The gaming industry, a dynamic realm driven by innovation and technology, is poised for another remarkable year. As we peer into the horizon of 2023, a tapestry of opportunities and challenges paints the picture of a global games market on the cusp of transformation. In this article, we embark on a comprehensive journey through the intricate web of this ever-evolving landscape.

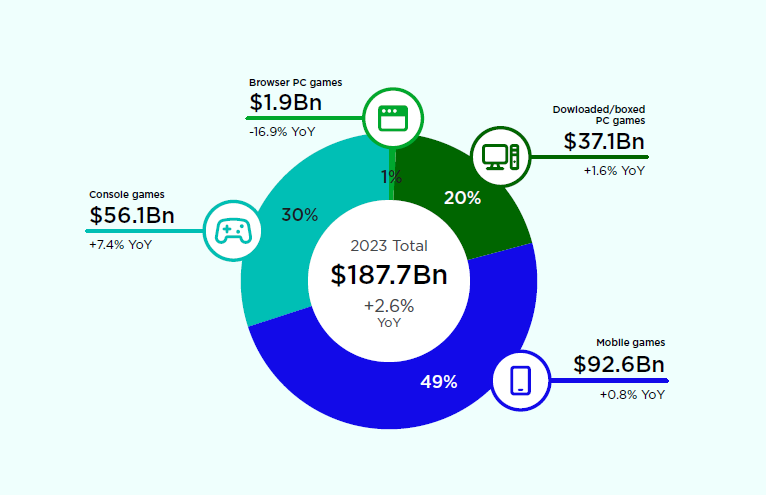

Charting the Financial Terrain Anticipating a crescendo of growth, the global games market is projected to amass a staggering $187.7 billion in revenue during 2023, signifying a robust 2.6% increase compared to the previous year. This monetary surge is no mere coincidence; it is the product of persistent dedication and strategic ingenuity within the industry. As we delve into the following segments, we’ll dissect the nuances of regional disparities and revenue distribution to gain an in-depth understanding of this economic marvel.

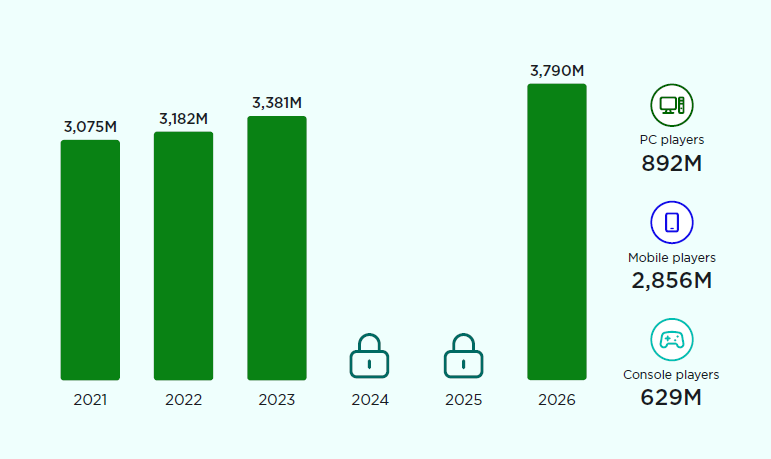

A Glimpse into the Player Realm Numbers do not merely tell a story; they narrate the journey of an ever-expanding community. In 2023, the number of global players is set to swell to an impressive 3.38 billion, reflecting a remarkable year-on-year growth of 6.3%. This surge is underpinned by the mobile gaming sector, a fertile ground for innovation and inclusivity. In the era of gaming’s ubiquity and the maturation of a new generation, player numbers ascend in harmony, transcending age and geography.

Unveiling the Payer Landscape The fabric of the gaming world is not woven solely by players; it is enriched by the contributions of payers, a community whose influence is paramount. The global payer cohort is forecasted to burgeon by 7.3%, reaching a commendable 1.47 billion in 2023. This trajectory, a testament to the allure of immersive experiences, holds steady as we gaze further into the future. With a projected compound annual growth rate (CAGR) of 4.7% between 2021 and 2026, the payer ranks are poised to swell to 1.66 billion by the close of 2026.

Decoding the Revenue Tapestry The symphony of revenue streams is a melody crafted by various instruments, with mobile claiming the most prominent note. Yet, within this harmonious composition, the challenges of a shifting privacy landscape present a counterpoint. This pivotal balance is explored, offering insights into how growth might be tempered until 2026.

Console’s Resurgent Symphony In the intricate ensemble of gaming platforms, console emerges as a resolute crescendo. With a staggering year-on-year growth of 7.4%, the console segment leads the charge in 2023. This redemption story is placed in context, recounting the setbacks of the previous year and drawing parallels with the present resurgence. The industry’s recovery from pandemic-induced tremors paints a picture of stability, laying the groundwork for an inspiring crescendo.

Charting the Course to 2026 As the industry sails towards the horizon of 2026, a symphony of transformation awaits. The global games market is projected to resonate with annual revenues of $212.4 billion, a harmonious crescendo from the present. With the advent of a new console generation and a realm of possibilities in the mobile domain, the stage is set for innovation and adaptation.

