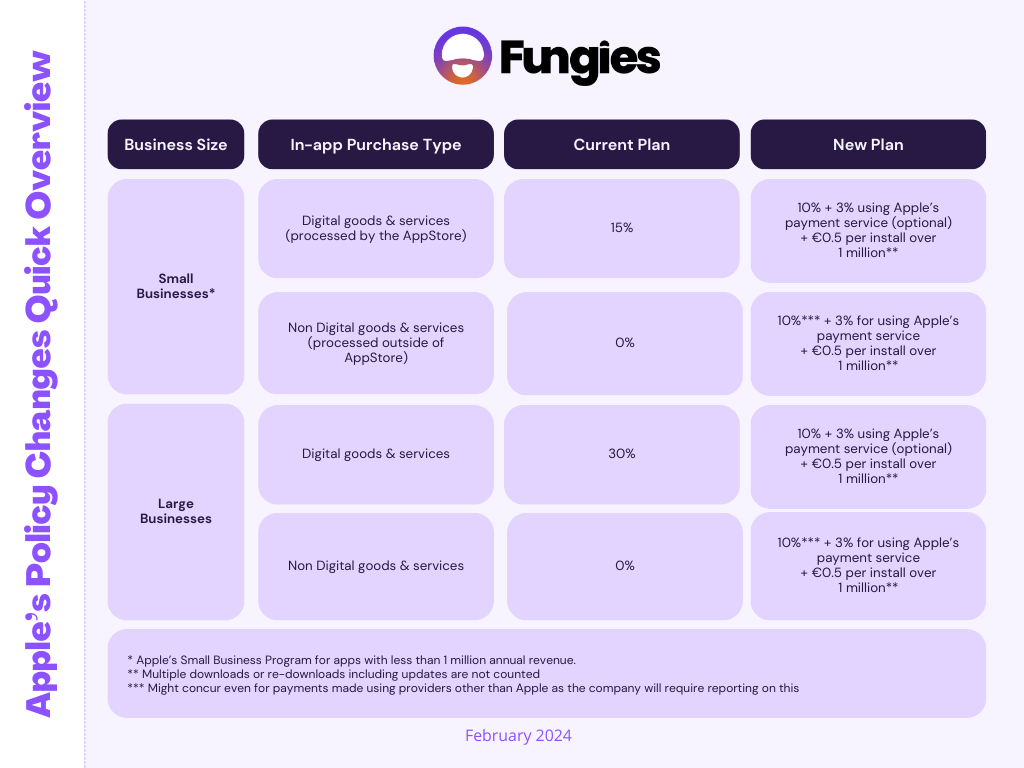

Apple’s recent adjustments in response to the EU’s Digital Markets Act (DMA) have ignited discussions across the mobile app ecosystem. While some see these changes as insufficient, our analysis suggests that, under certain conditions, Apple’s proposals could indeed offer new opportunities for developers and publishers. This development is particularly significant for mobile game publishers, who are now facing a transformative shift in how they distribute and monetize their apps within the EU. Let’s delve into the implications of these changes and why they matter.

Apple’s announcement entails modifications across its suite of services, including the iOS, App Store, and various other platforms, with the most notable change being the allowance for apps to be downloaded from alternative marketplaces. This move introduces a pivotal moment for game publishers, providing them with new avenues to reach their audience and potentially reducing the fees paid to Apple.

Under the new framework, developers are given the flexibility to choose their distribution model: sticking with the current App Store setup, moving to alternative marketplaces, or adopting a hybrid approach. This decision is crucial, as it affects various factors such as in-app purchase fees, app discoverability, and the overall business model.

Choice of Model

Deciding on the optimal model for app distribution and monetization under Apple’s new EU DMA guidelines hinges on several critical factors, beyond the straightforward calculation of in-app purchase fees offered by Apple’s calculator. Here’s a nuanced look at the elements at play:

Market Reach: The existing App Store model mandates fees only for in-app purchases, covering digital goods and services. This raises the question: Why should apps not reliant on in-app purchases—like those in eCommerce, travel, or food delivery—consider migrating to alternative platforms where they currently enjoy zero fees to Apple? The lure here is the enhanced visibility and growth potential offered by emerging marketplaces, such as those envisioned by Meta or Microsoft, which promise expansive user bases.

Development Investment: Venturing into new marketplaces isn’t without its costs. Each marketplace will have its own set of payment methods and requirements, necessitating significant development work. This factor alone could be a substantial investment for businesses considering expansion beyond the App Store.

Business Model Considerations: For apps monetized through advertising, such as hypercasual games or social media platforms, the App Store’s fee structure has been a non-issue. However, exploring new marketplaces might not be financially viable for all, especially when considering the thin profit margins of some app categories. Nevertheless, the potential for increased user reach may justify the exploration of new distribution channels for certain business models.

Application Size and Fees: The impact of Apple’s core technology fee, which applies beyond a certain download threshold, should not be underestimated. This fee could significantly affect larger apps, necessitating a careful analysis of the costs versus benefits of adopting a new model.

