Look for in a MoR Provider

When evaluating potential Merchant of Record solutions, certain core capabilities should be non-negotiable:

Comprehensive Tax Management

The provider should offer:

- Automatic tax calculation for all relevant jurisdictions

- Tax filing and remittance services

- VAT/GST registration management

- Tax compliance documentation

- Regular updates to accommodate changing tax laws

Flexible Payment Processing

Look for support for:

- Major credit and debit cards

- Regional payment methods

- Multiple currencies

- Subscription billing

- One-time purchases

- Trial periods and freemium models

Robust Subscription Management

Essential subscription capabilities include:

- Automated recurring billing

- Upgrade/downgrade handling

- Proration for mid-cycle changes

- Dunning management for failed payments

- Cancellation and refund processing

- Subscription analytics and reporting

Security and Compliance

The provider should maintain:

- PCI DSS compliance

- GDPR compliance (for European customers)

- Strong fraud prevention systems

- Secure data handling practices

- Regular security audits and certifications

Developer-Friendly Integration

Evaluate the technical implementation requirements:

- Well-documented APIs

- SDKs for major programming languages

- Webhook support for event notifications

- Sandbox environment for testing

- Responsive developer support

Comparison Factors for MoR Providers

Beyond these essential features, several factors can help differentiate between providers:

Pricing Structure

MoR providers typically charge using one of these models:

- Percentage of transaction value (typically 2-8%)

- Fixed fee per transaction plus a smaller percentage

- Monthly subscription plus transaction fees

- Volume-based tiered pricing

Consider how each model aligns with your business economics and growth projections. A percentage-based model might be simpler but can become expensive as you scale, while tiered pricing might offer better economics for high-volume businesses.

Geographic Coverage

Providers vary significantly in their global reach:

- Some focus primarily on North America and Europe

- Others offer comprehensive global coverage

- Certain providers specialize in specific regions

Evaluate whether the provider’s geographic strengths align with your target markets, both current and future.

Customization Options

Consider the level of branding and customization available:

- White-labeled checkout experiences

- Custom email templates

- Branded invoices and receipts

- Flexible checkout flows

- Customizable pricing displays

Integration Complexity

Assess the implementation effort required:

- Time to complete integration (typically 1-4 weeks)

- Technical resources needed

- Availability of pre-built components

- Migration path from existing systems

- Ongoing maintenance requirements

Support Quality

Evaluate the provider’s support infrastructure:

- Availability of technical support (hours, channels)

- Response time guarantees

- Implementation assistance

- Account management for larger customers

- Community resources and documentation

Why Fungies.io Stands Out as a MoR Provider for SaaS

Among the various Merchant of Record providers available, Fungies.io has emerged as a particularly strong option for SaaS businesses due to several distinguishing factors:

SaaS-Specific Focus

Unlike general-purpose payment processors that serve multiple industries, Fungies is specifically designed for digital products and SaaS businesses. This specialization is reflected in:

- Subscription management features tailored to SaaS models

- Checkout flows optimized for software purchases

- Integration options designed for web applications

- Analytics focused on SaaS-specific metrics

Developer-Centric Approach

Fungies prioritizes the developer experience with:

- Clean, well-documented APIs

- Comprehensive SDKs

- Detailed implementation guides

- Active developer community

- Responsive technical support

Flexible Integration Options

Fungies offers multiple integration paths to suit different needs:

- Hosted checkout for the simplest implementation

- Overlay checkout for embedding in existing websites

- API-first approach for custom implementations

- Webhooks for seamless backend integration

Competitive Pricing

Fungies offers transparent pricing that typically provides better economics for growing SaaS businesses compared to traditional payment processors or other MoR providers.

Questions to Ask Potential MoR Providers

When evaluating providers, consider asking these critical questions:

- Tax Compliance: “Which specific tax jurisdictions do you support, and how do you handle tax filing and remittance?”

- Integration Timeline: “What is the typical implementation timeline for a business of our size and complexity?”

- Subscription Features: “How do you handle subscription changes, pauses, and cancellations?”

- Global Expansion: “What would be involved in expanding to [specific market of interest] in the future?”

- Reporting Capabilities: “What financial and operational reports are available, and can they be customized?”