In this article, we navigate the currents of change, illuminating the trends that shape the gaming industry’s destiny. From financial milestones to player dynamics and beyond, the gaming landscape of 2023 unveils a canvas both vibrant and nuanced—a tapestry we’re privileged to explore.

Engaging the Gaming Sphere: Players and Payers in Focus

In the realm of gaming, a captivating narrative of expansion emerges. The year 2023 will witness an extraordinary surge in the global player count, soaring to an impressive 3.38 billion—a remarkable uptick of 6.3% from the previous year. While mobile gaming carves a significant path for these newcomers, it’s important to note that each segment of the gaming landscape contributes to this surge. The allure of game-related interaction possesses a tenacious hold, with a multitude of players introduced during the pandemic’s early lockdown years poised to maintain their engagement with the gaming tapestry in various forms.

The roots of gaming have now firmly entrenched themselves in mainstream culture. With each passing generation, the engagement with gaming swells. As the existing player base ages and fresh enthusiasts join the ranks, the trajectory of player numbers remains upward. In a captivating synergy, the pinnacle of 2023’s transmedia releases, including highly anticipated projects like the Super Mario Bros. Movie and HBO’s The Last of Us series, alongside an array of other game-inspired films and TV productions, will continue to lend legitimacy to the industry, captivating both those new to the gaming sphere and those who have rediscovered their passion. In this spirit, the global player community is primed to expand, projected to achieve a Compound Annual Growth Rate (CAGR) of +4.3% between 2021 and 2026, culminating in an impressive 3.79 billion players by the close of 2026.

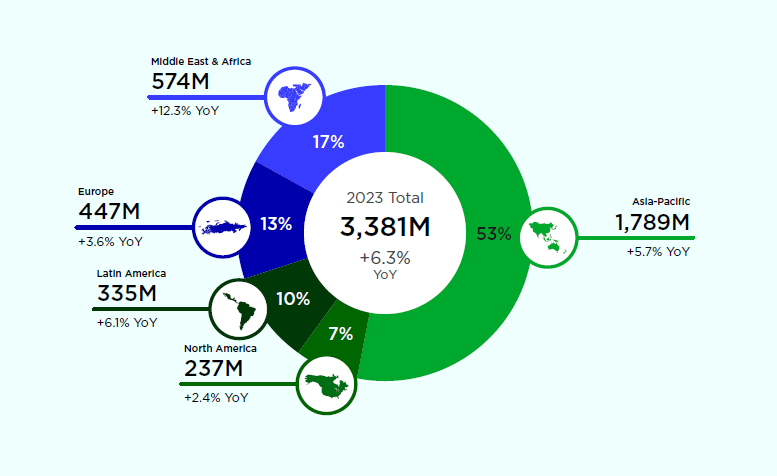

Players per region in 2023

The tapestry of global gaming is woven with distinct regional patterns. A significant spotlight falls on the Asia-Pacific region, which claims a lion’s share of global players, predominantly fueled by monumental gaming markets in India and China, as well as the fervent gaming communities in Japan and South Korea. Meanwhile, North America and Europe jointly account for 20% of the worldwide player base. Notably, 2023 presents a noteworthy narrative of growth for the emerging gaming landscapes of the Middle East & Africa, showcasing an impressive year-on-year player growth of +12.3%, and Latin America, poised to embrace a +6.1% surge. The driving forces behind these expansions are manifold, encompassing the augmentation of (mobile) internet infrastructure, the accessibility and affordability of (mobile) internet services, and the ascent of the middle class. Furthermore, the availability of gaming as an economical leisure pursuit, facilitated by the free-to-play model and the escalating populace of smartphone users, plays a pivotal role in propelling this evolutionary journey.

Game revenues in 2023

In the year 2023, the worldwide gaming industry is anticipated to generate total earnings of $187.7 billion. This signifies a positive year-on-year expansion of +2.6%, defying challenges posed by complex macroeconomic conditions. The chart below illustrates that the mobile gaming sector is projected to experience a modest +0.8% increase in revenue compared to the previous year, which is notably lower than growth rates observed in preceding years.

The mobile gaming domain is presently grappling with obstacles related to privacy-centered monetization and user acquisition, largely due to regulatory measures implemented by Apple and Google. This situation has necessitated mobile developers and marketers to recalibrate their strategies and explore novel approaches, interrupting the segment’s trend of remarkable growth. Nevertheless, the ascent of revenue in emerging markets, coupled with the sustained robust performance of mobile gaming’s prominent legacy titles, is set to contribute to some level of expansion in 2023.

Remaining the dominant force in consumer expenditure within the gaming landscape, the mobile segment will account for nearly half of the entire global market, underscoring its continued significance in the industry’s dynamics.

In the realm of gaming, the console segment holds the position of the second-largest market division. It is predicted to yield $56.1 billion in revenues during the year 2023, constituting 30% of the overall market. Notably, the console sector is poised to serve as the primary driver of revenue growth in 2023, showcasing a commendable year-on-year expansion of +7.4%.