Additional Costs: It’s essential to account for other possible expenses, such as local taxes or additional fees charged by new marketplaces, which could affect the overall financial model for app developers.

Performance Measurement: The transition to new marketplaces also raises questions about metrics and analytics, particularly how Apple’s App Tracking Transparency (ATT) and the SKAdNetwork (SKAN) will operate within these ecosystems.

Irreversibility of Decision: Apple has stated that developers opting for the new business terms cannot revert to the traditional model for their EU apps, a stipulation that underscores the importance of a well-considered decision.

In summary, while the allure of new marketplaces and the potential for reduced fees is compelling, the decision to shift from Apple’s App Store requires a comprehensive evaluation of several factors, including market reach, development costs, the suitability of the business model, and the implications of additional fees and measurement challenges. The answer to the “million-dollar question” of which model to choose is nuanced and will vary based on the unique circumstances of each developer and app.

Examples of Choices

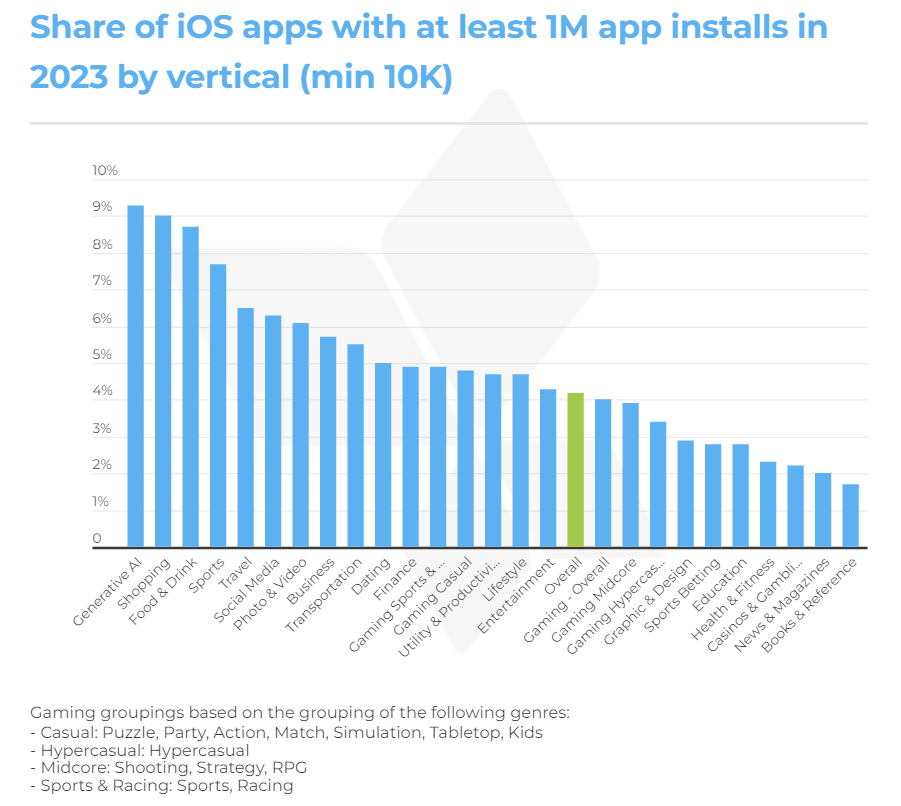

Determining which applications might bear the brunt of the core technology fee requires a deep dive into data. According to AppsFlyer’s analysis, encompassing over 2 billion iOS app installations across the EU in 2023 from a wide array of applications, reveals that 4.2% of apps surpassing a 10,000 annual install threshold would be subject to the core technology fee under the new model—a notable proportion.

Upon closer inspection, certain sectors stand out. eCommerce, Food & Drink, and Travel apps, often larger in scale, currently evade App Store fees due to their transactions occurring outside the digital goods and services sphere. Yet, the emerging Gen AI sector, marked by rapid expansion, faces a substantial core technology fee, given its significant number of large apps. Despite this, the prevalent subscription model within Gen AI means these apps are already accustomed to a fee structure, complicating the decision to switch models.