- Security Measures: “What specific security measures do you implement to protect customer data and prevent fraud?”

- Support Structure: “What level of support can we expect during and after implementation?”

- Contract Terms: “What are your contract terms, including any minimum commitments or early termination fees?”

- Roadmap: “What new features or capabilities are on your near-term roadmap?”

- Reference Customers: “Can you provide references from similar SaaS businesses using your platform?”

Red Flags to Watch Out For

Be cautious of providers that exhibit these warning signs:

- Vague tax compliance details: If they can’t clearly explain how they handle specific tax scenarios, they may not have robust compliance capabilities.

- Limited API documentation: Poor or incomplete documentation often indicates a challenging integration experience.

- Restrictive contracts: Long-term commitments with significant termination penalties may indicate the provider is concerned about retention.

- Unclear pricing: Hidden fees or complex pricing structures can lead to unexpected costs as you scale.

- Limited subscription capabilities: If the provider struggles to explain how they handle common subscription scenarios, they may not be truly SaaS-focused.

- Poor support during sales process: If responsiveness and support quality are lacking during the sales process, they’re unlikely to improve post-implementation.

Selecting the right Merchant of Record provider is a critical decision that will impact your business operations, customer experience, and growth potential for years to come. By thoroughly evaluating providers against these criteria and asking detailed questions, you can identify the partner best positioned to support your SaaS business’s unique needs and growth trajectory.

Now that you understand the importance of early Merchant of Record integration and have evaluated your options, this section provides a comprehensive guide to implementing Fungies.io as your Merchant of Record provider. Following these steps will help you establish a robust payment infrastructure that scales with your SaaS business.

Creating an Account with Fungies.io

Getting started with Fungies is straightforward:

- Visit the Fungies website: Navigate to [Fungies.io](https://fungies.io) and click on the “START FREE” button in the top navigation.

- Register your account: You can register using your email address and password or use Google or Discord SSO for faster signup.

- Verify your email: Check your inbox (including spam folder) for a verification email from Fungies and click the verification link.

- Create your workspace: After verification, you’ll be prompted to name your store or marketplace and select a subdomain. This will be your unique Fungies workspace.

- Complete your profile: Fill in your business details, including company name, address, and contact information. This information is crucial for proper tax documentation.

Setting Up Your Development Environment

Before proceeding with the technical integration, prepare your development environment:

- Review documentation: Familiarize yourself with the [Fungies documentation](https://docs.fungies.io) to understand the available integration options.

- Enable sandbox mode: In your Fungies dashboard, navigate to “Workspace Settings” → “Sandbox Mode” and enable it for testing. This allows you to simulate transactions without processing actual payments.

- Generate API keys: Go to the API section of your dashboard to generate both public and secret API keys for your sandbox environment.

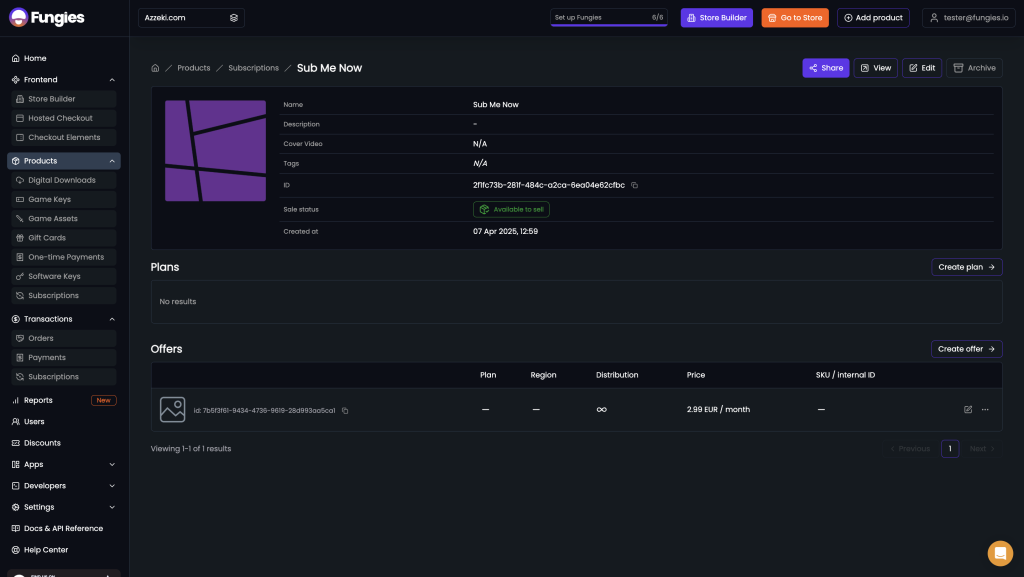

Setting Up Products and Subscriptions

With your account established, the next step is configuring your product offerings:

For Subscription Products

- Navigate to Products: In your Fungies dashboard, go to “Products” → “Subscriptions” and click “Add Subscription.”

- Define subscription details:

- Name your subscription plan

- Set the price and billing frequency (monthly, annual, etc.)

- Configure trial periods if applicable

- Add product descriptions and images

- Set up pricing tiers if you offer multiple plans

- Configure advanced options:

- Set up usage-based billing components if needed

- Configure upgrade/downgrade paths between plans

- Define proration rules for mid-cycle changes

- Set up free trial parameters

- Create subscription variants (optional):

- If you offer the same subscription with different options (e.g., number of users, storage limits), create variants to manage these efficiently

For One-Time Purchases

If your SaaS also offers one-time purchases (like setup fees or add-ons):

- Navigate to Digital Downloads: Go to “Products” → “Digital Downloads” and click “Add Digital Download.”

- Define product details:

- Name your product

- Set the price

- Add product descriptions and images

- Upload any deliverable files if applicable

- Configure delivery options:

- Set up automatic delivery mechanisms

- Configure access restrictions if needed

Customizing Checkout Options

Fungies offers multiple checkout options to suit different integration needs:

Hosted Checkout

The simplest integration option, requiring minimal technical work:

- Configure checkout appearance: In your Fungies dashboard, go to “Store Settings” → “Checkout” to customize colors, logos, and messaging.

- Set up payment methods: Enable the payment methods you want to accept (credit cards, PayPal, etc.).

- Configure checkout fields: Determine which customer information to collect during checkout.

- Set up post-purchase redirects: Configure where customers should be directed after completing their purchase.

- Generate checkout links: For each product, you can generate direct checkout links to share with customers or embed in your marketing materials.

Testing the Payment Flow

Before going live, thoroughly test your integration:

- Test account creation: Verify that new accounts are properly created in Fungies.

- Test checkout process: Complete test purchases using Fungies’ sandbox test cards:

- Success: 4242 4242 4242 4242

- Decline: 4000 0000 0000 0002

- Insufficient funds: 4000 0000 0000 9995

- Test subscription lifecycle:

- Create new subscriptions

- Test upgrades and downgrades

- Test cancellations and reactivations

- Verify webhook handling for each event

- Test error scenarios:

- Failed payments

- Card expiration

- Invalid card details

- Verify tax calculation: Test purchases from different countries to ensure proper tax calculation.

Going Live with Fungies as Your MoR

Once testing is complete, you’re ready to transition to production:

- Connect your Stripe account: In your Fungies dashboard, go to “Workspace Settings” → “Connect your Stripe account” to link your payment processing.

- Switch to production mode: Disable sandbox mode in your Fungies dashboard.

- Update API keys: Replace sandbox API keys with production keys in all integrations.

- Verify production webhooks: Ensure your webhook endpoints are configured for production events.

- Monitor initial transactions: Closely monitor the first few live transactions to ensure everything is working as expected.

Best Practices for a Smooth Integration

To ensure a successful implementation and ongoing operation:

During Implementation

- Start with simple products: Begin with your core offerings before adding complex pricing models.

- Implement incrementally: Start with basic checkout functionality, then add advanced features like webhooks and custom flows.

- Test extensively: Create comprehensive test scenarios covering the entire customer lifecycle.

- Document your integration: Maintain clear documentation of your integration choices and configurations.

Post-Implementation

- Monitor webhooks: Set up alerting for webhook failures to quickly identify integration issues.

- Review transaction logs: Regularly check transaction logs for unusual patterns or errors.

- Stay updated: Keep your integration current with Fungies platform updates and new features.

