News and Resources

We hope to bring the best knowledge base for digital business.

SaaS Pricing Models and Strategies: How to Price a SaaS Product

Find out how to price your SaaS product accurately by learning about various pricing models. Get tips on how to choose the right model for your product.

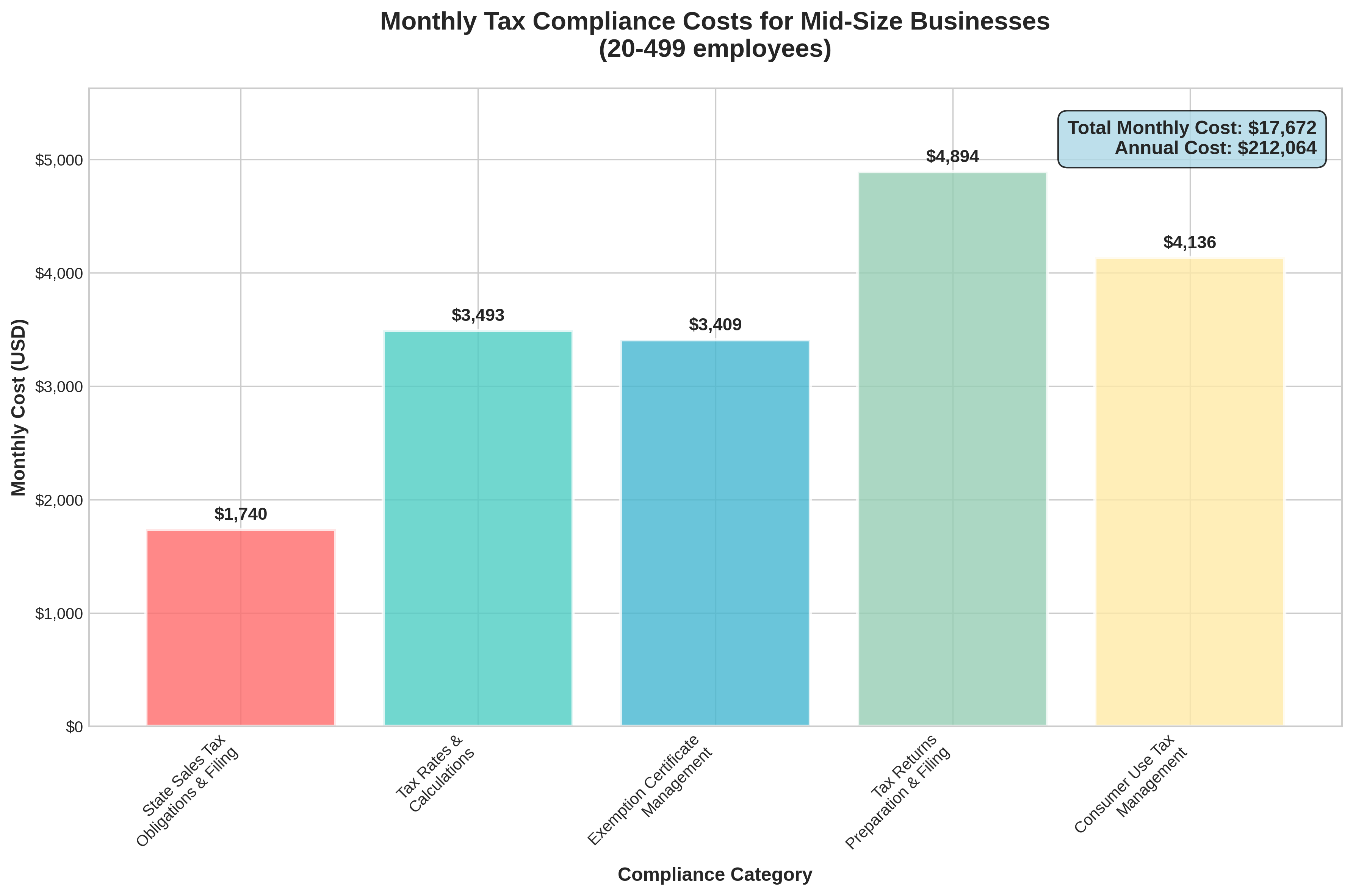

The Unseen Engine of Growth: Why Your SaaS and Digital Business Needs a Merchant of Record

In the fast-paced world of SaaS and digital downloads, your focus is on creating an exceptional product and building a loyal customer base. You’re a creator, an innovator, a problem-solver. But as your business grows, a new set of challenges emerges, a silent and complex web of administrative tasks that can quickly become a major...

Streamlining SaaS MVP Development with Modern DevOps Automation Tools: A Strategic Guide for Accelerated Product Delivery

Introduction In today’s competitive software landscape, the success of Software as a Service (SaaS) products often hinges on the speed and efficiency of bringing a Minimum Viable Product (MVP) to market. Modern DevOps automation tools have emerged as game-changers, enabling development teams to streamline workflows, reduce time-to-market, and maintain code quality throughout the development lifecycle....

Developer-Focused API Monetization Strategies for SaaS Revenue Diversification: A Strategic Guide to Unlocking New Revenue Streams

Introduction As the software-as-a-service (SaaS) industry continues to mature, companies are increasingly seeking innovative ways to diversify their revenue streams and create sustainable competitive advantages. API monetization has emerged as a powerful strategy that not only generates additional income but also fosters ecosystem growth, enhances customer retention, and accelerates product adoption. By opening their platforms...