Nonetheless, it’s essential to recognize that a series of setbacks resulted in suboptimal performance in 2022. Many of these delayed game releases are anticipated to contribute to the projected performance of 2023. These delays were primarily attributed to disruptions in development schedules caused by the impact of COVID. Given the expanding ambit and intricacy of game development endeavors, delays have become an inevitable aspect, particularly concerning high-scale revenue-generating AAA games.

Consequently, numerous major titles that were originally slated for launch in 2022, 2021, and even 2020 have been rescheduled for release this year. This encompasses blockbuster titles like Hogwarts Legacy, The Legend of Zelda: Tears of the Kingdom, and Final Fantasy XVI, all of which achieved substantial sales figures during the first half of the year.

The latter half of the year is set to introduce a series of highly anticipated titles that hold immense appeal for consumers. Among these, Marvel’s Spider-Man 2 for PlayStation 5, Forza Motorsport, and Starfield for Xbox stand out, along with Nintendo’s first original 2D Mario title in quite some time, known as Super Mario Bros. Wonder.

Furthermore, the array of yearly third-party powerhouses, including Call of Duty, EA Sports FC (formerly FIFA), and a fresh Assassin’s Creed installment, are poised to bolster the revenue stream for 2023. Naturally, live-service sensations like Fortnite, Rocket League, and others will persist in captivating and monetizing gamers through their seasonal content.

While several third-party titles will also contribute to PC-based revenues, this segment is projected to experience modest growth, edging up by +0.5% to reach $39.1 billion in the current year. While the PC platform has enjoyed successes such as Hogwarts Legacy and other third-party releases, it has been somewhat lacking in the array of first-party hits commonly seen on consoles (many of which were postponed to this year).

In parallel, PC ports have demonstrated suboptimal optimization in the present year, potentially motivating platform-neutral players to lean towards console versions of third-party games. Additionally, strategic moves like PlayStation’s timed exclusivity for titles such as Final Fantasy XVI and co-marketing arrangements for games like Hogwarts Legacy are likely to divert revenues from PC to the console segment.

Evolution of Console and PC Game Markets: Embracing New Avenues

In the landscape of PC and console gaming, resilience and expansion are evident. Yet, numerous enterprises contend with a complex macroeconomic backdrop that poses challenges to revenue growth. Simultaneously, the growth of the console and PC player communities is aligning at a slower pace with the ambitious growth goals of many companies. In response, developers across the spectrum of console (both first- and third-party) and PC gaming are delving into innovative strategies. These strategies encompass further monetizing existing players, broadening revenue channels, and expanding the potential player base. Noteworthy tactics encompass venturing into mobile gaming, exploring content subscription models, and perhaps most conspicuously, embracing live services—a trend projected to shape the landscape of console and PC game development for the upcoming half-decade. Live services involve sustained developer support with fresh content that players engage with and invest in over an extended period.

This analysis delves into the swift transition of console and PC developers from conventional premium games with full price points to immersive live service offerings. The discussion particularly highlights the robust adoption of this trend by PlayStation and, to a somewhat lesser extent, Xbox. Additionally, it delves into the entry of mobile developers and influential Chinese tech giants into the domain of console and PC live services. As a surfeit of time-intensive live service content becomes available within a finite player base and playtime, the discourse also examines the current and future sustainability of the live service game market.

Pros and Cons of using AI in gaming

OpenAI introduced ChatGPT to the public on November 20, 2022, and its reverberations across society were nearly instantaneous. Today, it’s hard to peruse business or technology news platforms without encountering extensive discourse on generative AI and its all-encompassing effects, including its influence on the gaming sector. Generative AI, a technology that employs neural networks to discern patterns and structures within data, enabling the generation of original content, has swiftly become a prized asset for expediting content creation. The rapid advancement of large language models (LLMs) further heightens the credibility, utility, and often indistinguishable nature of AI-generated content. In the realm of possibilities, the day may arrive when generative AI facilitates the creation of complete games from inception.

Presently, the game development community’s response to generative AI spans the spectrum from optimism—envisaging how it could expedite the creative process—to pessimism, with concerns revolving around potential mass layoffs, an issue already prevalent in the industry. The rapid proliferation of AI tools and their immediate influence on gaming foster a certain level of AI-related apprehension, particularly among developers fearing the erosion of their professional roles.

Within this exploration, we delve into these scenarios, offering a more comprehensive analysis of how AI’s presence might impact the gaming industry:

CEO Perceptions of Generative AI’s Impact on Gaming CEOs in the gaming arena are divided in their perspectives regarding the influence of generative AI. Some prominent figures express dissatisfaction at these initial stages. Activision Blizzard’s CEO, Bobby Kotick, holds the belief that AI will profoundly enhance the gaming landscape, while Andrew Wilson, CEO of EA, cautions that it might contribute to workforce displacement. Meanwhile, the first indications of resistance from gamers have already surfaced.

