As a company focused on creating top-tier digital products, you’ve likely struggled with the details of international tax regulations. Instead of focusing your energy on innovation, you might be navigating global sales tax, PCI-DSS compliance, and billing requirements. These foundational tasks can quickly become a burden, pulling you away from what truly matters: growing your business.

A Merchant of Record (MoR) can prove to be your one-stop solution. An MoR takes these taxing responsibilities off your plate. By handling your billings, sales tax, and compliance across multiple countries, they free up your time and resources. Therefore, instead of getting bogged down in administrative details, you can focus on product development and strategic growth.

In this article, we’ll walk you through the top 10 Merchant of Record payment providers. We’ll break down their key features, weigh the pros and cons, and give you a clear picture of pricing.

Disclaimer: Fungies is our solution, built with the features that help you grow your business. Learn more or book a demo today.

Quick Comparison Table

| Provider | Key Features | Pros | Cons | Pricing |

| Fungies.io | Flexible subscription management, comprehensive tax and compliance handling, customizable storefront and checkout experience | Extensive payment options, developer-friendly integration, global reach | Feature-rich, which might overwhelm new users | Free; 5% + 50¢ per transaction |

| Paddle | Automated tax compliance, detailed invoicing | Strong commitment to data privacy, simplifies global payments | Customer support could be more responsive, web purchase interface can be confusing | 5% + 50¢ per transaction |

| Lemon Squeezy | Licensing management, global tax compliance, renewal reminders | Easy implementation of recurring subscriptions, flexible subscription options | Slow customer support response times, limited customization options for store designs | 5% + 50¢ per transaction |

| XSolla | Checkout customization, payment localization, advanced user tracking | Great customer service, comprehensive tools for payment issues | Platform may take time to load due to extensive data | Contact for pricing |

| Stax | Customizable payment solutions, secure payment processing, professional invoicing | Dedicated support teams, easy to implement, mobile app for payments and insights | Integration limitations, slow customer service | $99/month+ based on processing volume |

| FastSpring | Transaction management, robust localization, global tax compliance | Rapid-response support, wide variety of payment and currency options | Initial setup can be tricky, limited integrations with web and eCommerce platforms | Contact for pricing |

| Square | Digital invoicing, built-in data tools, deposit requests | Easy to navigate and set up, reliable payment accuracy, flexible setup | Security concerns, occasional glitches and crashes | Free; Plus: $29+/month; Premium: Custom pricing |

| PayPro Global | SaaS sales analytics, subscription management tools, tax compliance | Customizable subscription options, professional and responsive team, localized purchasing | User interface could be improved | Custom pricing; request through website |

| Stripe | Data pipeline setup, automated tax calculation, customizable revenue recognition | Autopayments for memberships, reliable and easy-to-use tools | Navigation can be cumbersome, limited customer support (email only) | 2.9% + 30¢ per successful charge for domestic cards |

| Cleverbridge | Subscription management, tax compliance and localization, churn prevention | Smooth API integration, quick and professional customer service | Tools can be challenging to navigate, especially for canceling subscriptions | Percentage of transaction amounts; custom pricing available |