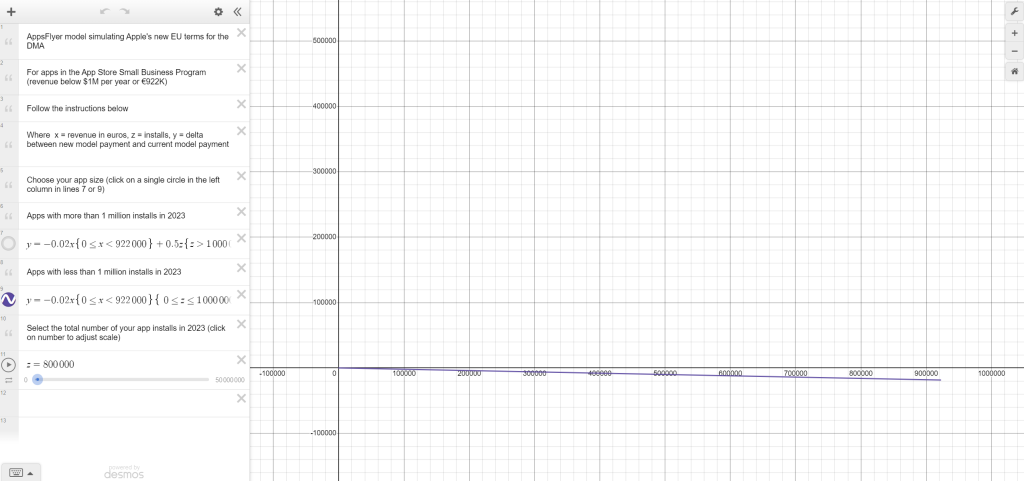

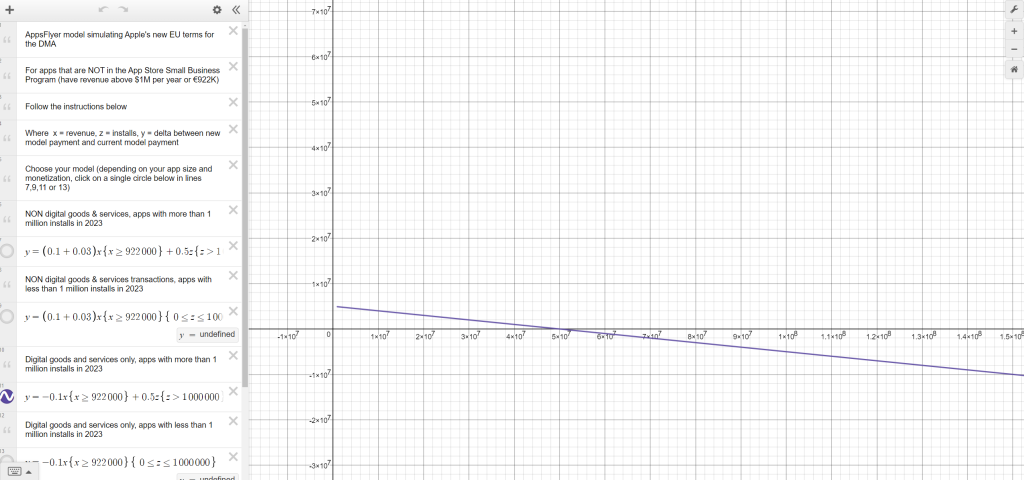

To guide you through these intricate considerations, AppsFlyer developed a Desmos model. This tool allows App Companies to plot out your strategy and ascertain when transitioning to the new model might prove financially beneficial.

The model examines three key variables:

- x represents Revenue,

- y calculates the difference between payments under the new and current models,

- z denotes Installs.

A negative y value indicates scenarios where the new model offers a financial advantage, though it’s crucial to weigh other considerations beyond mere mathematics.

For entities under Apple’s Small Business Program, generating less than $1 million in annual revenue, this model offers tailored guidance. Larger enterprises will find the model equally useful, with specific instructions to navigate their unique scenarios.

For larger enterprises, using this model:

- Digital Goods & Services with 10,000,000 Annual Installs: Switching to the new plan is recommended once your revenue exceeds 50 million euros. This strategic move can optimize the cost-benefit ratio for businesses dealing in digital products and services at this scale.

- Non-Digital Goods & Services with 10,000,000 Annual Installs: Maintaining the current plan is advised for businesses in this category. The existing model may continue to serve well, offering a more favorable framework for those not primarily dealing in digital goods and services.

For small businesses, using this model:

- Both Digital and Non-Digital Goods & Services with 800,000 Annual Installs: Small businesses, irrespective of whether they deal in digital or non-digital goods and services, are encouraged to adopt the new plan. This recommendation holds for those experiencing up to 800,000 installs annually, suggesting that the new model could present a more advantageous financial structure for smaller scale operations.

The Importance of Building a Web Store for Mobile Game Publishers

In light of Apple’s policy changes, building a web store becomes a strategic move for mobile game publishers for several reasons:

- Direct Revenue Collection: With the ability to sideload apps and use alternative app stores, publishers can direct users to their web stores, bypassing the traditional app store fees. This direct-to-consumer approach not only enhances revenue but also builds a direct relationship with the audience, invaluable for fostering loyalty and understanding user behavior.

- Enhanced Discoverability and Marketing Freedom: A web store offers publishers complete control over their marketing strategies, free from the constraints and competition of crowded app stores. This autonomy allows for tailored promotions, special offers, and a branded shopping experience that can significantly boost user engagement and conversion rates.

- Adaptation to Regulatory Changes: The shifting regulatory landscape, as evidenced by the EU’s DMA, suggests a future where digital marketplaces will become increasingly open and competitive. Establishing a web store positions game publishers to navigate these changes proactively, ensuring they are not solely dependent on any single platform or marketplace for distribution and sales.

Apple’s policy shift represents a watershed moment for the app economy, particularly for mobile game publishers. Embracing the opportunity to develop web stores and explore alternative distribution channels could not only enhance revenue streams but also offer greater control over the customer experience. As the digital marketplace continues to evolve, those who adapt swiftly and strategically are poised to reap the most significant benefits.