Early Examples and Reactions In early June, the incorporation of “AI-assisted content” by Cyan Worlds, the studio behind Myst, triggered negative reactions from fans. The company utilized AI to assist in crafting journals, logs, narratives, songs, poems, and in-game visuals. Certain players criticized the perceived lack of depth in the game’s world-building, attributing it to AI involvement, and others expressed disappointment that humans were not solely responsible for the entire development process. It is pertinent to note that the puzzle-oriented title garnered mixed critical reviews, but the passionate feedback from fans regarding AI’s role in complementing game creation efforts remains substantial.

In response to player critiques, Cyan Worlds took to Twitter to minimize the extent of AI integration within the game’s development. Whether players would have noticed AI involvement without the explicit emphasis remains uncertain.

Harnessing Generative AI for Enhanced Game Development Efficiency and Reduced Expenditure

The integration of generative AI has emerged as a potent means to optimize game development processes and curtail financial outlays. The realm of AAA game development is characterized by its formidable challenges, marked by ever-increasing budgets and expansive undertakings that have experienced remarkable expansion over the past decade. While revenues stemming from the gaming market have generally managed to surpass these burgeoning costs, often owing to innovative monetization strategies, the timeline for AAA game creation has evolved to extend beyond five years, with certain projects such as Xbox’s Perfect Dark game stretching to a remarkable seven-year span.

The Transformative Influence of Generative AI in Game Development

The escalating costs tied to talent and technological requirements are a predominant component within the mounting expenses of game creation. When factoring in marketing outlays, development budgets now ascend to the realm of hundreds of millions of dollars, potentially reaching a billion for the most colossal projects. The elevated costs of LiveOps, in tandem with the proliferation of live-service games, further contribute to this financial landscape. Publishers are proactively exploring avenues to counterbalance these burgeoning costs, and a compelling avenue that has emerged is generative AI.

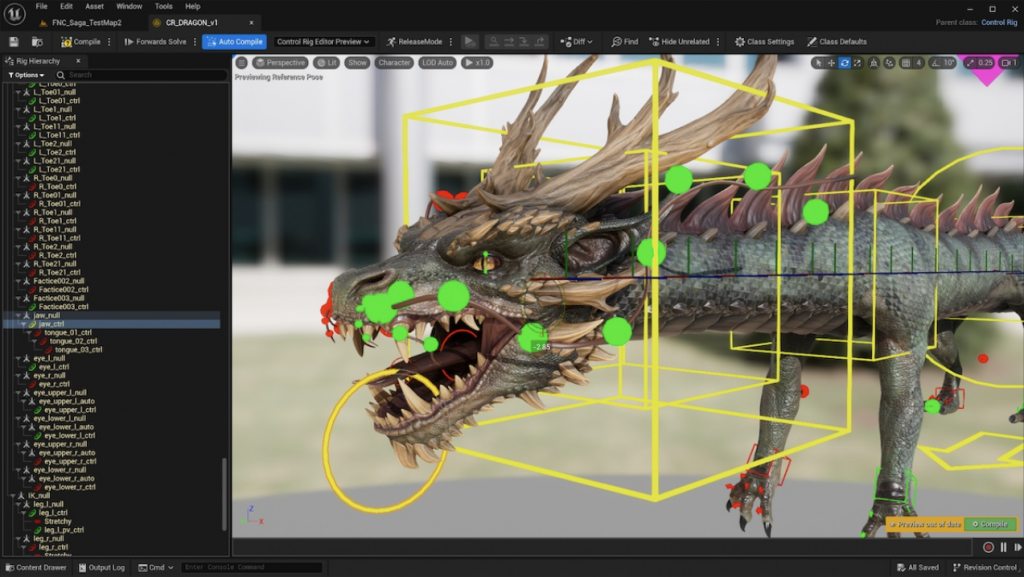

In a revealing Twitter thread, A16Z disclosed that 87% of the surveyed 243 studios are actively employing AI, with an additional 99% planning future integration. A notable 64% of studios intend to construct in-house models similar to Blizzard’s patented Diffusion tool, which harnesses generative AI to expedite the production of art assets. This innovative technique employs machine learning to metamorphose low-fidelity texture inputs into high-fidelity assets fit for AAA-grade games. Such technology profoundly streamlines tasks for artists operating within the game industry. For instance, artists can craft a foundational asset, such as a tree or flower, and subsequently leverage AI to engender hundreds or even thousands of variations. This alleviates the manual labor involved in crafting richly populated organic environments.

Generative AI’s potential extends to prototyping and concept art, altering the artist’s role to that of a curator. Here, the generative AI tool generates multiple designs based on the artist’s input (e.g., “generate a goblin character with a Viking-inspired style”). The artist then selects the optimal outcomes aligned with the game’s theme, using the AI-generated results as inspiration. While the proliferation of numerous assets may raise concerns about file sizes, particularly in 4K quality, procedural generation and other game development methodologies can alleviate this burden. In the foreseeable short term, the utilization of generative AI in image prototyping and creation is poised to become widespread.

Despite the potential for generative AI to reduce the demand for artists in certain projects, studios might sustain the same number of artists with the recognition that they now possess more time to create superior assets. Additionally, the integration of generative AI can expedite the hiring process, especially for specialized roles. Newly onboarded artists may leverage generative AI to construct assets within a game’s established aesthetic, negating the need for extensive experience in niche genres. This transformation could potentially broaden pathways for less-experienced artists to enter the industry.