#1 Fungies.io

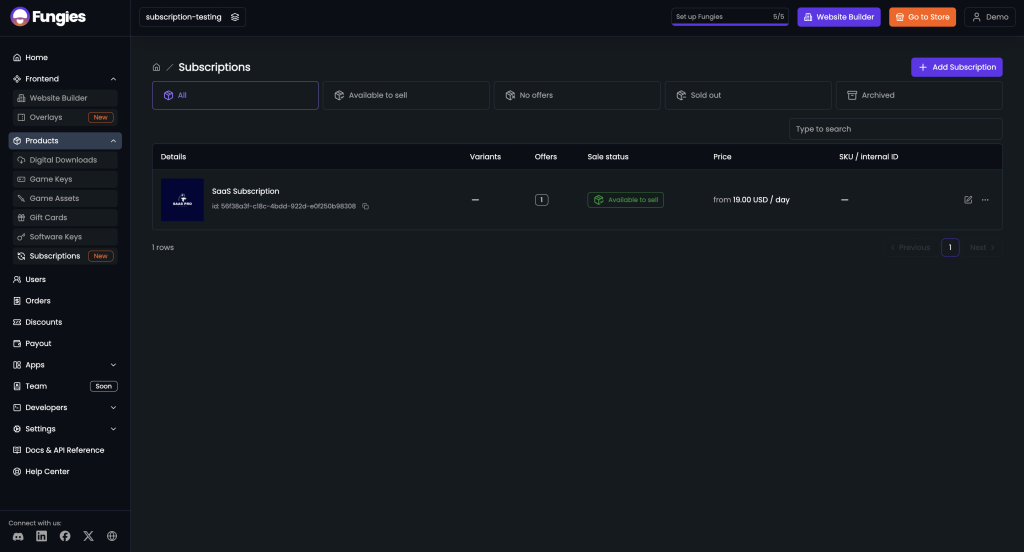

Fungies.io is one of the best Merchant of Record (MoR) platforms tailored for SaaS developers, game creators, and digital product sellers. It handles everything from payment processing to tax compliance, helping you simplify your business’ subscription services while ensuring high security and regulatory compliance. It’s an ideal choice for you if you want to streamline your operations and focus on growth.

Key Features

Flexible Subscription Management

Fungies lets you create and manage subscription billing plans that cater to your business model. For example, if you’re a SaaS company offering different tiers of service, you can easily set up monthly, yearly, or even usage-based billing plans.

With ready-made templates, launching new subscription products becomes a breeze, reducing the time to market. Fungies also allows you to roll out a new feature set with a specialized subscription plan.

Comprehensive Tax and Compliance Handling

Fungies takes the burden of legal and financial compliance off your shoulders. If you’re selling digital products internationally, the platform automatically calculates and applies the correct VAT or sales tax based on the customer’s location.

For instance, if you have customers in both the EU and the U.S., Fungies verifies that you comply with the differing tax laws of these regions. Additionally, it handles merchant fees, fraud prevention, chargebacks, and disputes, so you don’t have to worry about the complexities that come with international sales.

Customizable Storefront and Checkout Experience

The platform offers a fully customizable storefront, allowing you to maintain a consistent brand experience. For example, you can design a checkout process that fits the aesthetic of your product, whether it’s a one-page checkout or a more detailed, store-style checkout.

This level of customization allows your customers to have a comfortable experience from start to finish. Incorporating fintech identity verification at the checkout stage can help businesses meet regulatory requirements while offering a smooth user experience. Furthermore, the user management portal gives your customers control over their subscriptions, enabling them to easily upgrade, downgrade, or cancel their plans, which is especially useful if you are a SaaS business with multiple service levels.

Pros

- Extensive Payment Options: Fungies supports over 200 payment methods, including options like SEPA in Europe and PayPal globally, accommodating diverse customer preferences.

- Developer-Friendly Integration: Supports API and Webhooks support, with clean, well-documented code. This makes it easy for you to integrate Fungies into your existing systems.

- Global Reach: The platform comes with multi-language support and regional pricing options that can help you cater to international markets.

Cons

- While the platform’s extensive features are a significant advantage, they might overwhelm new users. However, Fungies provides a free demo, allowing users to familiarize themselves with the platform’s capabilities before fully diving in.

Pricing

Fungies.io is available for free, with no upfront or monthly costs. The platform charges 5% + 50¢ per transaction, with payouts and tax calculations managed by Fungies.

Review

“Fungies.io is a game-changer! They’re carving a niche as the premier solution for indie devs seeking a personalized storefront and asset marketplace. Their team’s commitment to continuous improvement and openness to feedback is unparalleled.” – Gatis Parlos

#2 Paddle

Paddle is a comprehensive solution for SaaS companies, offering payment processing, tax management, and subscription services in one platform. It simplifies operations by integrating with multiple payment providers and automating revenue reconciliation. This makes it well suited if you are a software company seeking improved eCommerce and subscription management.