- Optimize conversion: Use Fungies analytics to identify and address checkout abandonment issues.

By following this step-by-step guide, you can successfully implement Fungies as your Merchant of Record provider, establishing a solid foundation for your SaaS business’s payment infrastructure. This early integration will position your company to scale efficiently while maintaining focus on your core product development.

After implementing Fungies as your Merchant of Record provider, your SaaS business will experience numerous advantages that directly impact your operations, growth potential, and overall focus. This section explores the key benefits that make Fungies an excellent choice for SaaS companies looking to streamline their payment infrastructure.

Simplified Global Tax Compliance

One of the most immediate and valuable benefits of using Fungies is comprehensive tax management:

Automatic Tax Calculation and Filing

Fungies automatically:

- Calculates the correct tax rates for each customer based on their location

- Applies tax exemptions where appropriate

- Generates tax-compliant invoices and receipts

- Files tax returns in relevant jurisdictions

- Remits collected taxes to the appropriate authorities

VAT/GST Registration Management

For international sales, Fungies:

- Maintains necessary VAT/GST registrations across jurisdictions

- Updates registrations as thresholds are reached in new markets

- Ensures compliance with changing regulations

- Provides required documentation for tax authorities

Reduced Audit Risk

With Fungies handling your tax compliance:

- Your business faces significantly lower audit risk

- You maintain comprehensive compliance records

- You have expert support if questions arise

- You avoid penalties for non-compliance

Streamlined Payment Processing

Fungies simplifies the entire payment lifecycle:

Unified Payment Infrastructure

Rather than managing multiple payment processors and gateways, Fungies provides:

- A single integration point for all payment processing

- Consistent payment experiences across markets

- Unified reporting for all transactions

- Centralized management of payment methods

Optimized Conversion Rates

Fungies’ checkout experience is designed to maximize conversions:

- Localized for customer language and currency

- Optimized for mobile and desktop devices

- Supports popular payment methods in each region

- Minimizes friction in the payment process

- Implements best practices for checkout design

Reduced Payment Failures

Through sophisticated payment processing, Fungies helps:

- Decrease declined transactions with intelligent routing

- Reduce false positives in fraud detection

- Implement card updater services to maintain valid payment methods

- Apply smart retry logic for failed payments

Subscription Management on Autopilot

For SaaS businesses, Fungies’ subscription capabilities deliver exceptional value:

Automated Recurring Billing

Fungies handles all aspects of subscription billing:

- Automatic charging on billing dates

- Prorated billing for mid-cycle changes

- Flexible billing frequencies (monthly, annual, custom)

- Trial period management

- Grace periods for payment issues

Sophisticated Upgrade/Downgrade Handling

When customers change plans, Fungies manages:

- Immediate or end-of-cycle plan changes

- Appropriate proration calculations

- Credit application for downgrades

- Additional charges for upgrades

- Seamless transitions between plans

Effective Dunning Management

For failed payments, Fungies implements:

- Intelligent retry schedules

- Customizable customer communications

- Easy payment method updates

- Grace periods to maintain service

- Recovery analytics to optimize strategies

Fraud Prevention and Security

Fungies provides robust security measures to protect your business and customers:

Advanced Fraud Detection

The platform includes:

- Machine learning-based fraud scoring

- IP and device fingerprinting

- Behavioral analysis

- 3D Secure implementation where appropriate

- Custom rules for high-risk transactions

PCI Compliance Management

Fungies eliminates PCI compliance concerns by:

- Maintaining Level 1 PCI DSS certification

- Handling all credit card data securely

- Removing your systems from PCI scope

- Providing compliant payment collection methods

- Regularly updating security measures

Chargeback Protection

When disputes occur, Fungies:

- Manages the chargeback process

- Provides evidence for legitimate transactions

- Implements prevention measures

- Absorbs liability for many types of fraud

- Maintains acceptable chargeback ratios

Exchange Rate Management

Fungies handles currency complexities:

- Managing exchange rate fluctuations

- Optimizing conversion timing

- Providing stable pricing for customers

- Simplifying accounting across currencies

Global Payment Methods

Beyond traditional credit cards, Fungies supports:

- Regional payment networks

- Bank transfers and direct debits

- Digital wallets

- Buy-now-pay-later options

- Mobile payment systems

Reduced Administrative Overhead

Using Fungies significantly decreases your operational burden:

Streamlined Financial Operations

Your finance team benefits from:

- Consolidated reporting across all markets

- Automated reconciliation processes

- Simplified revenue recognition

- Standardized financial documentation

- Reduced manual data entry

Decreased Support Burden

Your customer support team experiences:

- Fewer payment-related inquiries

- Better tools to resolve billing issues

- More time to focus on product support

- Improved customer satisfaction

- Decreased churn from payment problems

Simplified Compliance Management

Your legal and compliance teams gain:

- Reduced workload for regulatory monitoring

- Decreased risk of non-compliance

- Expert guidance on regulatory changes

- Simplified audit processes

- Peace of mind regarding legal requirements

Focus on Core Business Growth

Perhaps the most significant benefit of using Fungies as your Merchant of Record provider is the ability to maintain focus on what truly matters:

Engineering Resources Optimization

Your development team can:

- Focus on core product features

- Avoid building payment infrastructure

- Reduce technical debt

- Implement new features faster

- Improve overall product quality

Strategic Business Focus

Your leadership team can:

- Make decisions based on product and market strategy

- Reduce time spent on payment operations

- Allocate resources to growth initiatives

- Enter new markets more quickly

- Respond to opportunities more effectively

Improved Customer Experience

Your customers benefit from:

- A more polished, professional payment experience

- Fewer payment-related issues

- Flexible subscription management

- Clear, compliant invoicing

- Multiple payment options

By leveraging Fungies as your Merchant of Record, you effectively outsource an entire category of complex operations, allowing your team to concentrate on building an exceptional product and delivering value to your customers. This strategic advantage is particularly powerful when implemented early in your SaaS journey, as it establishes a scalable foundation that grows with your business without requiring significant reinvestment or restructuring as you expand.

The Strategic Advantage of Early MoR Integration

Throughout this article, we’ve explored why integrating a Merchant of Record provider early in your SaaS journey is not merely a technical decision but a strategic one with far-reaching implications for your business. Let’s recap the key insights:

Early MoR integration allows you to:

- Avoid technical debt by establishing a scalable payment infrastructure from the start

- Simplify global expansion by removing tax and compliance barriers to new markets

- Reduce legal and financial risks by transferring compliance responsibilities to experts

- Maintain focus on core product development rather than payment infrastructure

- Provide a professional, conversion-optimized checkout experience from day one

- Establish scalable financial operations that grow with your business

Conversely, postponing MoR integration typically leads to:

- Costly re-architecture of payment systems

- Delayed market entry opportunities

- Increased compliance risks

- Diverted engineering resources

- Suboptimal customer experiences

- Administrative overhead that distracts from growth initiatives

The evidence is clear: the question isn’t whether to integrate a Merchant of Record, but when—and the answer is as early as possible in your SaaS journey.

Why Fungies Stands Out for SaaS Businesses

Among the various Merchant of Record providers available, Fungies.io offers a compelling solution specifically designed for SaaS businesses:

- SaaS-focused features tailored to subscription business models

- Developer-friendly integration with comprehensive documentation and support

- Flexible implementation options to suit different technical requirements

- Comprehensive tax management across global markets

- Robust subscription handling for the entire customer lifecycle

- Secure, compliant payment processing that reduces your risk exposure

These capabilities allow you to offload the complexities of payment processing, tax compliance, and subscription management to experts while maintaining a seamless, branded experience for your customers.

Start Your MoR Journey Today

Ready to transform your SaaS payment infrastructure and focus on what truly matters—building an exceptional product and delivering value to your customers?

Try Fungies.io and discover how the right Merchant of Record provider can simplify your operations, reduce your risks, and accelerate your growth.

With a free sandbox account, you can explore the platform, test the integration, and experience firsthand how Fungies can serve as your trusted partner in managing the complexities of global payments and compliance.

Don’t wait until payment challenges become overwhelming. Make the strategic decision to integrate a Merchant of Record early, and position your SaaS business for sustainable, focused growth.

Your future self—and your engineering, finance, and leadership teams—will thank you.