The integration of AI-generated voices into games is already emerging, exemplified by 2022’s “High on Life” from Squanch Games. While voice-cloning imitations are on the rise, game developers are tapping into AI’s capabilities to forge distinctive voices, sidestepping the necessity for voice actors in roles such as NPCs and main characters. However, this progression might lead to fewer opportunities for voice actors in the future, particularly as AI contributes to reducing development costs and time. Notably, renowned AAA titles such as “The Last of Us” and “God of War” continue to prioritize motion capture and voice acting, much like the practices in Hollywood productions. In contrast, other games like “Cyberpunk 2077” feature celebrity voice actors like Idris Elba and Keanu Reeves. For these high-profile games, AI isn’t expected to replace real-world actors. The situation diverges for smaller-scale games, indie titles, and mods operating on limited budgets. Notably, modders have begun integrating tools like ChatGPT into games like Skyrim to enhance NPCs with dynamic, limitless interactions that react to in-game events.

Over the next two to three years, generative AI tools could significantly alter the landscape of CGI and video production in games, extending their influence to game marketing campaigns reliant on videos, images, and audio. Compact teams of artists leveraging AI might surpass the efficiency of larger teams specializing in CGI, thereby enhancing video quality and gameplay elements. This transformative change could revitalize older titles that were previously deemed too expensive to remaster. Nevertheless, larger developers might lean toward preserving an “authentic” remastering approach.

While the long-term implications of AI remain uncertain, it’s reasonable to anticipate that developers and even non-specialists will eventually harness generative AI to create entire games. As AI tools become more accessible and user-friendly, the boundaries between developers and players will continue to blur, potentially leading to a more community-driven gaming industry. Already, user-generated content is shaping companies’ strategies, with Epic, Roblox, and even PlayStation venturing into UGC-driven game initiatives. Roblox is on the cusp of enabling every user to craft content within the game’s environment.

Despite being in its nascent stages, generative AI could revolutionize RPGs, especially MMORPGs, by cultivating infinite, evolving worlds that mature organically alongside players—a LiveOps aspiration for many developers. The potential extends to IP-based games and transmedia experiences. By employing algorithms, well-established intellectual properties like “Star Wars” could spawn fresh, authentic content for player engagement. Each entry into the game world could yield an entirely distinct narrative with unique outcomes. Naturally, player preferences will vary, with some favoring tightly curated experiences they can complete and step away from. The landscape teems with developers keen on creating narratives akin to those found in “Spiritfarer” or “Journey.” However, concerns related to profitability and oversaturation are inevitable as AI democratizes game development, rendering it more accessible and cost-effective.

Throughout its history, the gaming industry has witnessed a parade of technologies aimed at streamlining development for over four decades. Remarkably, numerous developers, particularly within the AAA segment, have been hesitant to embrace these advancements to expedite game creation. Instead, they often utilize these technologies to craft more expansive games loaded with additional content, thereby exacerbating development expenses and time commitments. In some instances, the development cycle of AAA games extends beyond five or even seven years. Generative AI holds the potential to reshape this trajectory for multiple studios, offering respite from temporal and financial pressures. The advent of generative AI could catalyze a more diverse, sustainable, and astonishingly innovative games industry.

The Challenges and Promises of Generative AI

The legal landscape surrounding the use of AI-generated content in games, as well as other media forms, remains ambiguous at best. Generative AI draws upon vast datasets to craft seemingly original content, making it exceedingly difficult to discern whether these data points encompass copyrighted texts or images. Employing generative AI without comprehensive due diligence exposes developers to potential copyright infringement lawsuits. Notably, Getty Images has already initiated legal action against Stable Diffusion for using images owned by the former without prior authorization. Though the litigation is ongoing, it presages potential legal complications for AI-utilizing developers.

Foreseeably, these emerging legal challenges will be met with resistance from developers and gamers alike. Studios could seize this as an opportunity to educate players on the merits of generative AI in game creation, fostering increased transparency regarding its implementation. As generative AI tools advance, players may even craft their own games, prompting the industry to turn to AI as a method for combating intellectual property infringement and evaluating games for platforms, akin to the mechanisms observed on platforms like YouTube. Reports from GameDiscoverCo suggest that Valve has commenced the practice of banning games on Steam that incorporate AI-generated art assets without compelling legal grounds. However, individuals or groups could potentially establish servers in unregulated territories, serving as hubs for unregulated AI-enabled UGC titles—regardless of copyright, likenesses, and licenses. Such scenarios complicate the enforcement of generative AI regulations. Appropriate regulations will be imperative to govern the use of generative AI in video game creation, encompassing clear delineation of fair use within artificial intelligence utilization.