Key Features

- Paddle automatically collects and remits sales tax and VAT in over 100 jurisdictions, helping you maintain compliance with global regulations.

- The platform lets you quickly create and send detailed invoices to customers, speeding up accounts receivable.

Pros

- Paddle offers a strong commitment to data privacy and security, including SOC 2 Type 2 certification.

- It simplifies global payments through card transactions, making it easy for your customers to pay without complicated registration.

Cons

- Some users report that customer support could be more responsive.

- The web purchase interface can be confusing and lacks customization options.

Pricing

Paddle operates on a pay-as-you-go model, charging 5% + $0.50 per transaction.

Review

“Paddle acts as Merchant of Record, so we do not have to spend time managing sales tax applicable in multiple countries. A valuable solution for any SaaS platform that serves globally.” – User in Computer Software Industry

#3 Lemon Squeezy

Lemon Squeezy is an all-in-one platform designed to simplify running your SaaS business. It’s tailored for creators and entrepreneurs, offering a comprehensive solution for selling digital products online. With Lemon Squeezy, you can quickly set up a customized online store, manage products and payments, and take advantage of built-in marketing tools—all in one place.

Key Features

- Lemon Squeezy gives you full control to deactivate, re-issue, and customize licensing terms to suit your customers’ needs.

- The platform handles global tax compliance for you, from sales tax in Kansas to VAT in the EU, making it easier for you to focus on growth.

- The platform’s renewal reminders integrate with email marketing and global payments, helping you recover revenue from abandoned carts and allowing smooth subscription renewals.

Pros

- Allows easy implementation of recurring subscriptions via PayPal.

- It has flexible subscription options, including discounted trials, API integration, and usage-based billing.

Cons

- Some users have complained that the customer support response times can be slow, with reports of unresolved issues.

- Some user feedback suggests that there are limited customization options for store designs.

Pricing:

- Lemon Squeezy charges 5% + 50¢ per transaction with no monthly fees for eCommerce features.

- Email marketing is free for up to 500 subscribers, with additional charges based on the total number of subscribers.

Review:

“I’ve never come across a platform that has made it SO easy-peasy to start selling. Lemon Squeezy is full of beautiful surprises, and it’s a genuine joy to use!” – Rachel Shillcock

#4 XSolla

Xsolla is a global commerce company dedicated exclusively to the video game industry. It provides a comprehensive suite of tools and services designed to help developers, publishers, and platform partners monetize, and scale their games worldwide.

Key Features

- Xsolla offers various checkout experiences, including Hosted Checkout, which provides a ready-to-use UI for instant game monetization. If you need more control, the Headless Checkout option allows for extensive customization of UI and UX.

- Enter new markets easily with XSolla’s access to over 700 local payment methods and more than 10 recurrent methods tailored to different regions. Xsolla also handles VAT and taxes, simplifying global expansion for game developers.

- The platform lets you diagnose and resolve potential payment issues with its advanced tracking and automated communication tools for a smooth experience for players.

Pros

- Offers great customer service, accessible via WhatsApp chat.

- XSolla has comprehensive tools for diagnosing payment issues and optimizing the payment process.

- You can utilize the platform’s free guide to help you create a successful subscription program.

Cons

- The platform may take some time to load due to the extensive data it provides, which could impact user experience.

Pricing

Contact Xsolla directly to obtain current pricing information.

Review

“I think the overall UI/UX is designed well. It is easily approachable, and any user could implement this payment processor for their company. I personally believe that this is a great tool and have been using it for the last few years.” – User

#5 Stax

Stax is a payment technology platform for small and large businesses, as well as software platforms, with an all-in-one payments API. It provides you with the tools to manage your payment ecosystem, analyze data, and work on the customer experience through integrated payment solutions. Stax partners with SaaS companies, ISOs, and SMBs to deliver flexible, multi-channel payment processing and invoicing.