The Dawn of a New Era in Game Development

While generative AI is poised to revolutionize the conceptualization, creation, and distribution of games, it marks not an endpoint but the commencement of a novel era in our cherished entertainment medium. While challenges will inevitably arise, generative AI is likely to democratize game development, accelerate trends like user-generated content (UGC) and live services—thanks to refined content creation processes—and pave the way for gaming experiences that were hitherto inconceivable. In 1993, players could scarcely imagine the games available today. Similarly, in 2053, the advent of generative AI and the resultant trends, content, and cultures it fosters could potentially usher in unforeseen possibilities. Our perspective on generative AI’s incredible potential in gaming is underscored by the imperative for vigilant regulation.

Revolutionizing Console Gaming: The Emergence of Portable Play

In 2017, Nintendo introduced the Switch, a groundbreaking console that revolutionized the gaming landscape with its innovative hybrid concept. This novel console offered players the freedom to enjoy gaming both in the traditional console style, tethered to a television (docked), and as a standalone handheld device (undocked). This dual-purpose capability resonated profoundly with consumers, fundamentally altering their perceptions of and interaction with games.

Today, various manufacturers and platform developers are actively exploring avenues to empower gamers to take their console and PC gaming experiences on the road. This pursuit involves a range of strategies, including dedicated cloud gaming devices exemplified by the Logitech G Cloud, the implementation of local Wi-Fi remote play as seen in Sony’s Project Q, and the creation of self-contained handheld gaming PCs such as the Steam Deck and Asus ROG Ally. These innovations are conceived as supplementary to gamers’ primary gaming apparatus. For instance, Project Q serves as a companion to Sony’s PlayStation 5, while the Steam Deck complements a dedicated gaming PC. In this context, we will reference these portable devices as “complementary devices.”

Disruption and Uncertainty in the Mobile App Market: Apple’s Impact on User Acquisition Strategies

Apple’s implementation of the App Tracking Transparency (ATT) and SKAdNetwork 2.0 in April 2021 sent shockwaves through the mobile app market, including the gaming sector. The introduction of these features brought about a state of chaos and unpredictability. While subsequent updates like the developer-friendly enhancements in SKAdNetwork 4.0 were introduced, they failed to fully reinstate the precise targeting methods that developers had long relied upon. The situation took another turn during WWDC2023 when Apple unveiled the “Privacy Manifest” feature, further constricting ad networks’ capacity to employ user tracking for the optimization of advertising campaigns.

Impact on Mobile User Acquisition Strategies: Apple’s ATT and subsequent privacy-focused measures have significantly affected mobile user acquisition strategies, particularly in the context of ad targeting and campaign optimization. These changes have posed challenges to developers aiming to acquire new users and maintain efficient advertising efforts. The reduction in access to precise user data has made it harder for developers to create tailored and effective campaigns that directly reach their target audiences. This shift has led to a less predictable user acquisition process, as the previously available granular data and insights have been limited.

As a result, developers and marketers have had to rethink their user acquisition approaches, focusing on strategies that are less reliant on direct user tracking. The shift towards more privacy-conscious practices has demanded creativity and innovation in reaching potential users without compromising privacy standards.

Addressing Increasing User Acquisition Costs: Given the evolving landscape shaped by privacy-focused measures, developers and marketers can consider several strategies to counteract the rising costs of user acquisition:

- Embrace Contextual Advertising: Instead of relying heavily on personalized data, contextual advertising targets users based on the context of their current activity or content consumption. This approach aligns with privacy regulations while still enabling effective user engagement.

- Leverage First-Party Data: Developers can focus on gathering and leveraging their own first-party data collected through in-app interactions and engagements. This data can be used to understand user behavior and preferences, enabling more tailored campaigns.

- Explore Influencer Partnerships: Collaborating with influencers who have a relevant audience can help reach potential users through trusted channels. Influencers can provide authentic recommendations and reviews, fostering user trust.

- Optimize Creatives and Messaging: With limitations on data, the creative aspect of ads becomes even more crucial. Designing compelling visuals and crafting persuasive messaging can attract users based on the ad content itself.

- Utilize Retargeting Effectively: Retargeting campaigns focus on engaging users who have already shown interest in an app or game. These users are more likely to convert, making retargeting campaigns efficient in a privacy-focused environment.

- Explore New Channels: Beyond traditional advertising channels, developers can explore emerging platforms, partnerships, and content collaborations to engage users in innovative ways.

- Enhance App Store Optimization (ASO): Optimizing app store listings, keywords, and visuals can improve visibility and attract users organically, reducing the dependency on paid campaigns.

- Implement A/B Testing: Continuously test different ad creatives, targeting strategies, and messaging to identify what resonates best with users and maximize campaign effectiveness.

The Integral Role of Influencers in the Games Market

In the games market, influencers have emerged as an indispensable element. Content creators active on video platforms such as Twitch have played a pivotal role in game marketing for years. Titles like Apex Legends and Valorant have masterfully harnessed influencers to rapidly gather substantial player bases. These creators’ perspectives and endorsements have effectively supplanted traditional journalism and games critique in the eyes of many consumers.

Simultaneously, content creators are strategically broadening their revenue streams to reduce their dependency on the video and social media platforms that initially fueled their audience growth. A series of contentious policies from Twitch, including adjustments to revenue sharing and the restriction of simultaneous casting on Twitch and other non-mobile streaming platforms, have expedited this shift among streamers towards diversifying their income sources.