Key Features

- Tailored to the needs of merchants and payment facilitators, Stax supports a personalized payment journey.

- The platform offers secure in-person and online credit card payment processing through Stax Pay, an all-in-one business management platform.

- With Stax, you are able to create branded digital invoices with customizable fields and tax rates.

Pros

- Dedicated support teams are available by phone, online, or through a secure knowledge base.

- The platform is easy to implement, even for users new to credit card processing.

- Has an easy-to-use mobile application.

Cons

- Some customers report that Staz has integration limitations and requires workarounds to function with certain tech stacks.

- Customer service can be slow, as reported by some customers.

Pricing

Stax offers subscription pricing based on processing volume, starting at $99/month for up to $150,000 in processing. Custom quotes are available on their website.

Review

“It is an easy-to-use program with a good-looking interface. The support is perfect, and the flat rate pricing is the best.” – Vasilis A

#6 FastSpring

FastSpring is a commerce platform designed to simplify back-office operations for businesses in SaaS, software, video games, and online content. It manages everything from sales tax and VAT filings to billing and order processing, allowing your company to focus on growing revenue.

Key Features

- FastSpring takes responsibility for all transactions, including tax collection and remittance. You retain access to all customer data and analytics, with full ownership and the ability to migrate your data as needed.

- The platform comes with a robust localization with over 20 languages available for your storefront and checkout, making it easier to reach a global audience.

- FastSpring assists you in managing purchase-related taxes across thousands of jurisdictions worldwide.

Pros

- Customers praise the platform’s rapid-response support.

- The platform has a wide variety of payment and currency options for your customers.

- FastSpring lets you utilize convenient tools for managing sales reports and tracking subscription payments.

Cons

- The initial setup for new products can be tricky, particularly when configuring email templates for customer communications.

- There are limited integrations with web and eCommerce platforms.

Pricing

FastSpring does not disclose pricing publicly. You can contact FastSpring directly for detailed pricing information.

Review

“We have been using FastSpring for over 6 years now, and the first thing that comes to mind is that it is a solid product that we never have issues with.” – User

#7 Square

Square Payments is a versatile online payment processing solution that integrates easily with Square hardware and Point-of-sale (POS) software. Designed specifically for small businesses, Square makes it easy to accept various payment types without complicated setup processes. Its modern, user-friendly equipment and online checkout features allow you to start selling quickly.

Key Features

- Send digital invoices in seconds via email, SMS, or a shareable link. Square then lets your customers pay instantly using their preferred method. You can also track invoice status to see what’s paid, unpaid, or overdue.

- Square simplifies payment management by reducing the number of systems you need. Every payment link comes with built-in tracking and reporting, allowing you to monitor sales performance and customer payments directly from the Square Dashboard.

- You can secure your customer’s commitment by requesting an upfront deposit and easily setting a separate due date for the remaining balance.

Pros

- The platform is easy to navigate and set up, making it ideal for small businesses.

- It comes with reliable payment accuracy so that you never miss a payment.

- Square is a simple setup with additional options available as needed, providing flexibility for both business and customer needs.

Cons

- Some security concerns have been reported, with a few users experiencing account compromises and fraudulent activity.

- There have been complaints about occasional glitches and crashes, which can disrupt business operations.

Pricing

- Free: No setup or monthly fees; only pay when you take a payment.

- Plus: $29+/mo. with advanced features for restaurants, retailers, or appointment-based businesses.

- Premium: Custom pricing rates available on demand.

Review

“What a great processing company. They’ve got great loans that are easy to repay. They help you in every aspect of your business. I highly recommend using Square for your credit card processing.” – B Wise

#8 PayPro Global

PayPro Global is an eCommerce solution tailored for software developers and vendors, aiming to simplify the distribution and resale of digital products. The platform offers complete automation of online sales management including global distribution and sales optimization, allowing you to focus on product development.