Future Trends for User-Generated Content and Its Impact on Game Development:

- Collaborative Content Creation: Influencers and content creators are increasingly collaborating with game developers to co-create content. This symbiotic relationship not only engages the gaming community but also empowers developers to tailor content to user preferences.

- Influencer-Driven Game Design: Game developers are leveraging influencer feedback to shape gameplay features and mechanics. Integrating influencers’ insights can enhance user experiences and increase the resonance of games among target audiences.

- User-Generated Content Integration: Game developers are facilitating user-generated content (UGC) creation within their titles. Players can design levels, characters, and other in-game elements, fostering a sense of ownership and creativity that resonates with audiences.

- UGC as a Marketing Tool: UGC is becoming a potent marketing asset. Game developers are encouraging players to share their in-game experiences and creations on social media, creating a network effect that amplifies game visibility and engagement.

- Content Monetization Models: Developers are exploring ways to enable content creators to monetize their contributions within games. This can range from revenue sharing for in-game purchases influenced by creators to exclusive in-game items designed by influencers.

- Player-Developer Feedback Loop: The integration of user-generated content allows players to influence game development directly. Player-created content can inspire developers and shape future updates, fostering a dynamic feedback loop.

- Virtual Economies and NFTs: The rise of non-fungible tokens (NFTs) is influencing the concept of virtual economies within games. Creators can tokenize their in-game creations, enabling unique and tradable digital assets that players can own.

- Diverse Representation: User-generated content allows for a more diverse representation of characters, narratives, and experiences in games. Players can craft stories that resonate with underrepresented communities, leading to richer and more inclusive gaming experiences.

- Emergence of In-Game Platforms: Some games are evolving into platforms where creators can host their content and connect with audiences. These platforms provide tools for content creation, streaming, and collaboration.

- Impact on Indie Game Development: Influencers play a significant role in promoting indie games, allowing smaller studios to gain exposure and build communities around their titles.

The Evolution of Virtual Reality (VR) Gaming and the Anticipated Path for AR and the Metaverse

In recent years, the trajectory of virtual reality (VR) gaming has mirrored the broader trends within the gaming market. VR experienced a notable surge in popularity during periods of lockdown, serving as a means for individuals to transcend the limitations of their physical surroundings and immerse themselves in dynamic virtual realms. This trend closely paralleled the larger gaming landscape, with VR capturing attention as a captivating escape during times of confinement.

However, akin to the general gaming industry, VR encountered its share of challenges as people emerged from lockdowns and reintegrated pre-pandemic activities into their lives. As players began prioritizing physical world engagements, their allocation of time and resources to VR gaming experienced a decline, impacting both playtime and content expenditure.

While these fluctuations mark a phase of adaptation, the prospects for the future of VR remain promising. Among the anticipated developments is a clearer trajectory toward the broader adoption of augmented reality (AR) devices. AR holds the potential to seamlessly integrate digital content into the real world, transforming how users perceive and interact with their environment. As technology continues to advance, AR experiences are expected to become more accessible, user-friendly, and integrated into everyday life.

The Future of AR and the Metaverse:

- Convergence of Physical and Digital Realities: AR technology is poised to bridge the gap between the physical and digital realms. Users will be able to interact with digital content while still being fully present in the real world, leading to novel experiences and applications across various industries.

- Enhanced Consumer Engagement: AR’s immersive nature has the potential to revolutionize marketing and advertising. Brands can create interactive and personalized campaigns that captivate audiences through engaging AR experiences.

- Workplace Transformation: AR will find applications in business and industry, revolutionizing fields such as remote collaboration, training, and maintenance. Overlaying digital information onto real-world objects can streamline processes and enhance productivity.

- Entertainment and Gaming: AR will redefine entertainment and gaming experiences, offering users unique and interactive ways to engage with content. Location-based AR games and immersive storytelling are just a glimpse of what’s to come.

- AR Wearables: As AR devices become more compact and socially acceptable, wearable technology like AR glasses could become commonplace. These devices would seamlessly blend the digital and physical worlds, enhancing user experiences.

- Development of the Metaverse: The concept of the metaverse—a collective virtual shared space—will become more tangible. AR technologies will contribute to the creation of interconnected digital universes where users can socialize, work, play, and create.

- Cultural and Social Impact: The metaverse will reshape how people communicate and interact. Virtual gatherings, events, and collaborations will become more common, transcending geographical boundaries.

- Data Privacy and Ethical Considerations: The widespread adoption of AR and the metaverse will necessitate discussions around data privacy, security, and ethical use of technology.

- Integration of AI and AR: The convergence of artificial intelligence and AR will enable more context-aware and personalized experiences, enhancing user engagement and convenience.

- Industry Collaborations: Tech giants, game developers, and various industries will collaborate to build a seamless AR ecosystem, fostering innovation and driving the adoption of AR technology.