Key Features

- PayPro Global provides a detailed overview of your SaaS sales, including metrics like AMR, MMR, churn rate, and LTV. With over 70 customizable reports, the platform helps you monitor trends and react swiftly to market changes.

- The platform offers robust tools for managing subscriptions, including options for upgrades, pricing strategies, downgrades, and invoice management.

- With PayPro Global’s reseller model, the platform handles all tax obligations so that your online sales are fully compliant with global regulations.

Pros

- Offers customizable subscription options with easy integration.

- The platform has a professional and responsive team offering personalized service.

- PayPro Global has the ability to offer your customers a localized purchasing experience with support for multiple currencies.

Cons

- Some customers mention that the user interface could be improved.

Pricing

PayPro Global offers custom pricing, which can be requested through their website.

Review

“The best service for selling software and SaaS over the Internet.” – Yuria A.

#9 Stripe

Stripe is a widely used payment processing and merchant services provider, favored by web developers and e-commerce specialists for its powerful APIs and user-friendly functionality. Whether you’re managing subscriptions or running an on-demand marketplace, Stripe offers tools designed to assist with your payment processes and user experience.

Key Features

- The platform lets you set up Stripe Data Pipeline in minutes, this feature automatically transfers Stripe data and reports to your data warehouse, requiring no coding and simplifying your data management.

- Stripe automatically calculates and collects the correct tax based on your customer’s location, ensuring compliance with global tax regulations. It also validates EU VAT IDs and Australian ABN numbers when needed.

- You can create and automate custom rules with Stripe to align revenue recognition with your accounting practices. It also lets you customize your chart of accounts for better integration with your general ledger.

Pros

- Autopayments simplify managing memberships, and transaction filtering allows easy trend analysis.

- The platform’s comprehensive tools are reliable and easy to use.

Cons

- Some features are buried in menus, making navigation less intuitive.

- Some customers argue that the customer support is limited to email with slow, impersonal responses.

Pricing

Stripe offers pay-as-you-go pricing at 2.9% + 30¢ per successful charge for domestic cards. There are no setup or monthly fees, and custom packages are available.

Review

“We used a lot of payment gateways over the years and Stripe is the most reliable and easy to use. We highly recommend Stripe.” – Angelica S.

#10 Cleverbridge

Cleverbridge is a cloud-based eCommerce platform that simplifies payment processing, customer management, and recurring billing for businesses. It automates digital buying experiences across the customer lifecycle, making it easier for you to drive acquisitions, expansions, and renewals in over 240 countries.

Key Features

- Cleverbridge provides a fully automated system for managing subscriptions, complete with a product catalog and bundled offerings. Its payment solutions and workflows help you streamline renewals and transactions.

- The platform handles regional tax requirements, allowing you to focus on pricing strategy while it manages localization and tax remittance.

- The automated tools supported by Cleverbridge ensure you never miss a renewal, with built-in growth features that prioritize high-value customers for your sales team.

Pros

- The API Integration supports a smooth integration with third-party Enterprise resource planning (ERP) and Customer Relationship Management (CRM) systems.

- Users praise the quick and professional customer service of Cleverbridge.

Cons

- Some users find the tools challenging to navigate, especially when canceling subscriptions.

Pricing

Cleverbridge charges a percentage of transaction amounts, with pricing tailored to business needs.

Review

“Cleverbridge has solved our online payment model and provided subscription management. The customer service model has given us professional services whenever we needed them with no extra charge.” – User

Take the Next Step with Fungies

Choosing the right Merchant of Record payment provider is crucial for scaling your digital business. Whether you’re seeking tax compliance, subscription management, or global payment solutions, finding the right partner can make all the difference.

If you’re ready to simplify your operations and focus on growth, book a demo with Fungies today to see how we can support your journey to success.