Diverse Monetization Approaches and Revenue Trends Across Platforms

Global Monetization Landscape Within the context of global monetization growth, the most robust compound annual growth rate (CAGR) figures for the period spanning 2021 to 2026 are projected to stem from in-game subscriptions and downloadable content, which includes expansions. Concurrently, the sustained popularity of live-service games is set to drive growth within the PC and console realms. Nevertheless, privacy-related challenges are anticipated to temper substantial expansion within the mobile sector, albeit partially offset by promising growth in the console and PC domains. While multi-game subscriptions are poised to witness modest revenue growth from 2022 to 2026, their overall impact remains limited. For Indie Game Developers, a creative and diversified approach to monetization is paramount in carving a distinct niche within this dynamic landscape.

Monetization Trends in the PC Realm The period between 2015 and 2019 witnessed a marked decline in premium revenues within the PC market. This phenomenon can be chiefly attributed to the ascendancy of live-service games on the platform, coupled with the revenue influx from microtransactions. While expansion packs have been integral to the PC ecosystem since the 1990s, and microtransaction revenues have consistently underpinned the MMORPG segment, the PC market gleaned invaluable insights from the resounding success of the free-to-play transformation observed in the mobile domain. For Indie Game Developers operating within the PC realm, innovation in monetization strategies holds the key to sustained success and recognition.

Monetization Developments in the Console Space Similar to the PC landscape, premium console revenues underwent a perceptible decline from 2015 to 2019, only to stabilize and adapt from 2020 onward. This stabilization can be attributed to multiple factors, including the gradual wane of the battle royale genre’s momentum and the continued maturation of live-service models. Furthermore, the indirect repercussions of the pandemic played a role in moderating the decline of premium monetization on both console and PC platforms. Notably, the console sector now witnesses live-service models contributing to 27% (equating to $15.3 billion) of global console revenues. Among the console markets, Japan stands out with the highest microtransaction revenues, accounting for a substantial 33% of the sector’s console revenue share. Indie Game Developers in the console sector can harness these trends by crafting innovative gameplay experiences that resonate with diverse audiences.

Monetization Dynamics in the Mobile Arena The early 2010s marked the epoch when the mobile games sector propelled free-to-play monetization into mainstream prominence. Since then, in-game monetization has consistently constituted the core of the segment’s revenue landscape. Projections for 2023 indicate that revenue derived from in-game spending is set to surge to an impressive $89.7 billion, encompassing 97% of the global mobile segment’s revenues. The remaining 3% is anticipated to emanate from full-game digital revenues, encompassing mobile adaptations of nostalgic franchises like the early Final Fantasy titles. Indie Game Developers in the mobile domain are poised to benefit by infusing creativity and value into their offerings to capture the attention of discerning mobile gamers.

Summary

In the dynamic landscape of the gaming market, the next five years promise an exhilarating journey of transformation and innovation. The convergence of various trends and shifts across different platforms—PC, console, mobile, and even the nascent AR and metaverse spaces—foreshadows a future that is both exciting and challenging for stakeholders across the industry.

Platform Monetization: The monetization methods within the gaming ecosystem are poised for a paradigm shift. In the years to come, in-game subscriptions and downloadable content, including expansions, are projected to drive substantial revenue growth. While live-service games are set to sustain their popularity, privacy-related obstacles will likely dampen growth within the mobile segment. Nevertheless, the console and PC sectors are expected to witness noteworthy expansion, albeit with different focal points. The creative utilization of multi-game subscriptions is expected to gain traction, offering players a new way to access content while aiding developers’ revenue streams.

Emerging Platforms and Technologies: Beyond the traditional realms, the burgeoning domains of AR and the metaverse hold immense potential. Augmented Reality is anticipated to bridge the gap between the digital and physical worlds, revolutionizing industries and reshaping user experiences. The metaverse, as a digital collective space, is poised to offer entirely new ways to socialize, collaborate, and engage with content, transforming not just gaming but how we interact with the digital realm.

Diversified Monetization Strategies for Indie Developers: The spotlight also shines on indie game developers, who will play an increasingly significant role in shaping the industry’s future. In the PC, console, and mobile spheres, indie developers can thrive by innovating in monetization approaches, leveraging user-generated content, and capitalizing on community-driven engagement. The emphasis on creative freedom and unique gameplay experiences positions indie developers as pioneers in driving artistic expression and diversifying the gaming landscape.

Balancing Monetization and Player Experience: As the industry adapts to changing monetization landscapes, striking a delicate balance between revenue generation and player experience becomes paramount. Developers will continue to explore ways to enhance player engagement while navigating challenges posed by privacy regulations, player expectations, and evolving market dynamics.

Global Collaboration and Regulation: The global nature of the gaming industry necessitates collaboration and cooperation on a global scale. Regulation and ethical considerations will shape the industry’s trajectory, fostering a responsible ecosystem that values data privacy, user security, and ethical use of technology.

In conclusion, the gaming market‘s journey over the next five years will be marked by a fusion of technological advancements, evolving player expectations, and diversified monetization strategies. The industry’s evolution transcends conventional boundaries, promising an era of interconnected experiences, immersive realities, and community-driven innovation. As stakeholders harness the opportunities presented by AR, the metaverse, and innovative monetization models, the gaming landscape is poised for a future that is dynamic, inclusive, and transformative.